VIA Labs, Inc. (TPE:6756) just released a solid earnings report, and the stock displayed some strength. Despite this, our analysis suggests that there are some factors weakening the foundations of those good profit numbers.

See our latest analysis for VIA Labs

A Closer Look At VIA Labs' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

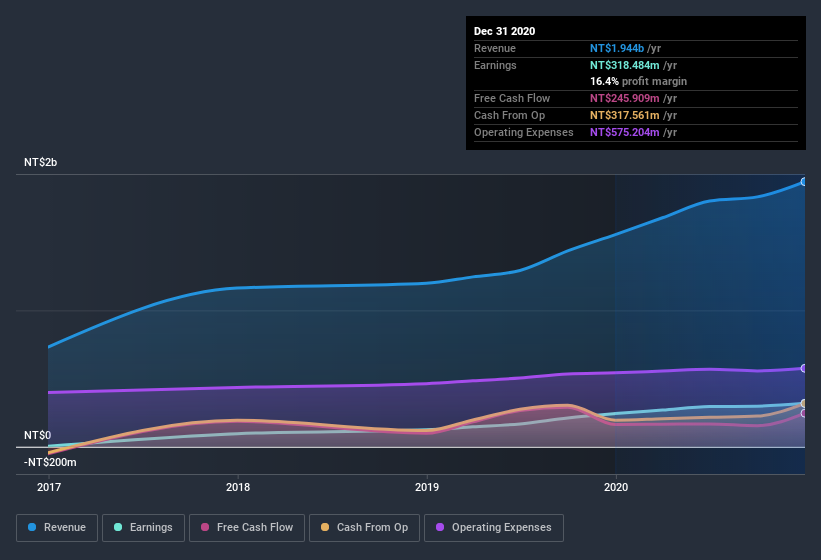

VIA Labs has an accrual ratio of 0.30 for the year to December 2020. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. To wit, it produced free cash flow of NT$246m during the period, falling well short of its reported profit of NT$318.5m. We note, however, that VIA Labs grew its free cash flow over the last year. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of VIA Labs.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, VIA Labs issued 13% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of VIA Labs' EPS by clicking here.

How Is Dilution Impacting VIA Labs' Earnings Per Share? (EPS)

As you can see above, VIA Labs has been growing its net income over the last few years, with an annualized gain of 232% over three years. In comparison, earnings per share only gained 152% over the same period. And the 31% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 31% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So VIA Labs shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On VIA Labs' Profit Performance

As it turns out, VIA Labs couldn't match its profit with cashflow and its dilution means that earnings per share growth is lagging net income growth. For the reasons mentioned above, we think that a perfunctory glance at VIA Labs' statutory profits might make it look better than it really is on an underlying level. If you want to do dive deeper into VIA Labs, you'd also look into what risks it is currently facing. Be aware that VIA Labs is showing 3 warning signs in our investment analysis and 1 of those makes us a bit uncomfortable...

Our examination of VIA Labs has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade VIA Labs, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6756

VIA Labs

Engages in the programming, designing, manufacturing, and sale of USB and USB power delivery controllers for multi-functional devices and platforms in Taiwan, Hong Kong, China, Japan, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)