- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6510

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

As global markets react to rising U.S. Treasury yields and a tempered outlook for Federal Reserve rate cuts, small-cap stocks have felt the pressure more acutely than their large-cap counterparts. In this environment, identifying promising high-growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Grifols (BME:GRF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grifols, S.A. is a plasma therapeutic company that operates in Spain, the United States, Canada, and internationally with a market cap of €6.40 billion.

Operations: Grifols primarily generates revenue from its Biopharma segment, which accounts for €5.78 billion, followed by the Diagnostic segment at €651.33 million and Bio Supplies at €186.91 million.

Grifols, a pioneer in healthcare solutions, recently received FDA approval for its plasma-protein based fibrin sealant for pediatric surgical use, enhancing its product portfolio in the U.S. and Europe. This development follows a strategic collaboration with Johnson & Johnson MedTech initiated in 2019, underscoring Grifols' commitment to expanding therapeutic applications and market reach. The company's R&D focus is evident from its significant investment in innovation; last year's R&D expenses were robustly aligned with revenue growth strategies, reflecting an ongoing emphasis on developing high-potential medical treatments. Moreover, Grifols' financial trajectory is promising with earnings expected to surge by 28.6% annually, outpacing the Spanish market's forecasted growth of 9.1%. This performance is anchored by a recent uptick in profitability and a forward-looking approach marked by strategic partnerships like those with BARDA to explore treatments for sulfur mustard ocular injuries—a testament to its agile adaptation to emergent medical needs.

- Dive into the specifics of Grifols here with our thorough health report.

Evaluate Grifols' historical performance by accessing our past performance report.

Siglent TechnologiesLtd (SHSE:688112)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Siglent Technologies CO.,Ltd. engages in the research, development, production, sale, and servicing of electronic test and measurement equipment both in China and internationally with a market cap of CN¥4.94 billion.

Operations: Siglent Technologies CO.,Ltd. focuses on the electronic test and measurement equipment sector, generating revenue through its comprehensive range of products and services. The company's business model includes research, development, production, sales, and servicing activities across both domestic and international markets.

Siglent Technologies, amid a challenging market, is navigating with a clear focus on growth and innovation. With an expected revenue surge of 26.3% per year, the company outpaces the Chinese market's average of 13.9%, underscoring its robust market position and strategic initiatives. This financial trajectory is complemented by an anticipated earnings growth of 31.3% annually, reflecting strong operational efficiency and market adaptation strategies. Particularly noteworthy is Siglent's commitment to research and development; last year's R&D expenses were not just substantial but strategically aligned to foster innovation in their tech offerings, which could be pivotal for sustaining long-term growth in the highly competitive tech landscape. Recent earnings reports show some fluctuations—CNY 91.65 million net income from CNY 119.02 million last year—but these are part of broader strategic adjustments as it invests heavily in future capabilities, including a notable increase in R&D spending to harness emerging technological trends.

Chunghwa Precision Test Tech (TPEX:6510)

