- Taiwan

- /

- Communications

- /

- TWSE:2314

Health Check: How Prudently Does Microelectronics Technology (TPE:2314) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Microelectronics Technology Inc. (TPE:2314) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Microelectronics Technology

What Is Microelectronics Technology's Debt?

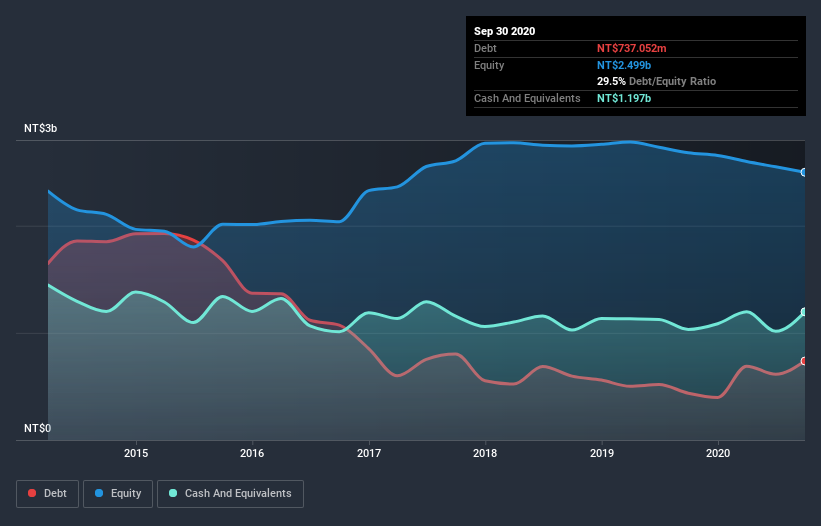

As you can see below, at the end of September 2020, Microelectronics Technology had NT$737.1m of debt, up from NT$436.5m a year ago. Click the image for more detail. But it also has NT$1.20b in cash to offset that, meaning it has NT$459.5m net cash.

A Look At Microelectronics Technology's Liabilities

We can see from the most recent balance sheet that Microelectronics Technology had liabilities of NT$1.58b falling due within a year, and liabilities of NT$892.2m due beyond that. Offsetting these obligations, it had cash of NT$1.20b as well as receivables valued at NT$983.0m due within 12 months. So it has liabilities totalling NT$287.9m more than its cash and near-term receivables, combined.

Given Microelectronics Technology has a market capitalization of NT$7.94b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Microelectronics Technology also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Microelectronics Technology's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Microelectronics Technology had a loss before interest and tax, and actually shrunk its revenue by 33%, to NT$4.4b. To be frank that doesn't bode well.

So How Risky Is Microelectronics Technology?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Microelectronics Technology lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through NT$115m of cash and made a loss of NT$32m. Given it only has net cash of NT$459.5m, the company may need to raise more capital if it doesn't reach break-even soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Microelectronics Technology .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Microelectronics Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2314

Microelectronics Technology

Designs, manufactures, and sells terrestrial microwave, satellite communication system, and customized products in the United States, Mainland China, and internationally.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

MPAA often has inventory and core-related timing issues. While this quarter’s problems may ease, similar issues have recurred historically and can persist for several quarters. It's not a one-off, it's a structural part of their business. Core returns are simply estimates: How many customers will actually return the original part; how quickly they'll do so; how many are useable; what they're worth, etc. MPAA predicts X sales in a quarter and Y core returns and its reserves, inventory values, etc. are based on that. If they expect a 90% core return rate and only 80% come back it doesn't change cash but they have to write down inventory and increase cost of goods sold which impacts EPS. They've also cited inventory buildup at key customers multiple times in the past. The assumption the latest backlog will all shift into future quarters this year with no impact on pricing, etc. seems more like wishful thinking. Retailer X was slated to buy $10m in parts this quarter but finds they have a lot more inventory on hand than they anticipated so they pushed the order. Realistically there are likely to be SKU cuts, reduction in safety stock on others, etc. Assuming that all $10m will come in this year plus the regular replenishment seems pretty unrealistic. MPAA also has a shaky track record when it comes to new lines and the supposed impact on business. If you look at the EV testing solutions hype back around 2020 that was supposed to diversify them beyond traditional reman and be a higher margin business that would grow with EV adoption. But it has never turned into a material contributor. The debt reduction and stock buy backs are meaningful but IMHO this narrative takes a very optimistic view of things.