- Germany

- /

- Oil and Gas

- /

- XTRA:ETG

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets respond to cooling inflation and strong bank earnings, major U.S. stock indexes have rebounded, with value stocks notably outperforming growth shares. Amid these market dynamics, dividend stocks can offer investors a reliable income stream and potential for portfolio enhancement, especially when economic conditions suggest stability in interest rates.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

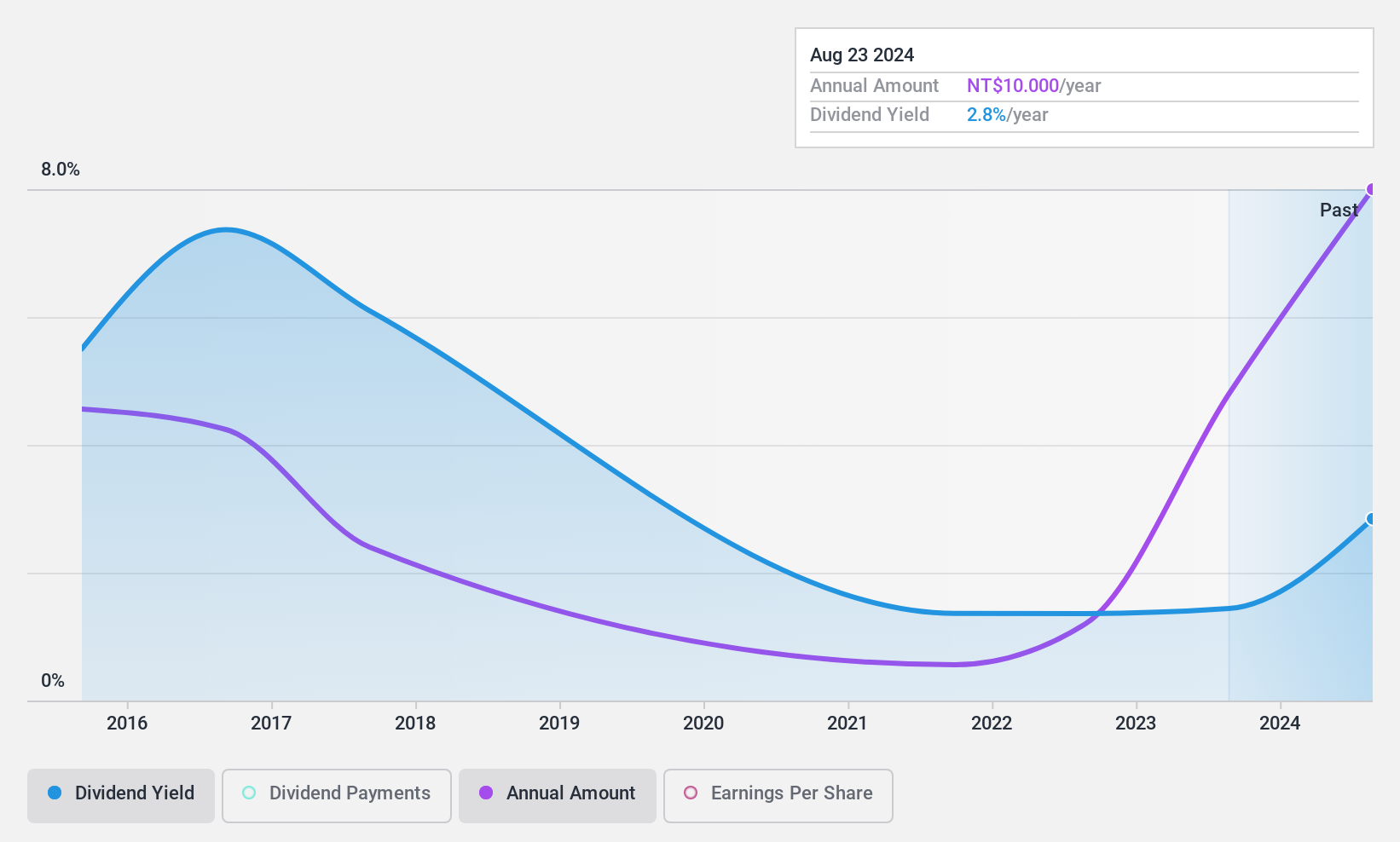

AIC (TPEX:3693)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AIC Inc. offers OEM/ODM, commercial off-the-shelf, and server and storage solutions across the United States, Asia, and Europe with a market cap of NT$14.23 billion.

Operations: AIC Inc.'s revenue primarily comes from its Computers and Related Spare Parts Department, totaling NT$8.79 billion.

Dividend Yield: 3%

AIC's dividend payments are well covered by earnings and cash flows, with a payout ratio of 37.9% and a cash payout ratio of 56.7%. However, dividends have been volatile over the past decade, despite recent growth. The current dividend yield is relatively low at 3.02% compared to top payers in the market. Recent earnings show mixed results with net income for nine months increasing to TWD 895.69 million from TWD 804.05 million year-on-year.

- Click to explore a detailed breakdown of our findings in AIC's dividend report.

- According our valuation report, there's an indication that AIC's share price might be on the expensive side.

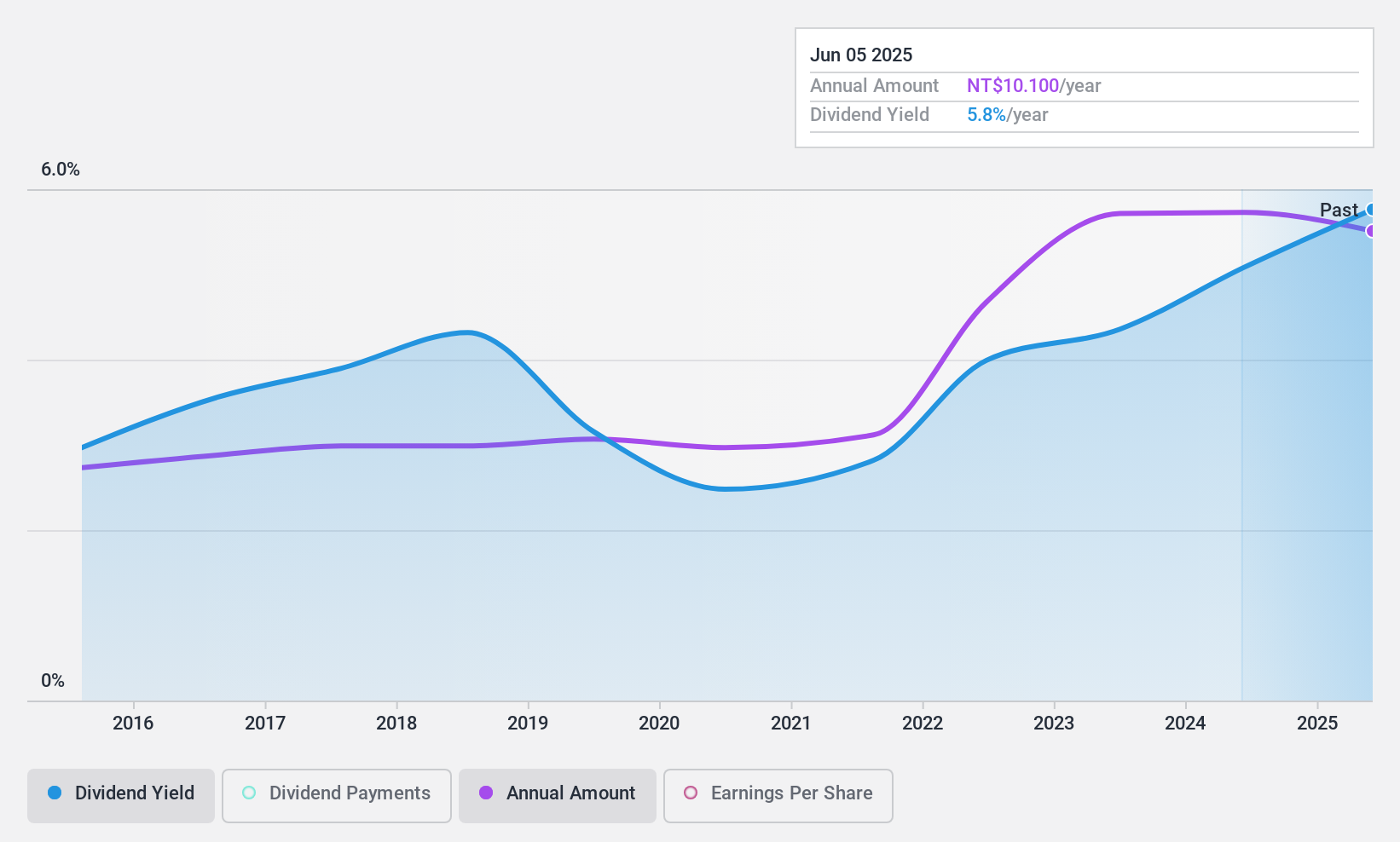

Sporton International (TPEX:6146)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sporton International Inc. offers product testing and certification services both in Taiwan and internationally, with a market cap of NT$20.68 billion.

Operations: Sporton International Inc.'s revenue primarily comes from its Testing certification and verification services, which generated NT$4.15 billion, complemented by its Parts Division contributing NT$438.77 million.

Dividend Yield: 5.2%

Sporton International's dividend yield of 5.17% ranks in the top 25% of the TW market, but its sustainability is questionable with a high cash payout ratio of 108.2%. Despite stable and reliable dividends over the past decade, they are not fully covered by free cash flows or earnings. Recent financials reveal declining revenue and net income for both Q3 and nine months ended September 2024, which could impact future dividend stability.

- Click here to discover the nuances of Sporton International with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Sporton International's current price could be inflated.

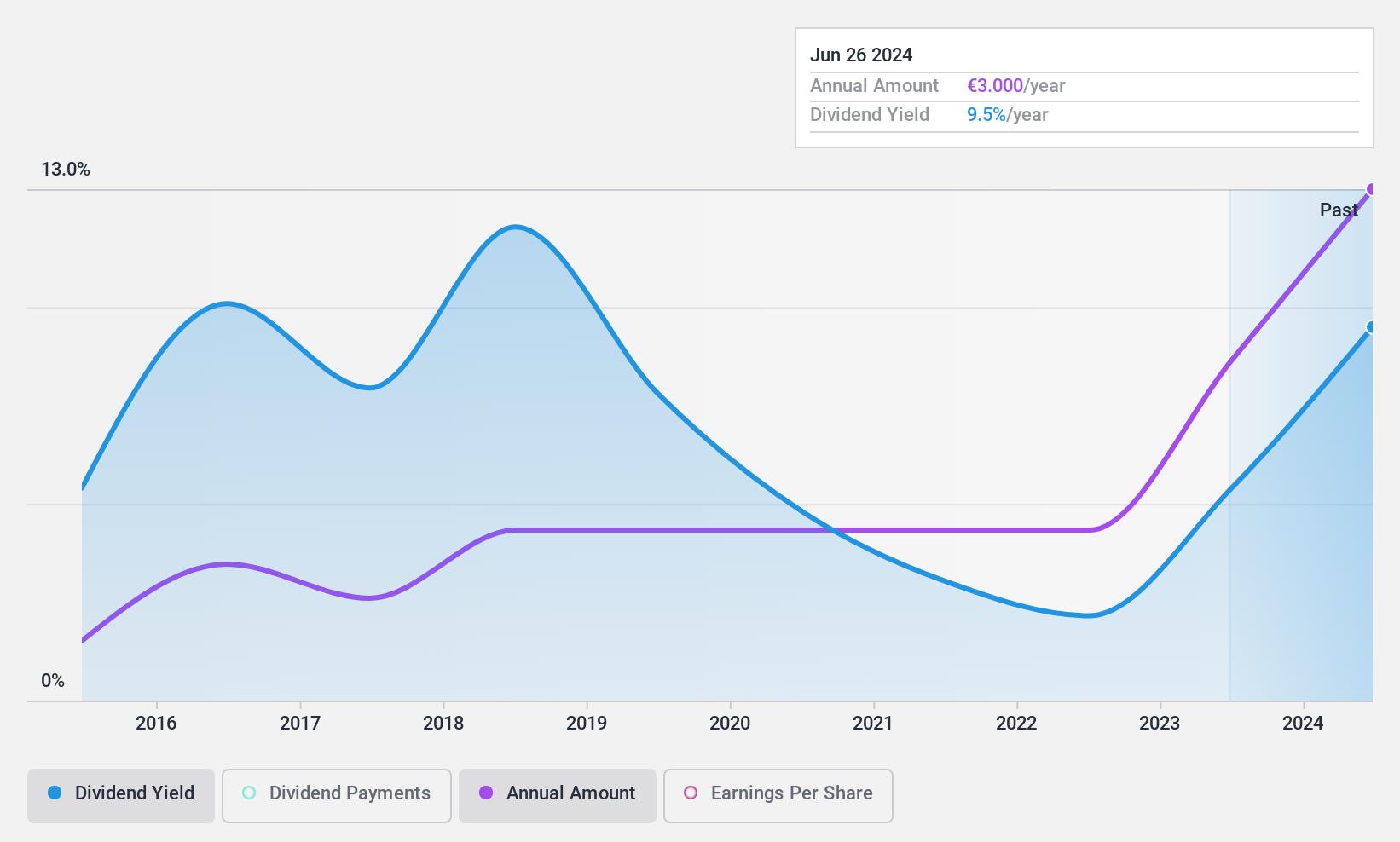

EnviTec Biogas (XTRA:ETG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EnviTec Biogas AG is a company that manufactures and operates biogas and biomethane plants across several countries, including Germany, Italy, Great Britain, and the United States, with a market cap of €448.47 million.

Operations: EnviTec Biogas AG generates revenue through the manufacturing and operation of biogas and biomethane plants across various international markets, including Europe, the United States, and China.

Dividend Yield: 9.9%

EnviTec Biogas offers a high dividend yield of 9.93%, placing it among the top 25% in Germany, though its sustainability is uncertain due to insufficient data on cash flow coverage. Trading significantly below its estimated fair value suggests potential upside, yet the dividend's volatility and unreliability over the past decade raise concerns. While dividends have grown over ten years, their inconsistency could pose risks for investors prioritizing stable income streams.

- Delve into the full analysis dividend report here for a deeper understanding of EnviTec Biogas.

- According our valuation report, there's an indication that EnviTec Biogas' share price might be on the cheaper side.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1983 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EnviTec Biogas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ETG

EnviTec Biogas

Manufactures and operates biogas and biomethane plants in Germany, Italy, Great Britain, the Czechia Republic, France, Denmark, the United States, China, Slovakia, Estonia, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)