- United Arab Emirates

- /

- Hospitality

- /

- ADX:AMR

3 Global Stocks That May Be Trading Below Intrinsic Value By Up To 48.4%

Reviewed by Simply Wall St

As global markets respond to recent monetary policy shifts, including the Federal Reserve's rate cut and ongoing trade negotiations between major economies, investors are keeping a keen eye on potential opportunities. In this environment of fluctuating interest rates and economic indicators, identifying stocks that may be trading below their intrinsic value becomes particularly appealing for those seeking to optimize their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sheng Siong Group (SGX:OV8) | SGD2.16 | SGD4.30 | 49.8% |

| Selvas AI (KOSDAQ:A108860) | ₩14220.00 | ₩28422.49 | 50% |

| Saudi Pharmaceutical Industries and Medical Appliances (SASE:2070) | SAR28.80 | SAR57.06 | 49.5% |

| NexTone (TSE:7094) | ¥2249.00 | ¥4456.32 | 49.5% |

| Micro Systemation (OM:MSAB B) | SEK61.60 | SEK121.94 | 49.5% |

| Kolmar Korea (KOSE:A161890) | ₩79100.00 | ₩155939.87 | 49.3% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥974.00 | ¥1933.14 | 49.6% |

| Dekon Food and Agriculture Group (SEHK:2419) | HK$80.00 | HK$159.63 | 49.9% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥29.89 | CN¥59.31 | 49.6% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥48.53 | CN¥96.82 | 49.9% |

Here's a peek at a few of the choices from the screener.

Americana Restaurants International (ADX:AMR)

Overview: Americana Restaurants International PLC operates a chain of restaurants across the Middle East and North Africa, with a market cap of AED15.87 billion.

Operations: The company's revenue segments include $1.74 billion from the Major Gulf Cooperation Council (GCC) and $230.15 million from the Lower Gulf, with an additional $192.45 million generated in North Africa.

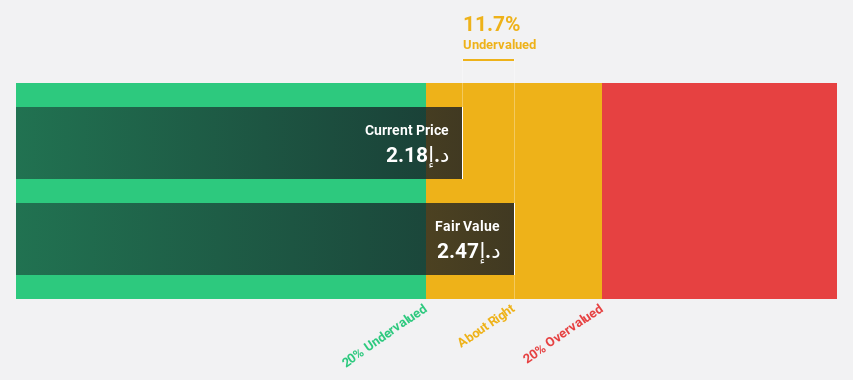

Estimated Discount To Fair Value: 28.6%

Americana Restaurants International is trading at AED1.89, significantly below its estimated fair value of AED2.65, suggesting undervaluation based on cash flows. Analysts agree on a potential price increase of 49.9%. The company's earnings are forecast to grow annually by 15.3%, outpacing the AE market's 6.6% growth rate, with a very high return on equity expected in three years (45.1%). Recent earnings show solid growth, with Q2 sales at US$643.59 million and net income at US$59.83 million.

- According our earnings growth report, there's an indication that Americana Restaurants International might be ready to expand.

- Take a closer look at Americana Restaurants International's balance sheet health here in our report.

Kardemir Karabük Demir Çelik Sanayi Ve Ticaret (IBSE:KRDMD)

Overview: Kardemir Karabük Demir Çelik Sanayi Ve Ticaret A.S. operates in the steel manufacturing industry and has a market capitalization of TRY35.02 billion.

Operations: Kardemir generates revenue from its core operations in the steel manufacturing sector.

