- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3311

Share Price Aside, Silitech Technology (TPE:3311) Has Delivered Shareholders A 8.7% Return.

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Silitech Technology Corporation (TPE:3311), since the last five years saw the share price fall 43%. There was little comfort for shareholders in the last week as the price declined a further 5.6%.

View our latest analysis for Silitech Technology

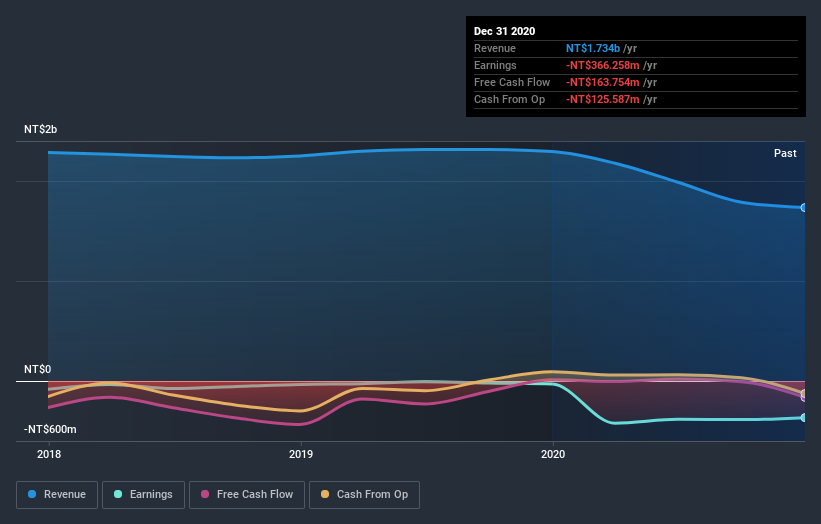

Given that Silitech Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Silitech Technology reduced its trailing twelve month revenue by 9.6% for each year. That puts it in an unattractive cohort, to put it mildly. On the face of it we'd posit the share price fall of 7% compound, over five years is well justified by the fundamental deterioration. This loss means the stock shareholders are probably pretty annoyed. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Silitech Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Silitech Technology's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Silitech Technology shareholders, and that cash payout contributed to why its TSR of 8.7%, over the last 5 years, is better than the share price return.

A Different Perspective

Silitech Technology provided a TSR of 20% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 1.7% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand Silitech Technology better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Silitech Technology you should be aware of, and 1 of them is potentially serious.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Silitech Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3311

Silitech Technology

Engages in the manufacture and sale of modules and rubber products in China, Malaysia, Taiwan, the United States, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026