- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2492

Is Walsin Technology Corporation's (TWSE:2492) Recent Performance Underpinned By Weak Financials?

It is hard to get excited after looking at Walsin Technology's (TWSE:2492) recent performance, when its stock has declined 4.0% over the past week. Given that stock prices are usually driven by a company’s fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. Specifically, we decided to study Walsin Technology's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Walsin Technology

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Walsin Technology is:

4.3% = NT$2.5b ÷ NT$59b (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.04 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Walsin Technology's Earnings Growth And 4.3% ROE

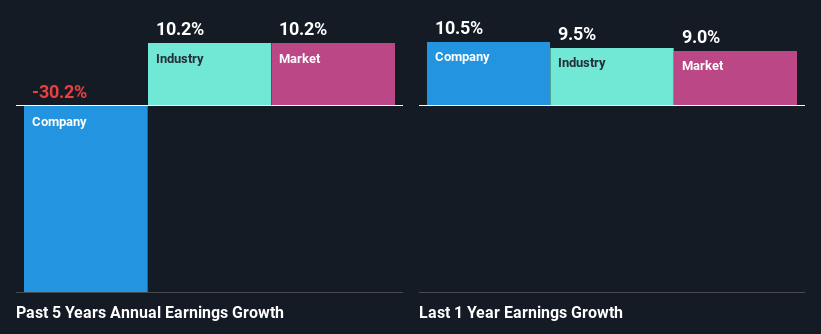

On the face of it, Walsin Technology's ROE is not much to talk about. Next, when compared to the average industry ROE of 8.9%, the company's ROE leaves us feeling even less enthusiastic. Given the circumstances, the significant decline in net income by 30% seen by Walsin Technology over the last five years is not surprising. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. Such as - low earnings retention or poor allocation of capital.

However, when we compared Walsin Technology's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 10% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is Walsin Technology fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Walsin Technology Using Its Retained Earnings Effectively?

With a high three-year median payout ratio of 53% (implying that 47% of the profits are retained), most of Walsin Technology's profits are being paid to shareholders, which explains the company's shrinking earnings. With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. Our risks dashboard should have the 2 risks we have identified for Walsin Technology.

Moreover, Walsin Technology has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning Walsin Technology. As a result of its low ROE and lack of much reinvestment into the business, the company has seen a disappointing earnings growth rate. Up till now, we've only made a short study of the company's growth data. To gain further insights into Walsin Technology's past profit growth, check out this visualization of past earnings, revenue and cash flows.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Walsin Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2492

Walsin Technology

Develops, manufactures, and sells passive electronic components in Asia, the America, and Europe.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)