The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that ASUSTeK Computer Inc. (TPE:2357) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for ASUSTeK Computer

How Much Debt Does ASUSTeK Computer Carry?

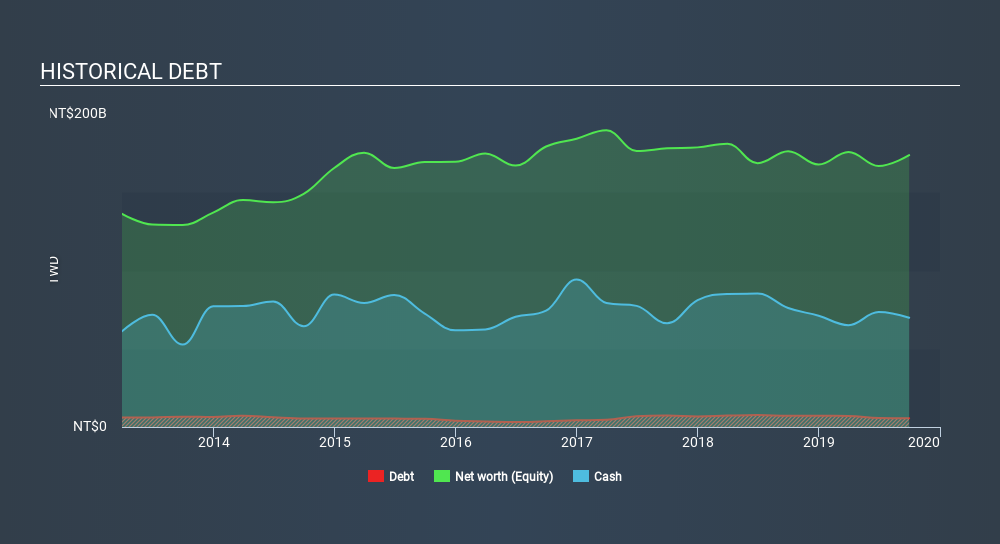

The image below, which you can click on for greater detail, shows that at September 2019 ASUSTeK Computer had debt of NT$5.60b, up from NT$7.1k in one year. But it also has NT$69.9b in cash to offset that, meaning it has NT$64.3b net cash.

A Look At ASUSTeK Computer's Liabilities

According to the last reported balance sheet, ASUSTeK Computer had liabilities of NT$150.9b due within 12 months, and liabilities of NT$12.5b due beyond 12 months. On the other hand, it had cash of NT$69.9b and NT$77.5b worth of receivables due within a year. So its liabilities total NT$16.1b more than the combination of its cash and short-term receivables.

Given ASUSTeK Computer has a market capitalization of NT$175.3b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, ASUSTeK Computer also has more cash than debt, so we're pretty confident it can manage its debt safely.

The modesty of its debt load may become crucial for ASUSTeK Computer if management cannot prevent a repeat of the 47% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine ASUSTeK Computer's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While ASUSTeK Computer has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, ASUSTeK Computer recorded free cash flow of 37% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that ASUSTeK Computer has NT$64.3b in net cash. So we don't have any problem with ASUSTeK Computer's use of debt. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check ASUSTeK Computer's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TWSE:2357

ASUSTeK Computer

Researches and develops, designs, manufactures, sells, and repairs computers, communications, and consumer electronic products in Taiwan, China, Singapore, Europe, the United States, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)