- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6164

Does Ledtech Electronics (TPE:6164) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Ledtech Electronics Corp. (TPE:6164) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Ledtech Electronics

What Is Ledtech Electronics's Debt?

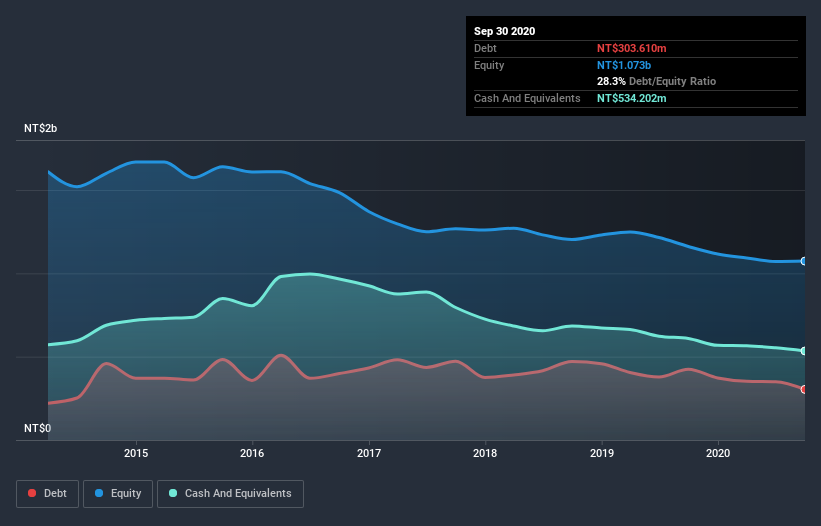

As you can see below, Ledtech Electronics had NT$303.6m of debt at September 2020, down from NT$424.3m a year prior. But on the other hand it also has NT$534.2m in cash, leading to a NT$230.6m net cash position.

How Strong Is Ledtech Electronics' Balance Sheet?

The latest balance sheet data shows that Ledtech Electronics had liabilities of NT$477.7m due within a year, and liabilities of NT$137.6m falling due after that. On the other hand, it had cash of NT$534.2m and NT$229.3m worth of receivables due within a year. So it can boast NT$148.2m more liquid assets than total liabilities.

This short term liquidity is a sign that Ledtech Electronics could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Ledtech Electronics boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Ledtech Electronics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Ledtech Electronics had a loss before interest and tax, and actually shrunk its revenue by 21%, to NT$776m. To be frank that doesn't bode well.

So How Risky Is Ledtech Electronics?

Although Ledtech Electronics had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of NT$173m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Ledtech Electronics (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Ledtech Electronics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6164

Ledtech Electronics

Research, develops, manufactures, processes, and trades in LED displays in Asia, the United Stated, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)