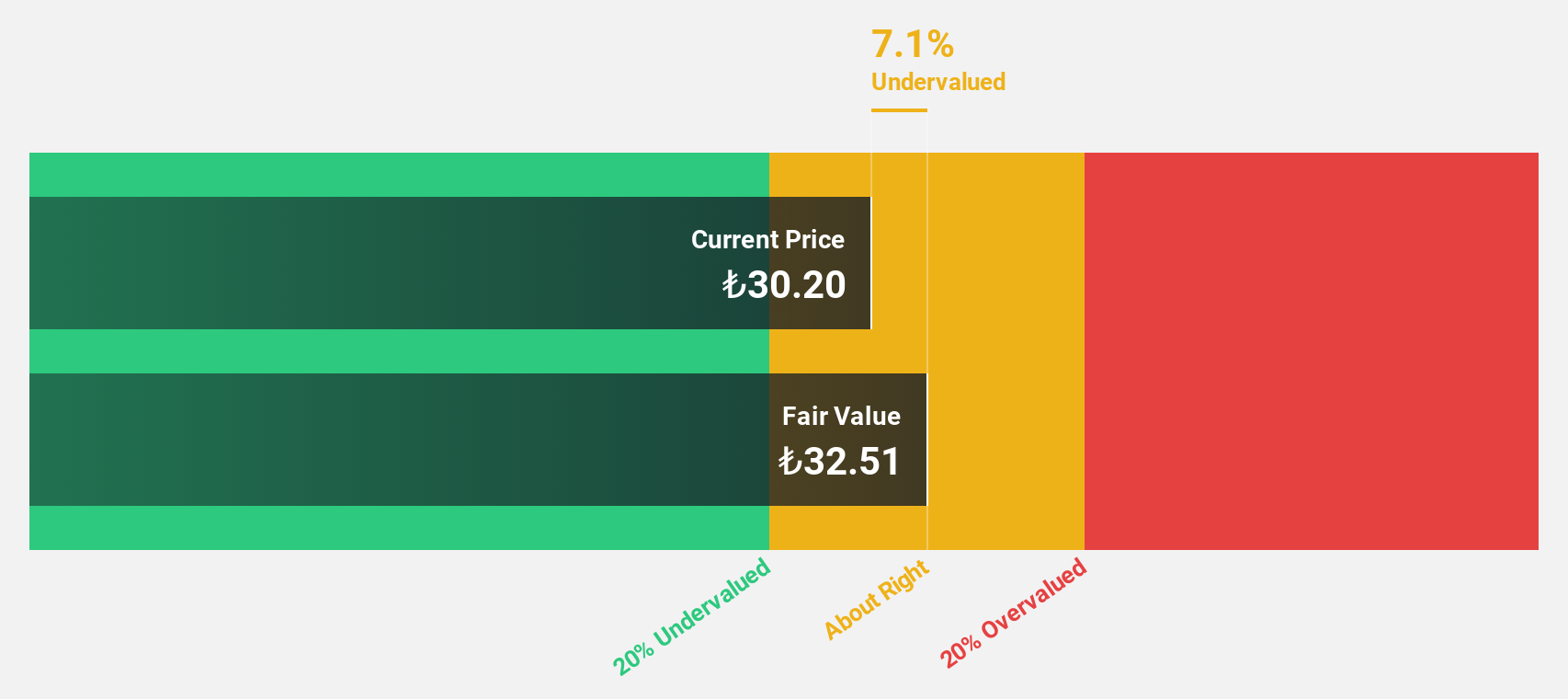

Estimated Discount To Fair Value: 11.9%

Kardemir Karabük Demir Çelik Sanayi Ve Ticaret is trading at TRY29.5, slightly below its fair value estimate of TRY33.48, indicating potential undervaluation based on cash flows. Recent earnings reveal a turnaround with a net income of TRY 1,316.18 million for Q2 2025 compared to a previous loss, despite lower sales year-on-year. Forecasts suggest strong revenue growth of 24.9% annually and profitability within three years, though return on equity remains modest at 9.8%.

- Upon reviewing our latest growth report, Kardemir Karabük Demir Çelik Sanayi Ve Ticaret's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Kardemir Karabük Demir Çelik Sanayi Ve Ticaret with our detailed financial health report.

Taiwan Union Technology (TPEX:6274)

Overview: Taiwan Union Technology Corporation manufactures and sells copper foil substrates, adhesive sheets, and multi-layer laminated boards both in Taiwan and internationally, with a market cap of NT$84.52 billion.

Operations: The company's revenue is primarily derived from its Foreign Sales and Manufacturing Sector, contributing NT$15.98 billion, and its Domestic Sales and Manufacturing Sector, which adds NT$10.10 billion.

