- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6140

Dimension Computer Technology's (GTSM:6140) Earnings Are Of Questionable Quality

Dimension Computer Technology Co., Ltd.'s (GTSM:6140) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that shareholders have noticed something concerning in the numbers.

See our latest analysis for Dimension Computer Technology

Zooming In On Dimension Computer Technology's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

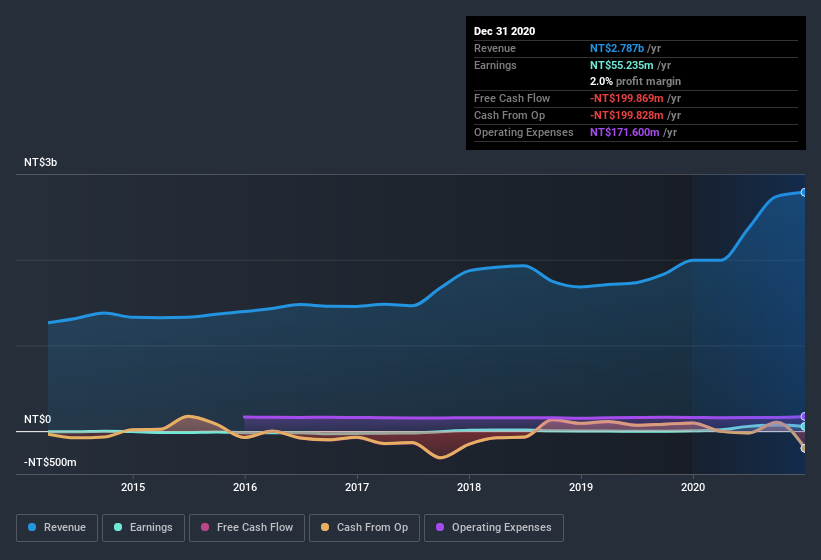

Over the twelve months to December 2020, Dimension Computer Technology recorded an accrual ratio of 0.46. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of NT$200m, in contrast to the aforementioned profit of NT$55.2m. It's worth noting that Dimension Computer Technology generated positive FCF of NT$94m a year ago, so at least they've done it in the past. The good news for shareholders is that Dimension Computer Technology's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Dimension Computer Technology.

Our Take On Dimension Computer Technology's Profit Performance

As we discussed above, we think Dimension Computer Technology's earnings were not supported by free cash flow, which might concern some investors. For this reason, we think that Dimension Computer Technology's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Our analysis shows 3 warning signs for Dimension Computer Technology (2 are concerning!) and we strongly recommend you look at these before investing.

Today we've zoomed in on a single data point to better understand the nature of Dimension Computer Technology's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Dimension Computer Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6140

Dimension Computer Technology

Provides software and hardware systems for corporate customers in Taiwan and the Mainland China.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion