- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3712

Would Shareholders Who Purchased FIT Holding's (TPE:3712) Stock Five Years Be Happy With The Share price Today?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term FIT Holding Co., Ltd. (TPE:3712) shareholders for doubting their decision to hold, with the stock down 44% over a half decade. The falls have accelerated recently, with the share price down 27% in the last three months.

See our latest analysis for FIT Holding

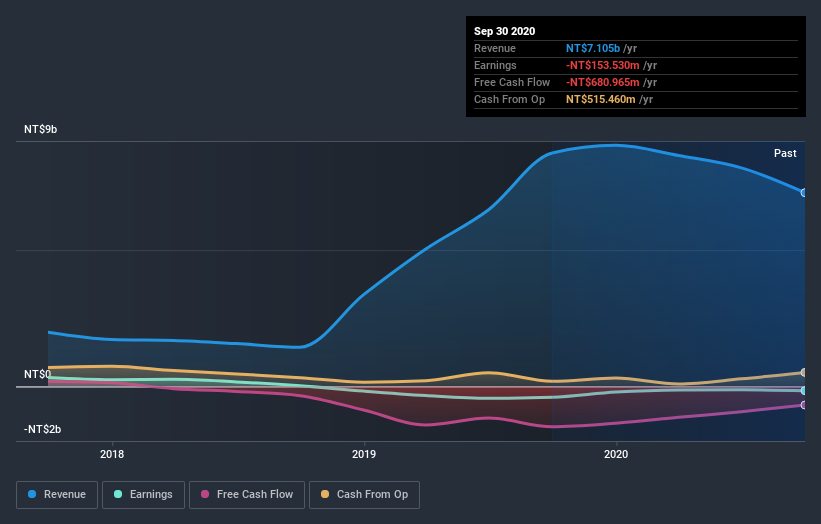

Given that FIT Holding didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, FIT Holding saw its revenue increase by 39% per year. That's better than most loss-making companies. Shareholders are no doubt disappointed with the loss of 8%, each year, in that time. You could say that the market has been harsh, given the top line growth. If that's the case, now might be the smart time to take a close look at it.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on FIT Holding's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered FIT Holding's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for FIT Holding shareholders, and that cash payout explains why its total shareholder loss of 29%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

FIT Holding's TSR for the year was broadly in line with the market average, at 39%. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 5%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for FIT Holding. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for FIT Holding you should be aware of, and 2 of them are potentially serious.

But note: FIT Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade FIT Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3712

FIT Holding

Operates in the optoelectronics, communications, and digital imaging industries in Hong Kong, China, the United States, Taiwan, and internationally.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026