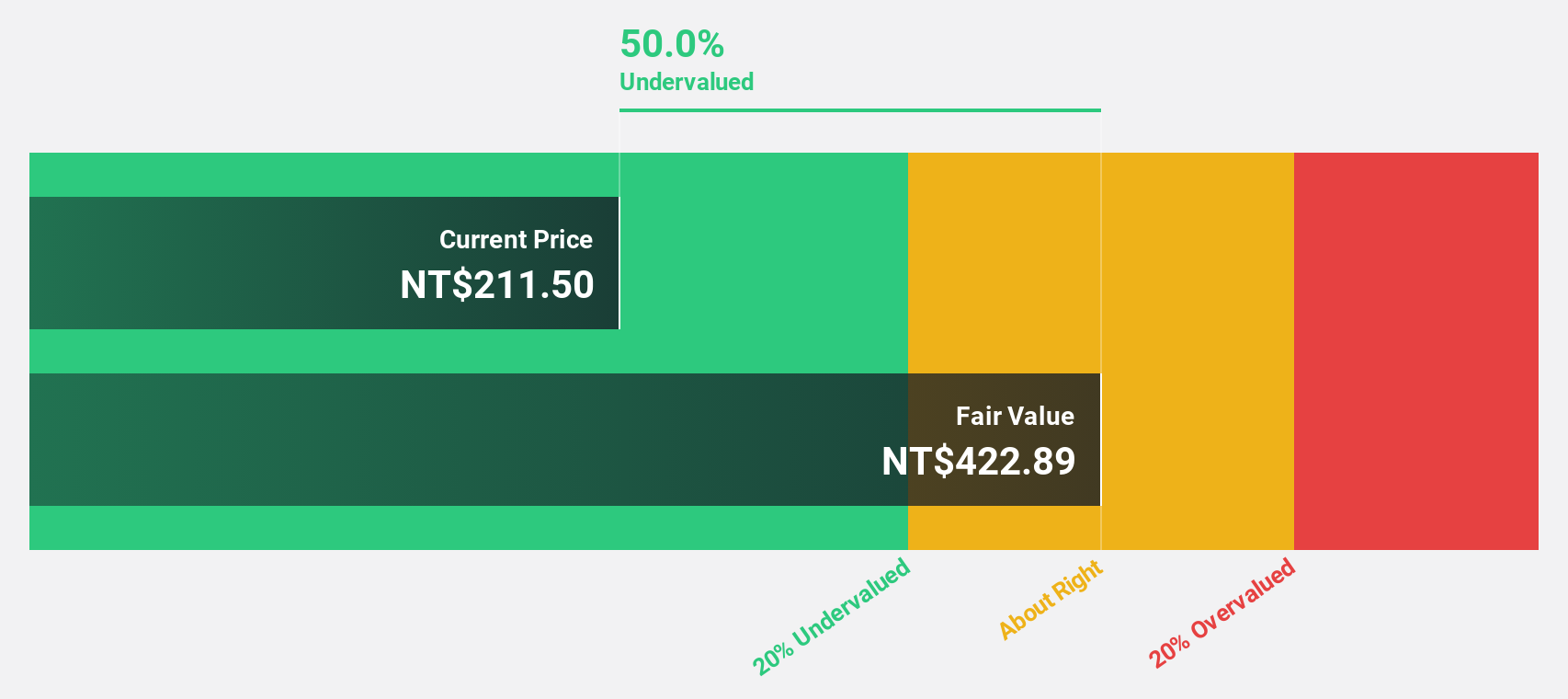

Estimated Discount To Fair Value: 48.4%

Taiwan Union Technology is trading at NT$319, significantly below its estimated fair value of NT$617.9, highlighting potential undervaluation based on cash flows. The company reported increased sales for the first half of 2025, though net income dipped slightly in Q2 compared to last year. With earnings projected to grow substantially at 31.64% annually and revenue growth expected to outpace the market, it presents a compelling investment opportunity despite recent share price volatility and a dividend not fully covered by free cash flows.

- Insights from our recent growth report point to a promising forecast for Taiwan Union Technology's business outlook.

- Navigate through the intricacies of Taiwan Union Technology with our comprehensive financial health report here.

Next Steps

- Embark on your investment journey to our 519 Undervalued Global Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:AMR

Americana Restaurants International

Operates a chain of restaurant in the United Arab Emirates, Saudi Arabia, Kuwait, Egypt, Qatar, Kazakhstan, Bahrain, Jordan, Oman, Lebanon, Morocco, North Africa, and Iraq.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives