Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Innolux Corporation (TPE:3481) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Innolux

What Is Innolux's Net Debt?

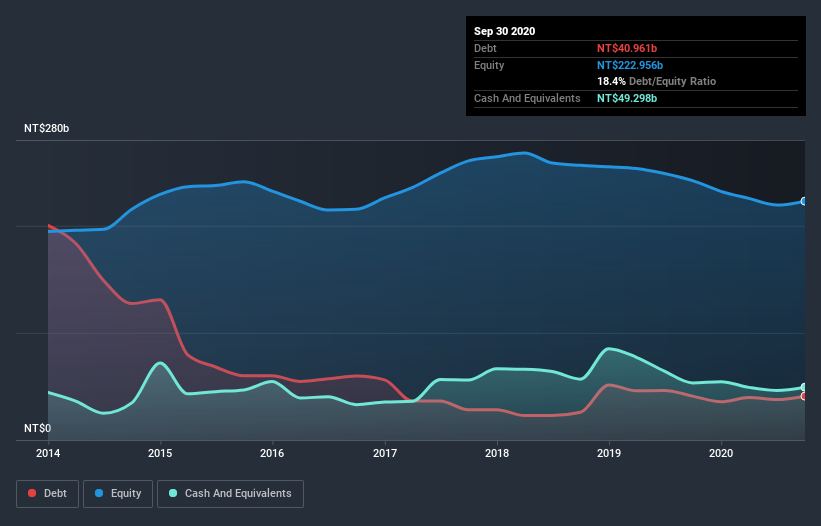

The chart below, which you can click on for greater detail, shows that Innolux had NT$41.0b in debt in September 2020; about the same as the year before. But on the other hand it also has NT$49.3b in cash, leading to a NT$8.34b net cash position.

How Healthy Is Innolux's Balance Sheet?

According to the last reported balance sheet, Innolux had liabilities of NT$105.3b due within 12 months, and liabilities of NT$37.6b due beyond 12 months. Offsetting this, it had NT$49.3b in cash and NT$56.7b in receivables that were due within 12 months. So it has liabilities totalling NT$36.9b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Innolux is worth NT$95.7b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Despite its noteworthy liabilities, Innolux boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Innolux can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Innolux saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

So How Risky Is Innolux?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Innolux had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of NT$1.7b and booked a NT$15b accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of NT$8.34b. That means it could keep spending at its current rate for more than two years. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Innolux's profit, revenue, and operating cashflow have changed over the last few years.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Innolux, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:3481

Innolux

Researches, designs, develops, manufactures, and sells modules and monitors of liquid crystal displays (LCD), color filters, low temperature poly-silicon thin film transistor (TFT)-LCDs, and TFT-LCD panels.

Excellent balance sheet average dividend payer.