Simply Wall St Growth Rating: ★★★★★☆

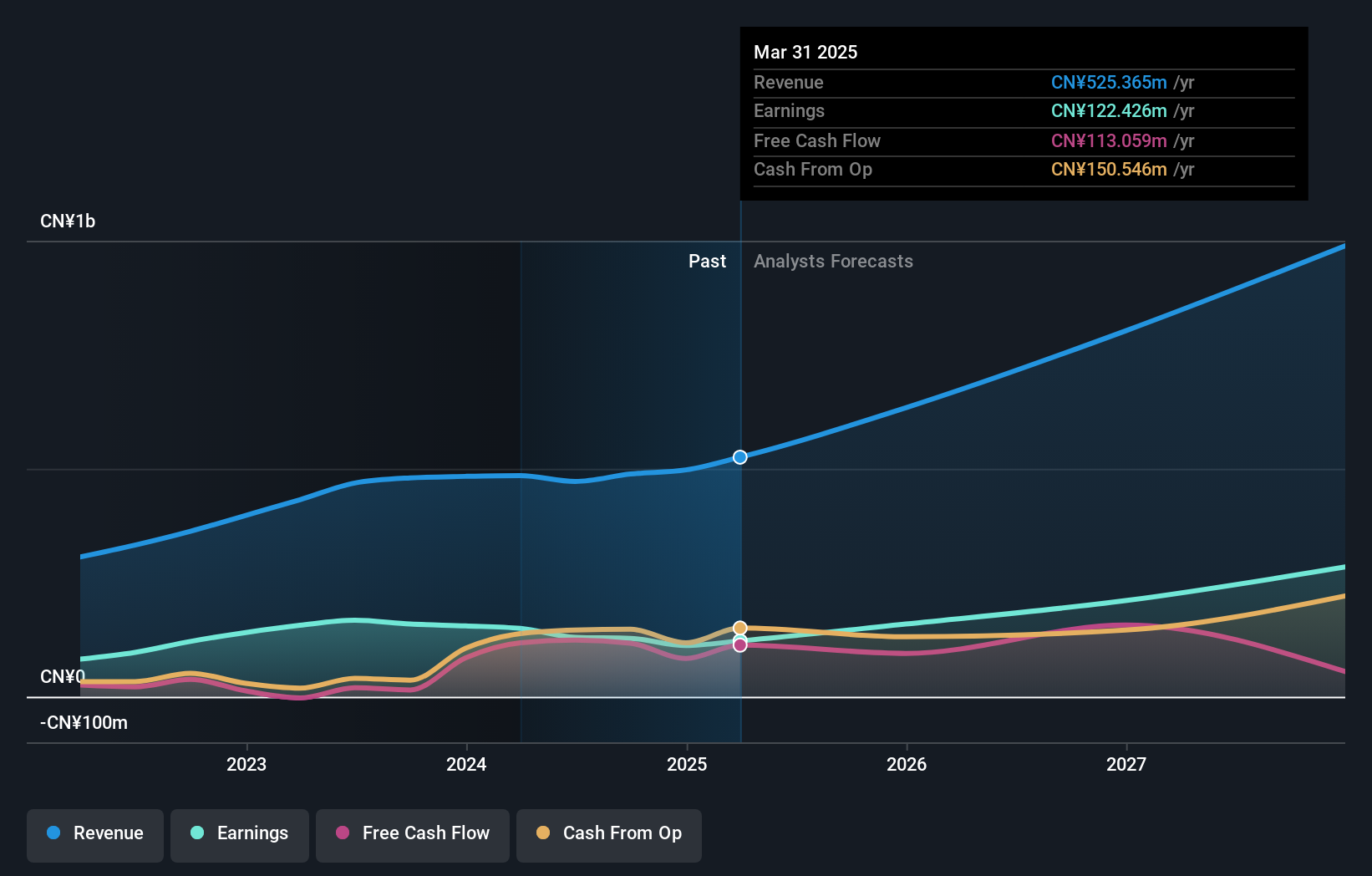

Overview: Chunghwa Precision Test Tech. Co., Ltd. operates in the testing of semiconductor components both domestically in Taiwan and internationally, with a market capitalization of NT$19.38 billion.

Operations: Chunghwa Precision Test Tech. generates revenue primarily from its electronic components and parts segment, totaling NT$2.86 billion. The company's operations span both domestic and international markets in the semiconductor testing industry.

Chunghwa Precision Test Tech has demonstrated a robust growth trajectory with an anticipated revenue increase of 24.7% per year, significantly outpacing the Taiwan market's average growth rate. This performance is bolstered by an impressive forecast for earnings growth at 91.4% annually, positioning the company well above regional benchmarks. The firm's commitment to innovation is evident in its R&D spending, which has been strategically increased to capitalize on emerging tech trends and maintain competitive advantage in precision testing solutions. Recent financial disclosures reveal a surge in net income to TWD 66.98 million from TWD 35.02 million year-over-year for Q2, underscoring effective operational management and possibly enhanced market demand for their specialized testing technologies.

- Take a closer look at Chunghwa Precision Test Tech's potential here in our health report.

Understand Chunghwa Precision Test Tech's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 1282 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6510

Chunghwa Precision Test Tech

Engages in the testing of semiconductor components in Taiwan, Republic of China, and internationally.

Flawless balance sheet with high growth potential.