- Taiwan

- /

- Tech Hardware

- /

- TWSE:3013

3 Asian Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade negotiations and economic uncertainties, the Asian market continues to capture attention with its unique growth opportunities. In this environment, companies exhibiting strong growth potential combined with high insider ownership can offer insights into confidence levels within the business, making them noteworthy considerations for investors seeking resilience and alignment of interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.8% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Laopu Gold (SEHK:6181) | 31.9% | 40.5% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

| giftee (TSE:4449) | 34.5% | 63.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

Let's take a closer look at a couple of our picks from the screened companies.

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment globally, with a market cap of ₩1.63 trillion.

Operations: The Semiconductor Machine Division contributes ₩320.95 billion to the company's revenue.

Insider Ownership: 30.7%

Earnings Growth Forecast: 26.8% p.a.

EO Technics is poised for significant earnings growth, with forecasts of 26.78% per year, outpacing the Korean market's 20.6%. Revenue growth is expected at 15.2% annually, surpassing the broader market's 7.4%. Analysts predict a potential stock price increase of 25.5%. Despite these prospects, insider trading activity has been minimal recently. The upcoming Annual General Meeting on March 28 in South Korea may provide further insights into strategic directions and shareholder engagement.

- Unlock comprehensive insights into our analysis of EO Technics stock in this growth report.

- Upon reviewing our latest valuation report, EO Technics' share price might be too optimistic.

SAMG Entertainment (KOSDAQ:A419530)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SAMG Entertainment Co., Ltd. is a global producer of TV series, animated feature films, advertisements, and games with a market cap of ₩503.71 billion.

Operations: The company's revenue segment includes computer graphics, generating ₩116.44 million.

Insider Ownership: 18.4%

Earnings Growth Forecast: 107.8% p.a.

SAMG Entertainment is anticipated to achieve profitability within three years, with earnings projected to grow by 107.85% annually. Despite its volatile share price recently, the stock trades at 12.2% below estimated fair value. Revenue growth is expected at 13.8% per year, exceeding the Korean market's average of 7.4%. The company boasts a high forecasted return on equity of 34.4%, although recent insider trading activity has been minimal.

- Navigate through the intricacies of SAMG Entertainment with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that SAMG Entertainment's current price could be inflated.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★☆

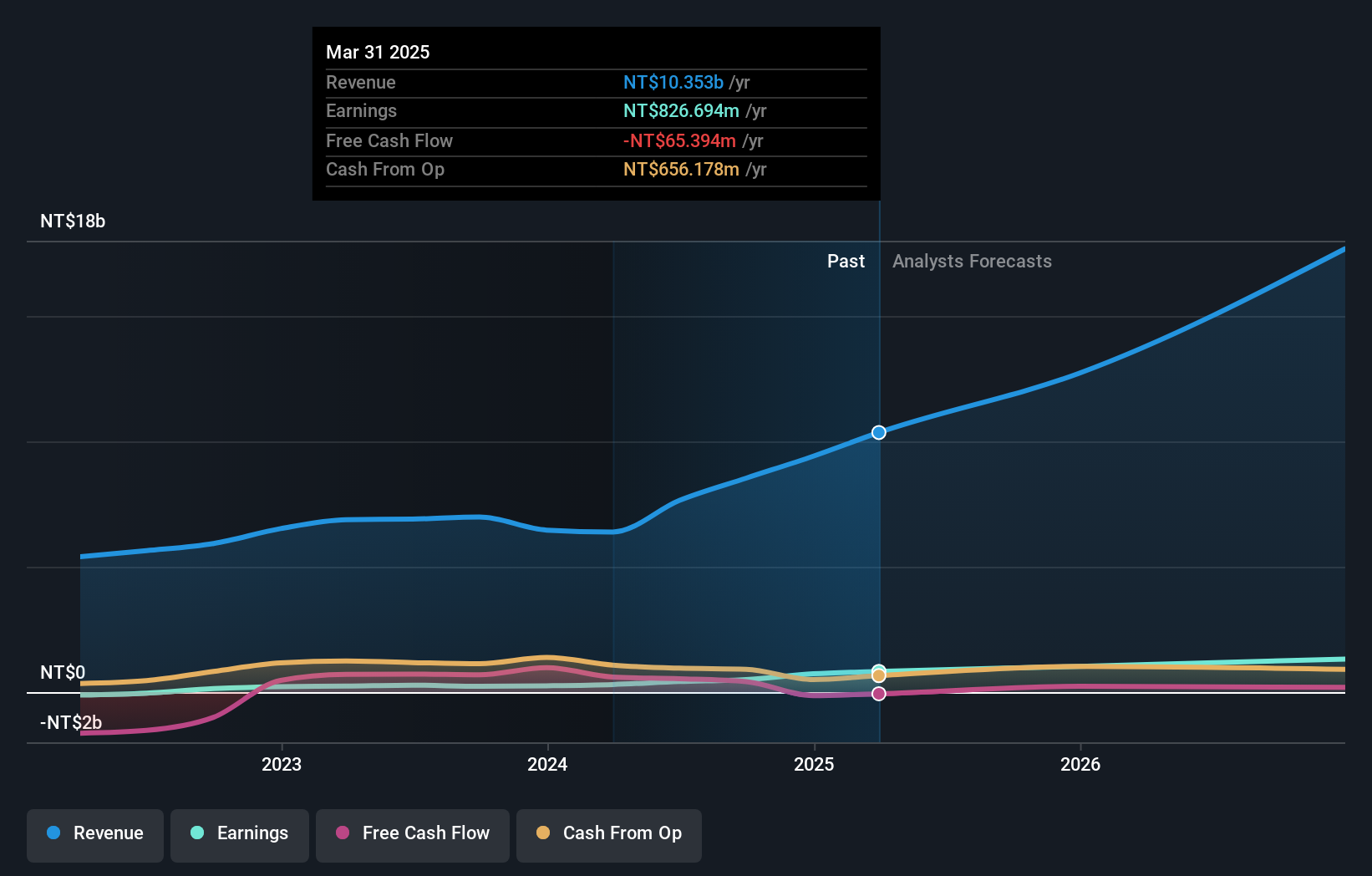

Overview: Chenming Electronic Tech. Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally with a market cap of NT$22.16 billion.

Operations: The company's revenue primarily comes from the production and sales of computer and mobile device components, totaling NT$10.35 billion.

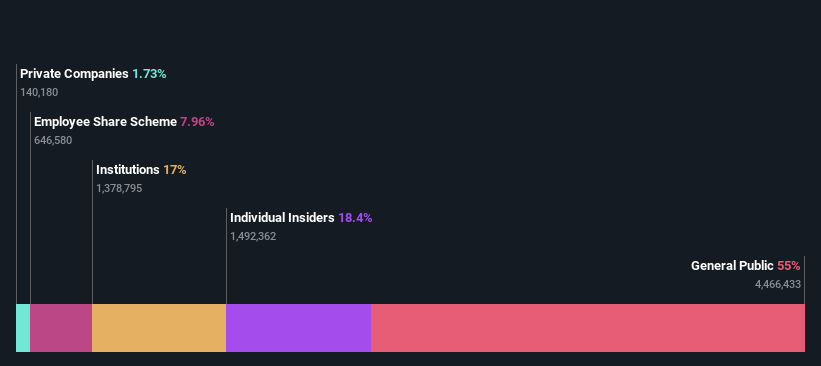

Insider Ownership: 18.7%

Earnings Growth Forecast: 26.6% p.a.

Chenming Electronic Tech. demonstrates strong growth potential with forecasted revenue and earnings growth rates of 31.1% and 26.64% annually, respectively, outpacing the Taiwan market averages. The company reported significant year-over-year increases in Q1 sales (TWD 2.40 billion) and net income (TWD 172.25 million). Despite high non-cash earnings, the volatile share price may concern some investors. Recent events include a cash dividend announcement and proposed amendments to its Articles of Association for shareholder approval.

- Click here and access our complete growth analysis report to understand the dynamics of Chenming Electronic Tech.

- Our comprehensive valuation report raises the possibility that Chenming Electronic Tech is priced higher than what may be justified by its financials.

Where To Now?

- Investigate our full lineup of 617 Fast Growing Asian Companies With High Insider Ownership right here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3013

Chenming Electronic Tech

An OEM/ODM manufacturer, engages in the research and development, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds in Taiwan, China, the United States, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives