- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2317

Hon Hai Precision Industry Co., Ltd. (TWSE:2317) Stock Catapults 30% Though Its Price And Business Still Lag The Market

Hon Hai Precision Industry Co., Ltd. (TWSE:2317) shareholders have had their patience rewarded with a 30% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

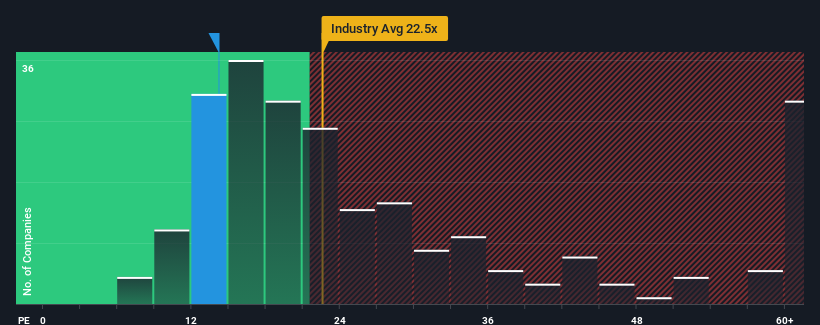

Even after such a large jump in price, Hon Hai Precision Industry may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.2x, since almost half of all companies in Taiwan have P/E ratios greater than 23x and even P/E's higher than 38x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

There hasn't been much to differentiate Hon Hai Precision Industry's and the market's retreating earnings lately. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Hon Hai Precision Industry

How Is Hon Hai Precision Industry's Growth Trending?

Hon Hai Precision Industry's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 24% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 12% each year over the next three years. With the market predicted to deliver 16% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Hon Hai Precision Industry's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Hon Hai Precision Industry's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Hon Hai Precision Industry's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Hon Hai Precision Industry that you need to be mindful of.

If you're unsure about the strength of Hon Hai Precision Industry's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hon Hai Precision Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2317

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives