As we enter January 2025, global markets are grappling with inflation concerns and political uncertainty, leading to a decline in U.S. equities and a notable underperformance of small-cap stocks compared to their large-cap counterparts. Amidst this backdrop, high-growth tech stocks continue to capture investor attention for their potential resilience and innovation-driven growth, making them interesting candidates for those looking to navigate the current economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

Overview: Park Systems Corp. is a company that develops, manufactures, and sells atomic force microscopy (AFM) systems globally, with a market cap of ₩1.67 trillion.

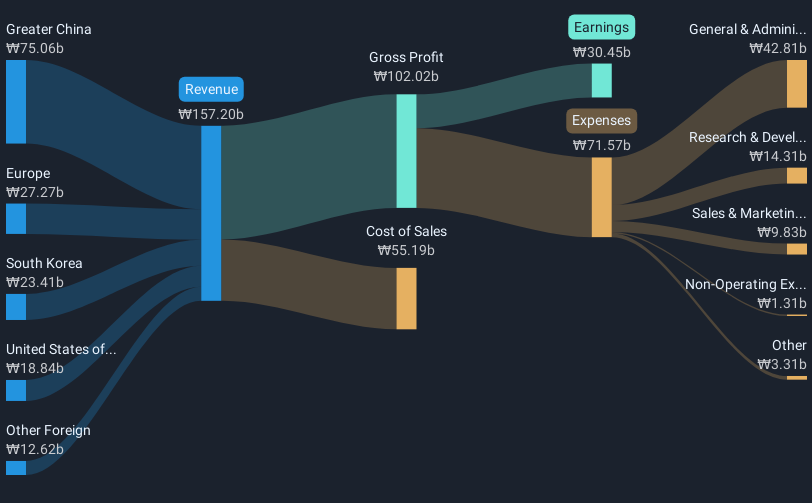

Operations: Park Systems Corp. focuses on the development, manufacturing, and global sales of atomic force microscopy (AFM) systems, generating revenue primarily from its Scientific & Technical Instruments segment, which amounts to ₩157.20 billion.

Park Systems, a leader in nanoscience metrology, has recently announced a strategic partnership with Labindia Instruments to expand its footprint in India's burgeoning semiconductor sector. This collaboration leverages Park Systems' advanced Atomic Force Microscopy (AFM) technology and Labindia's robust distribution network, enhancing both companies' positions in a market driven by the government-backed India Semiconductor Mission. Financially, Park Systems has demonstrated robust growth with revenue and earnings increasing annually by 23.6% and 36.9%, respectively. The company's commitment to innovation is underscored by significant R&D investments which have enabled it to stay ahead of technological advancements and maintain a competitive edge in the high-stakes field of semiconductor analysis. This strategic move comes at an opportune moment as the demand for sophisticated metrology solutions escalates alongside India’s ambitious plans to become a global hub for semiconductor manufacturing.

- Dive into the specifics of Park Systems here with our thorough health report.

Examine Park Systems' past performance report to understand how it has performed in the past.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trend Micro Incorporated is a company that develops and sells security-related software for computers and related services both in Japan and internationally, with a market capitalization of ¥1.09 trillion.

Operations: Trend Micro generates revenue primarily through its security-related software and services, with significant contributions from the Asia Pacific region (¥125.59 billion) and Japan (¥85.04 billion). The company also sees substantial sales in Europe (¥65.17 billion) and the Americas (¥70.30 billion).

Trend Micro, a stalwart in cybersecurity, has recently launched innovative AI-driven security tools and announced a strategic partnership with the Paris Peace Forum to enhance global AI safety frameworks. These initiatives underscore its commitment to leading-edge security solutions, particularly in cloud environments and AI integration. Financially, Trend Micro's revenue growth of 5.7% annually is complemented by an impressive earnings surge of 72% over the past year and R&D investments that are pivotal for maintaining technological leadership in a competitive market. The company's efforts are not only advancing its financial metrics but also solidifying its role as a critical player in shaping the future landscape of global cybersecurity standards and practices.

- Navigate through the intricacies of Trend Micro with our comprehensive health report here.

Evaluate Trend Micro's historical performance by accessing our past performance report.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

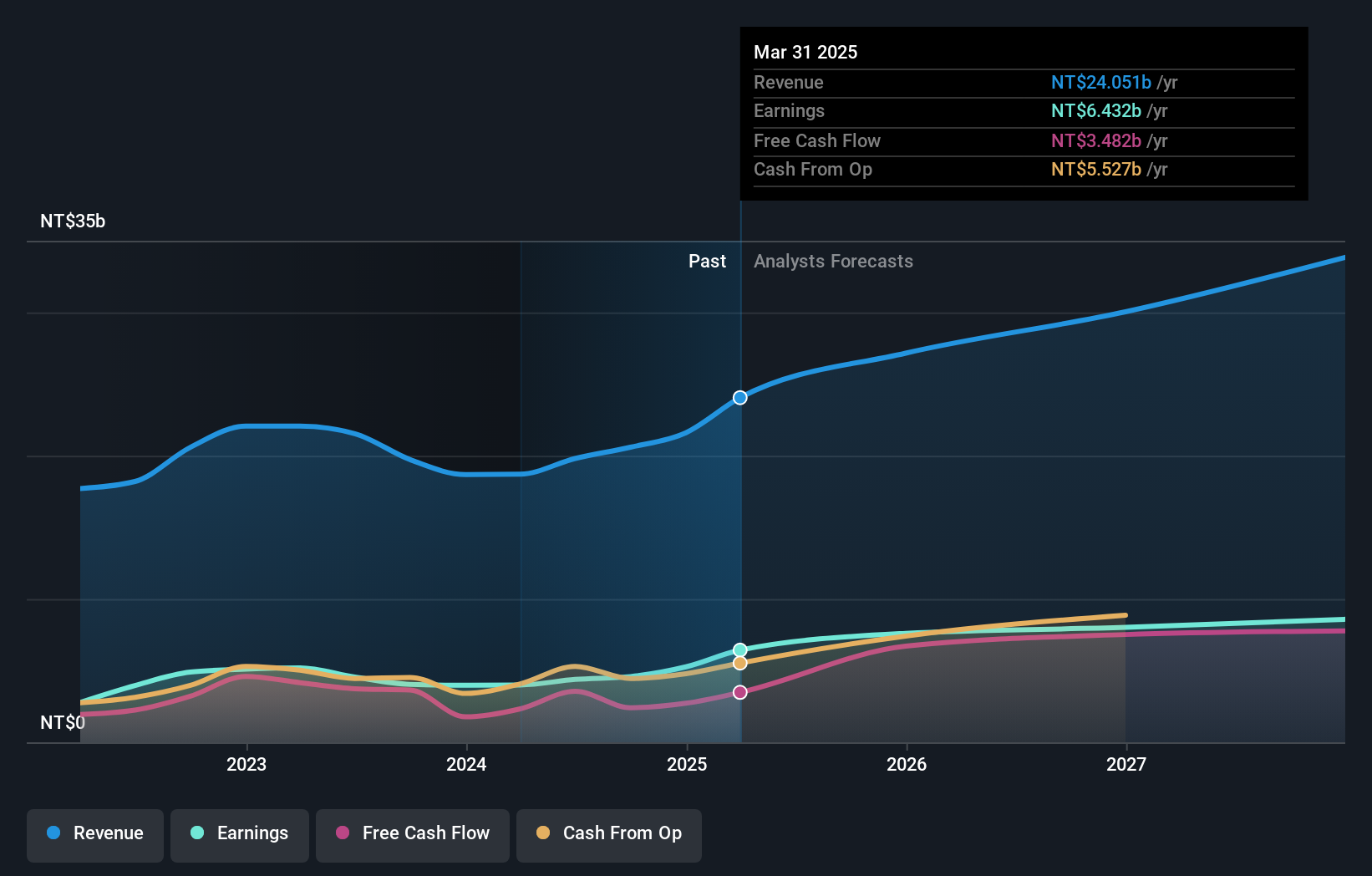

Overview: Chroma ATE Inc. is involved in the design, assembly, manufacturing, sales, repair, and maintenance of software and hardware for computers and peripherals as well as various electronic testing systems across Taiwan, China, the United States, and internationally; it has a market cap of approximately NT$155.27 billion.

Operations: Chroma ATE Inc. generates revenue primarily from its Measuring Instruments Business, contributing NT$30.84 billion, and Automated Transport Engineering, which accounts for NT$1.69 billion. The company's operations span across Taiwan, China, the United States, and other international markets.

Chroma ATE, a player in the tech sector, has demonstrated robust financial performance with a revenue growth of 17.1% and earnings growth of 26.7% annually. The company's commitment to innovation is evident from its R&D spending, which significantly contributes to its market position by fostering advancements in technology solutions. Recent presentations at high-profile conferences underscore Chroma's active engagement in industry dialogues and potential influence on future tech developments. With recent earnings reports showing substantial increases in both sales and net income, Chroma ATE is strategically positioning itself for sustained growth amidst evolving technological landscapes.

Seize The Opportunity

- Dive into all 1202 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives