- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1308

Global Dividend Stocks Highlighted With 3 Top Picks

Reviewed by Simply Wall St

As global markets respond positively to the recent U.S.-China tariff suspension, investors are witnessing a rally in major indices, with the Nasdaq Composite and S&P 500 leading gains. In this context of easing trade tensions and cooling inflation, dividend stocks stand out as an attractive option for those seeking stable income streams amidst market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.26% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| Daicel (TSE:4202) | 5.07% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.93% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.70% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.09% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.99% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

Click here to see the full list of 1565 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

SITC International Holdings (SEHK:1308)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SITC International Holdings Company Limited is a shipping logistics company providing integrated transportation and logistics solutions across Mainland China, Hong Kong, Taiwan, Japan, Southeast Asia, and internationally with a market cap of approximately HK$64.80 billion.

Operations: SITC International Holdings Company Limited generates revenue primarily through its Transportation - Shipping segment, which accounted for $3.06 billion.

Dividend Yield: 8.9%

SITC International Holdings recently approved a final dividend of HK$1.40 per share, reflecting its commitment to returning value to shareholders. The company's dividends are covered by earnings with a payout ratio of 70% and cash flows at 81.9%, indicating sustainability despite a volatile dividend history over the past decade. With an attractive dividend yield in the top 25% of Hong Kong payers, SITC benefits from strong recent earnings growth but faces potential future earnings declines.

- Delve into the full analysis dividend report here for a deeper understanding of SITC International Holdings.

- Our valuation report unveils the possibility SITC International Holdings' shares may be trading at a discount.

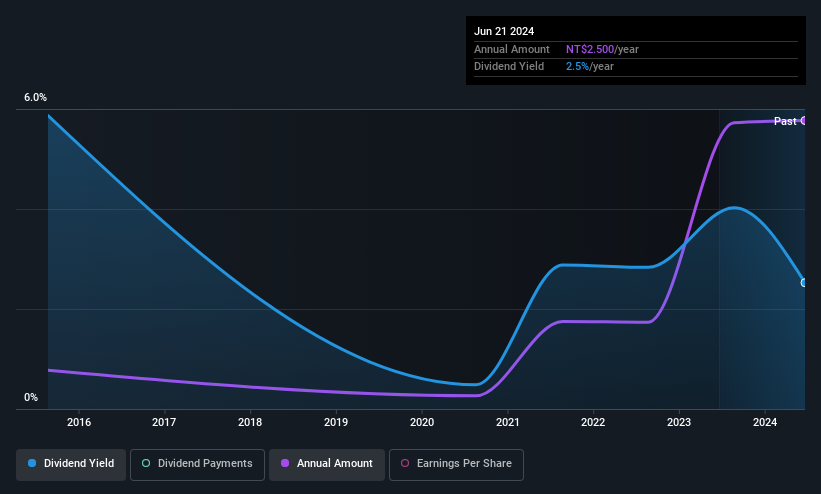

Powertip Image (TPEX:6498)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Powertip Image Corp, along with its subsidiaries, manufactures and sells electronic components and optical instruments across Mainland China, Taiwan, and internationally, with a market cap of NT$4.16 billion.

Operations: Powertip Image Corp generates revenue through the production and sale of electronic components and optical instruments in various international markets, including Mainland China and Taiwan.

Dividend Yield: 3%

Powertip Image Corp's dividend payments are well-supported by earnings and cash flows, with payout ratios of 48.9% and 32.4%, respectively. Despite recent earnings growth, the company's dividends have been volatile over the past decade. The annual dividend was recently increased to TWD 3 per share, payable in July 2025. However, its dividend yield remains low compared to top-tier payers in Taiwan's market and the stock has experienced high price volatility recently.

- Click here to discover the nuances of Powertip Image with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Powertip Image's current price could be quite moderate.

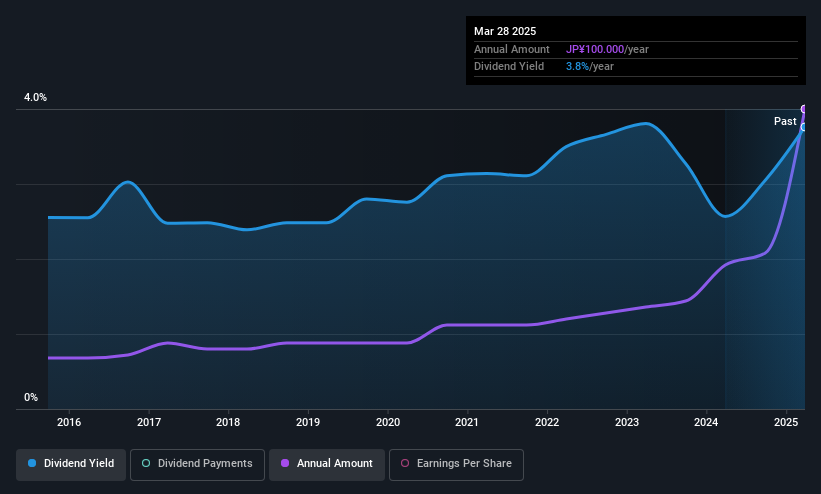

Techno Ryowa (TSE:1965)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Techno Ryowa Ltd. focuses on the design, construction, and maintenance of environmental control systems mainly in Japan, with a market cap of ¥69.43 billion.

Operations: Techno Ryowa Ltd.'s revenue is primarily derived from its operations in the design, construction, and maintenance of environmental control systems.

Dividend Yield: 3%

Techno Ryowa's dividends are well-covered by earnings and cash flows, with payout ratios of 28.2% and 48.1%, respectively, although the dividend has been volatile over the past decade. The dividend yield of 3.04% is below Japan's top-tier payers. A recent share repurchase program aims to enhance shareholder returns by buying back up to ¥2.20 billion worth of shares, reflecting a strategic move to improve capital efficiency amid a highly volatile share price environment.

- Unlock comprehensive insights into our analysis of Techno Ryowa stock in this dividend report.

- In light of our recent valuation report, it seems possible that Techno Ryowa is trading behind its estimated value.

Where To Now?

- Dive into all 1565 of the Top Global Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1308

SITC International Holdings

A shipping logistics company, engages in the provision of integrated transportation and logistics solutions in Mainland China, Hong Kong, Taiwan, Japan, Southeast Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)