- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3338

The TaiSol Electronics (TPE:3338) Share Price Has Gained 143%, So Why Not Pay It Some Attention?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance the TaiSol Electronics Co., Ltd. (TPE:3338) share price is 143% higher than it was three years ago. How nice for those who held the stock! Better yet, the share price has risen 8.2% in the last week. But this might be partly because the broader market had a good week last week, gaining 3.7%.

Check out our latest analysis for TaiSol Electronics

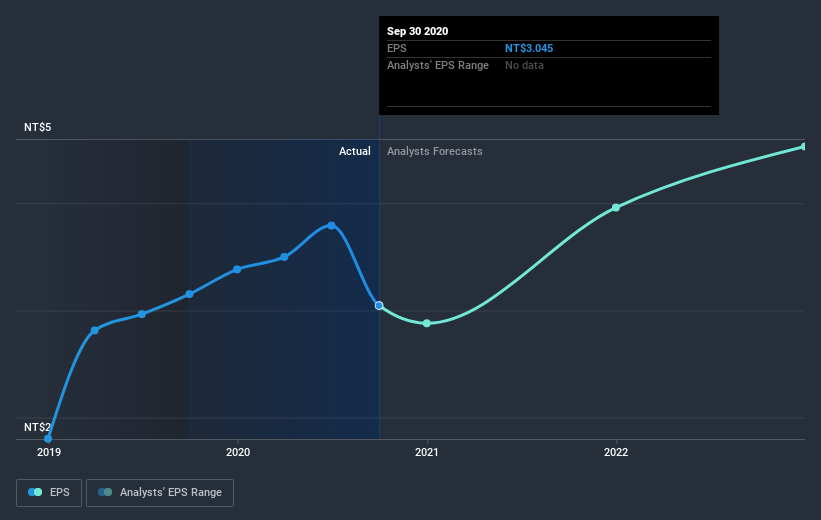

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, TaiSol Electronics achieved compound earnings per share growth of 20% per year. This EPS growth is lower than the 34% average annual increase in the share price. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into TaiSol Electronics' key metrics by checking this interactive graph of TaiSol Electronics's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of TaiSol Electronics, it has a TSR of 158% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

TaiSol Electronics shareholders are down 17% for the year (even including dividends), but the market itself is up 44%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 23% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for TaiSol Electronics that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade TaiSol Electronics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TaiSol Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3338

TaiSol Electronics

Engages in the manufacturing, processing, and trading of thermal modules, and components of electronic computers, electrical wires, and automobiles and motorcycles in Asia, the United Sates, and Europe.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives