- Taiwan

- /

- Tech Hardware

- /

- TWSE:6414

What Type Of Shareholders Own The Most Number of Ennoconn Corporation (TPE:6414) Shares?

The big shareholder groups in Ennoconn Corporation (TPE:6414) have power over the company. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. We also tend to see lower insider ownership in companies that were previously publicly owned.

With a market capitalization of NT$24b, Ennoconn is a decent size, so it is probably on the radar of institutional investors. In the chart below, we can see that institutions own shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Ennoconn.

View our latest analysis for Ennoconn

What Does The Institutional Ownership Tell Us About Ennoconn?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

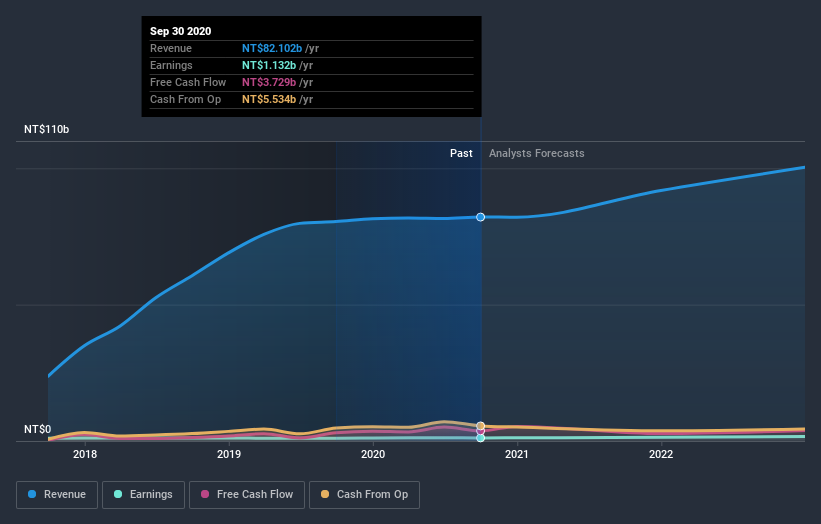

As you can see, institutional investors have a fair amount of stake in Ennoconn. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Ennoconn, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in Ennoconn. Our data shows that Hon Hai Precision Industry Co., Ltd. is the largest shareholder with 34% of shares outstanding. For context, the second largest shareholder holds about 2.0% of the shares outstanding, followed by an ownership of 1.7% by the third-largest shareholder.

A deeper look at our ownership data shows that the top 25 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Ennoconn

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own some shares in Ennoconn Corporation. In their own names, insiders own NT$270m worth of stock in the NT$24b company. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, mostly retail investors, hold a substantial 57% stake in Ennoconn, suggesting it is a fairly popular stock. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Public Company Ownership

It appears to us that public companies own 34% of Ennoconn. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Ennoconn is showing 1 warning sign in our investment analysis , you should know about...

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Ennoconn, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ennoconn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6414

Ennoconn

Manufactures and sells data storage, processing equipment, industrial motherboards, and network communication products in Taiwan, China, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)