- Taiwan

- /

- Tech Hardware

- /

- TWSE:2301

Top Asian Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

Amid escalating trade tensions between the U.S. and China, Asian markets have experienced a mixed performance, with some indices facing declines while others show resilience due to potential stimulus measures. In such volatile times, dividend stocks can offer investors a measure of stability and income, making them an attractive consideration for those navigating uncertain economic waters.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.02% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.87% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.23% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.73% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.19% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.39% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.53% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.08% | ★★★★★☆ |

Click here to see the full list of 1209 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

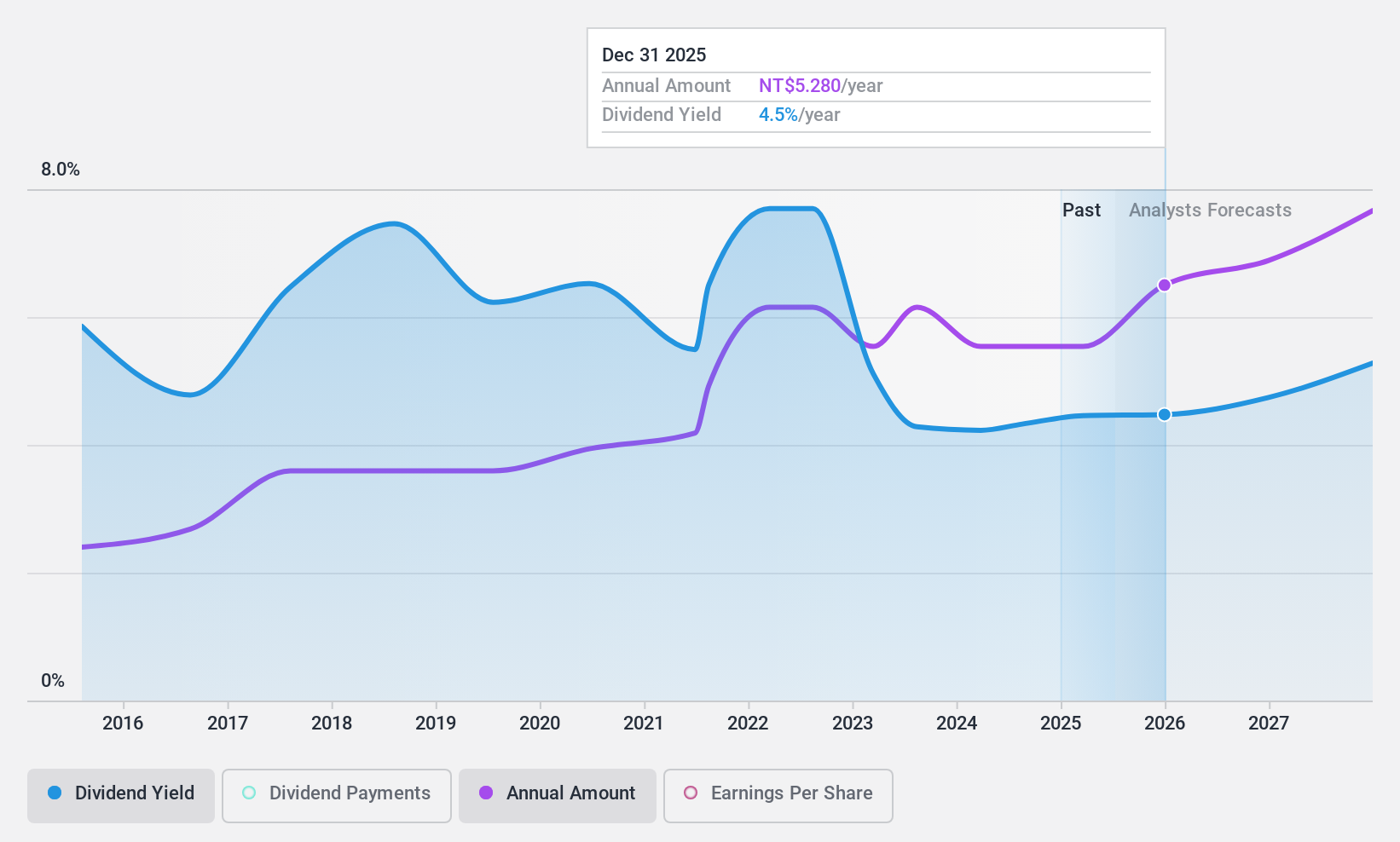

Lite-On Technology (TWSE:2301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lite-On Technology Corporation, along with its subsidiaries, focuses on the research, design, development, manufacture, and sale of modules and system solutions, with a market cap of NT$206.10 billion.

Operations: Lite-On Technology Corporation's revenue is primarily derived from its Information and Consumer Electronics Sector at NT$59.92 billion, followed by the Cloud and Internet of Things Department at NT$50.71 billion, and the Optoelectronic Department contributing NT$28.19 billion.

Dividend Yield: 5%

Lite-On Technology's dividends have been stable and reliable over the past decade, with consistent growth. However, its current dividend yield of 5.02% is lower than the top tier in Taiwan, and its high cash payout ratio indicates dividends are not well covered by free cash flows. Recent news includes a share buyback program valued at TWD 62.13 billion to enhance shareholder equity, which may impact future dividend sustainability positively or negatively depending on execution.

