- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6153

Career Technology (Mfg.) Co., Ltd. (TPE:6153) Is Going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock?

Career Technology (Mfg.) (TPE:6153) has had a great run on the share market with its stock up by a significant 24% over the last three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Career Technology (Mfg.)'s ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Career Technology (Mfg.)

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Career Technology (Mfg.) is:

2.7% = NT$410m ÷ NT$15b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.03.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Career Technology (Mfg.)'s Earnings Growth And 2.7% ROE

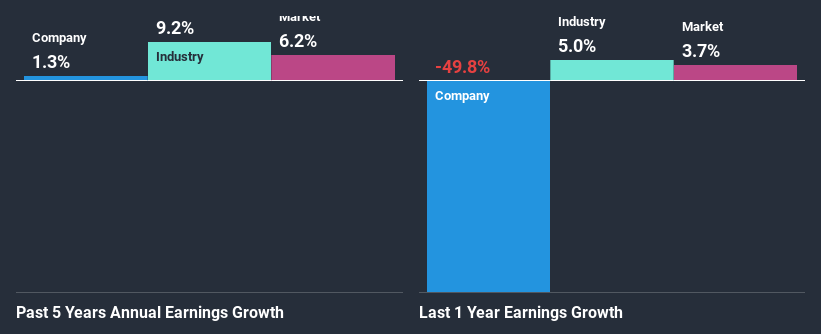

It is hard to argue that Career Technology (Mfg.)'s ROE is much good in and of itself. Not just that, even compared to the industry average of 9.9%, the company's ROE is entirely unremarkable. Hence, the flat earnings seen by Career Technology (Mfg.) over the past five years could probably be the result of it having a lower ROE.

As a next step, we compared Career Technology (Mfg.)'s net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 9.2% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Career Technology (Mfg.) is trading on a high P/E or a low P/E, relative to its industry.

Is Career Technology (Mfg.) Using Its Retained Earnings Effectively?

Career Technology (Mfg.) has a low three-year median payout ratio of 18% (or a retention ratio of 82%) but the negligible earnings growth number doesn't reflect this as high growth usually follows high profit retention.

Additionally, Career Technology (Mfg.) has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

Overall, we have mixed feelings about Career Technology (Mfg.). While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Career Technology (Mfg.) and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you decide to trade Career Technology (Mfg.), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6153

Career Technology (Mfg.)

Engages in the design, research and development, manufacturing and processing, trading, and import and export of flexible printed circuits in Taiwan, China, the United States, and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026