As global markets navigate a complex landscape of trade negotiations and economic uncertainties, small- and mid-cap indexes have shown resilience, posting gains for the fifth consecutive week amid mixed performances in major indices like the S&P 500 and Nasdaq Composite. In this environment, identifying high growth tech stocks in Asia requires a focus on companies that can leverage technological innovation to capitalize on emerging opportunities while effectively managing risks associated with shifting trade policies and economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.52% | 29.12% | ★★★★★★ |

| Flaircomm Microelectronics | 30.38% | 34.37% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.34% | 29.48% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| Cowell e Holdings | 20.16% | 24.57% | ★★★★★★ |

| PharmaResearch | 24.94% | 28.17% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc. is an investment holding company that operates globally in the social networking sector, with a market cap of approximately HK$11.89 billion.

Operations: The company primarily generates revenue from its social networking business, contributing CN¥4.63 billion, while its innovative business adds CN¥459.64 million.

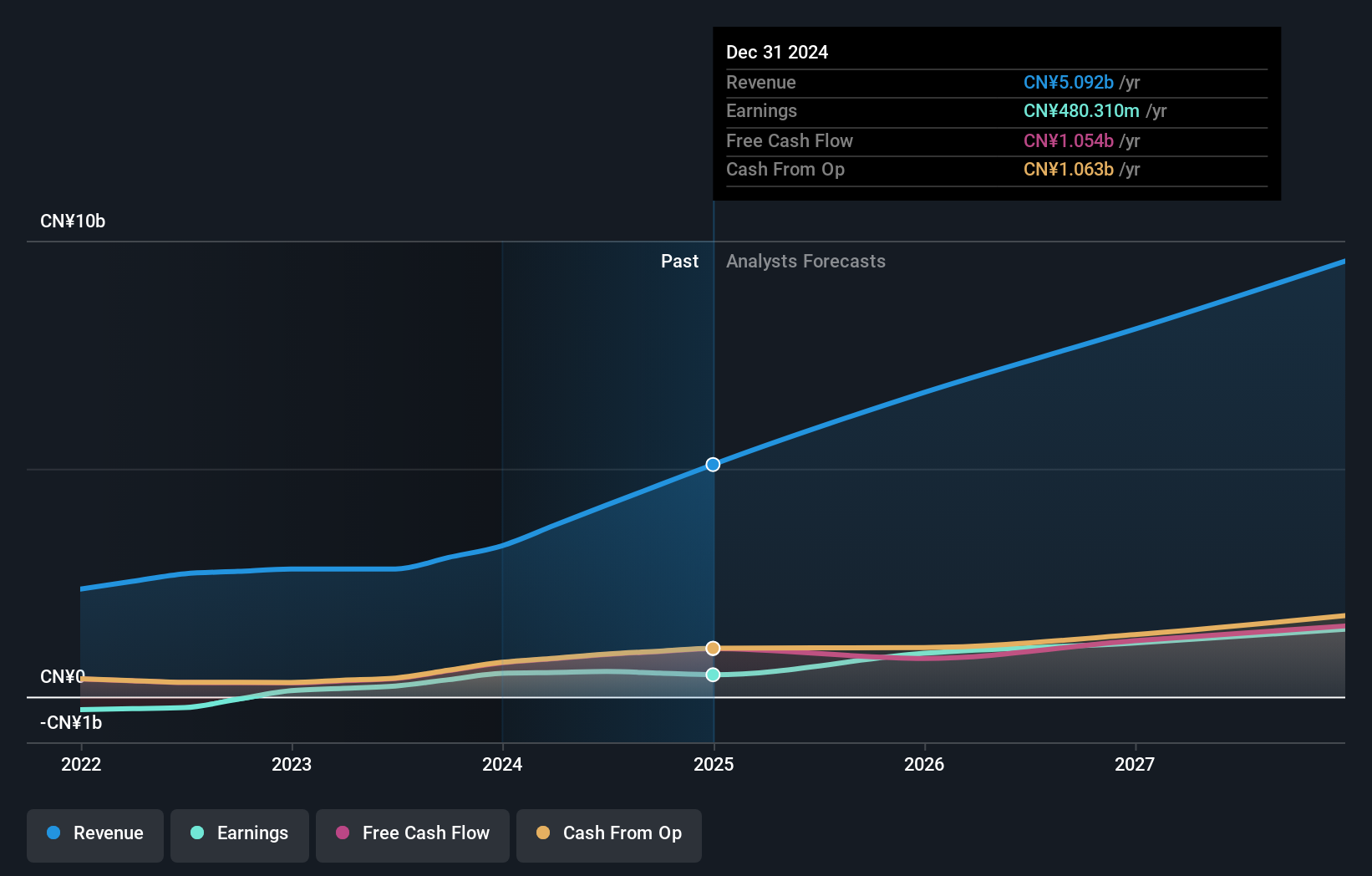

Newborn Town's recent financial trajectory underscores its potential in the high-growth tech sector in Asia. With an impressive year-on-year revenue increase projected between 41.5% and 48.1% for Q1 2025, and a robust annual revenue forecast of RMB 5,000 million to RMB 5,200 million for FY 2024, the company is outpacing many regional counterparts. Despite some fluctuations in net profit margins—down from last year's peak—strategic investments like the acquisition of Chizicheng Strategy Investment have bolstered earnings significantly by approximately 27.9% to 34.6%. This demonstrates a resilient expansion strategy amidst volatile markets, positioning Newborn Town well for sustained growth.

- Dive into the specifics of Newborn Town here with our thorough health report.

Explore historical data to track Newborn Town's performance over time in our Past section.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

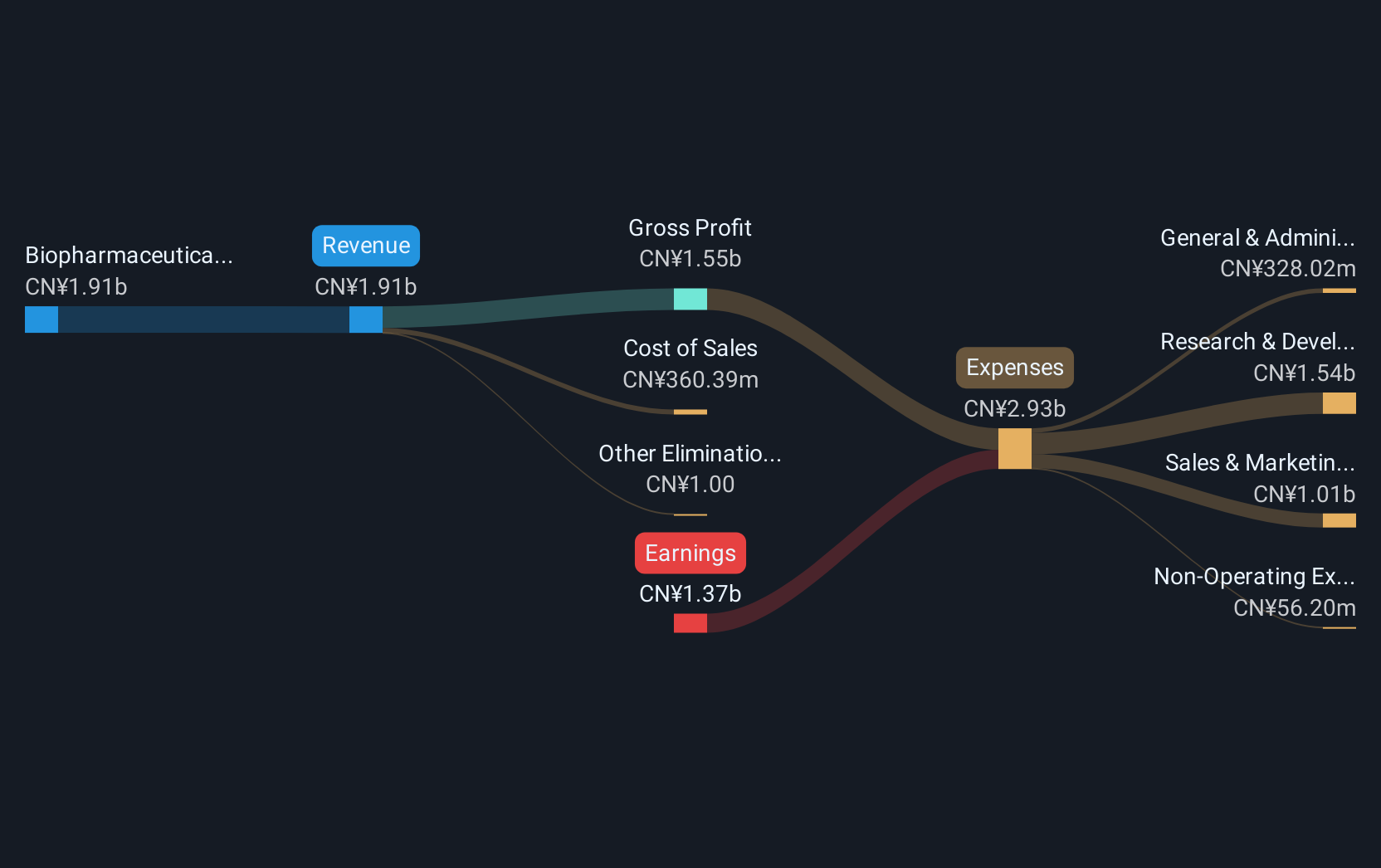

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on the discovery, development, and commercialization of biologics for treating autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States with a market cap of approximately HK$26.59 billion.

Operations: RemeGen Co., Ltd. generates revenue primarily through its biopharmaceutical research, service, production, and sales activities, totaling approximately CN¥1.91 billion. The company operates in the fields of autoimmune, oncology, and ophthalmic diseases across Mainland China and the United States.

RemeGen's recent advancements underscore its burgeoning role in the biotech sector, particularly with its innovative treatments like disitamab vedotin. The company's phase 3 clinical trial results, showing significant improvements in progression-free and overall survival rates for cancer patients, mark a pivotal achievement. Financially, RemeGen reported a revenue surge to CNY 525.97 million in Q1 2025 from CNY 330.43 million the previous year, reflecting a robust growth trajectory despite a net loss reduction to CNY 254.14 million from CNY 348.92 million year-over-year. These developments not only enhance RemeGen’s portfolio but also position it strategically for future regulatory approvals and market expansions within Asia's competitive high-growth tech landscape.

- Click here to discover the nuances of RemeGen with our detailed analytical health report.

Gain insights into RemeGen's past trends and performance with our Past report.

Elite Material (TWSE:2383)

Simply Wall St Growth Rating: ★★★★☆☆

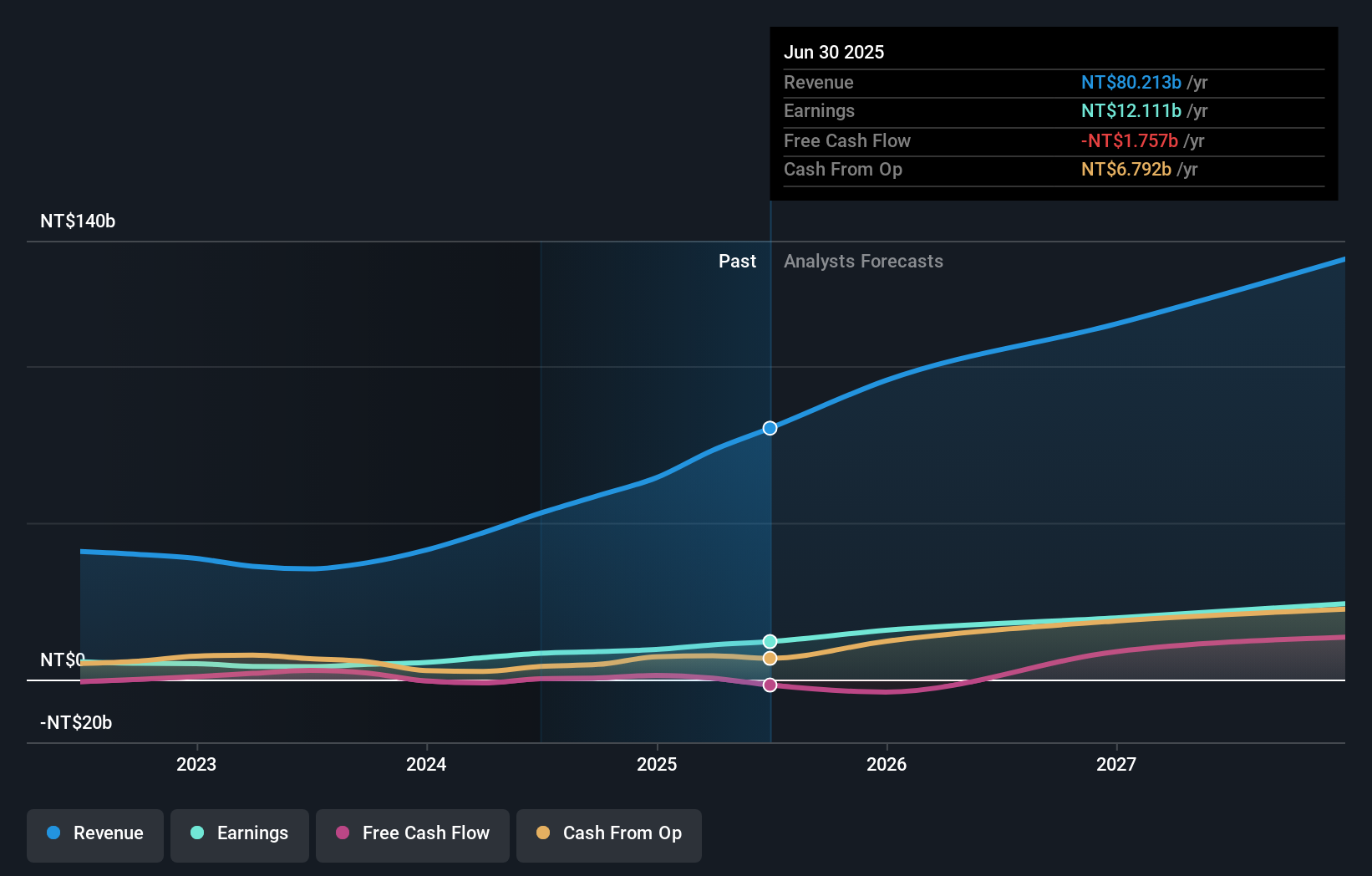

Overview: Elite Material Co., Ltd. is involved in the production and sale of copper clad laminates, electronic-industrial specialty chemicals and raw materials, and electronic components across Taiwan, China, and international markets with a market cap of NT$237.44 billion.

Operations: The company generates revenue primarily from its domestic segment, contributing NT$16.17 billion, and foreign departments, which add NT$69.60 billion.

In the dynamic landscape of Asian tech, Elite Material has demonstrated significant financial and operational growth. With a substantial increase in sales from TWD 12.9 billion to TWD 21.7 billion in just one year, the company's robust performance is further underscored by a net income rise to TWD 3.47 billion from TWD 1.98 billion, reflecting an earnings growth of 58.4% year-over-year—outpacing its industry's average of 17.7%. This surge is supported by strategic expansions like the new Tayuan factory, positioning Elite Material well for sustained advancements in technology sectors across Asia.

- Unlock comprehensive insights into our analysis of Elite Material stock in this health report.

Assess Elite Material's past performance with our detailed historical performance reports.

Seize The Opportunity

- Discover the full array of 476 Asian High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade RemeGen, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9995

RemeGen

A biopharmaceutical company, engages in the discovery, development, and commercialization of biologics for the treatment of autoimmune, oncology, and ophthalmic diseases with unmet medical needs in Mainland China and the United States.

Exceptional growth potential and slightly overvalued.

Market Insights

Community Narratives