- Dive into the specifics of Lite-On Technology here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Lite-On Technology is priced lower than what may be justified by its financials.

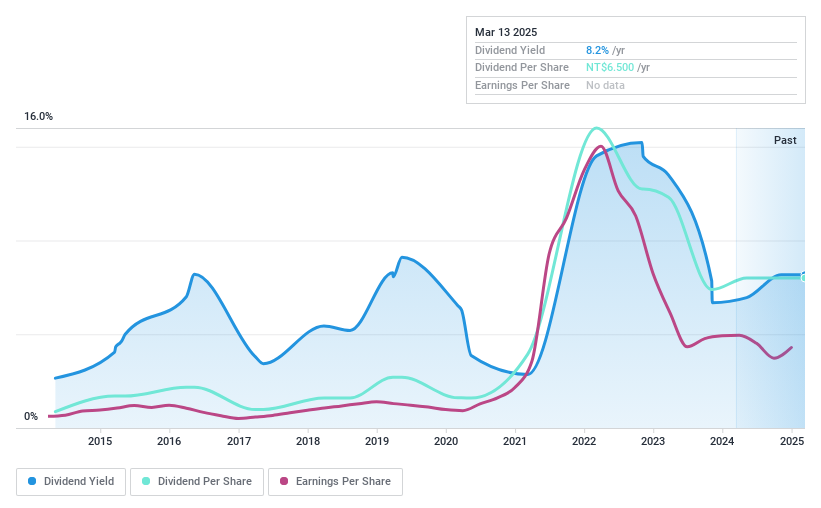

T3EX Global Holdings (TWSE:2636)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: T3EX Global Holdings Corp. is an investment holding company offering integrated logistics services across Taiwan, Hong Kong, China, East Asia, and internationally with a market cap of NT$9.89 billion.

Operations: T3EX Global Holdings generates revenue primarily from its Sea Freight/Transportation segment, which accounts for NT$16.70 billion, followed by the Air Freight/Transportation segment at NT$5.77 billion.

Dividend Yield: 8.3%

T3EX Global Holdings offers an attractive dividend yield of 8.31%, ranking in the top 25% of Taiwan's market, but its dividends are not well covered by free cash flows, with a high cash payout ratio of 200.7%. Despite a reasonable earnings payout ratio of 63.9%, dividend payments have been volatile and unreliable over the past decade. Recent earnings show increased sales to TWD 25.45 billion, though net income decreased to TWD 1.29 billion, reflecting margin pressures.

- Take a closer look at T3EX Global Holdings' potential here in our dividend report.

- Our valuation report here indicates T3EX Global Holdings may be overvalued.

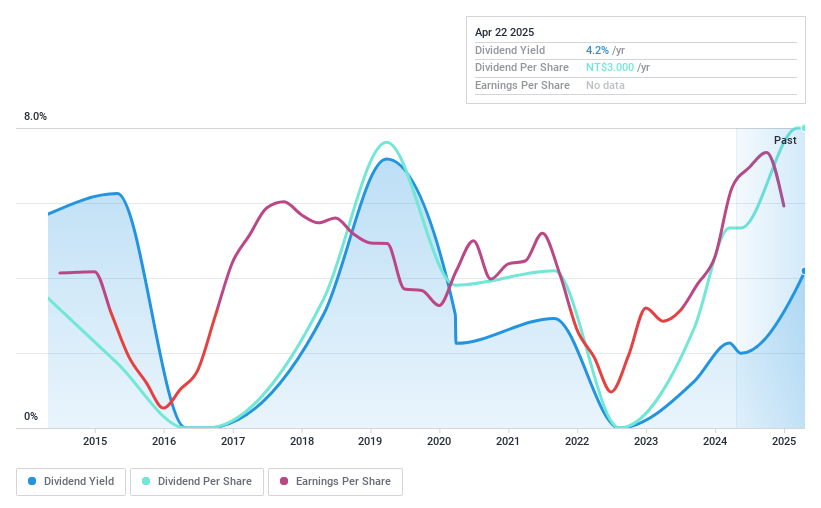

Team Group (TWSE:4967)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Team Group Inc. is a company involved in the manufacturing and sale of integrated circuit chips, memory, and computer peripheral equipment across Taiwan, Asia, the United States, Europe, and other international markets with a market cap of NT$6.66 billion.

Operations: Team Group Inc.'s revenue is primarily derived from its Memory Modules and Flash Memory Products segment, which generated NT$19.94 billion.

Dividend Yield: 3.8%

Team Group's recent earnings report shows a notable increase in sales to TWD 19.94 billion and net income to TWD 527.36 million, reflecting solid growth. The board approved a cash dividend of TWD 3 per share for 2024, indicating a commitment to returning capital to shareholders despite past volatility in dividend payments. With dividends well covered by both earnings (payout ratio of 44.1%) and cash flows (cash payout ratio of 28.6%), the company maintains financial prudence amidst share price volatility and trading below estimated fair value by 38.9%.

- Click here and access our complete dividend analysis report to understand the dynamics of Team Group.

- Our valuation report unveils the possibility Team Group's shares may be trading at a discount.

Make It Happen

- Dive into all 1209 of the Top Asian Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lite-On Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2301

Lite-On Technology

Engages in the research, design, development, manufacture, and sale of modules and system solutions.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives