- Taiwan

- /

- Communications

- /

- TPEX:4905

Tainet Communication System (GTSM:4905) Is In A Good Position To Deliver On Growth Plans

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Tainet Communication System (GTSM:4905) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Tainet Communication System

How Long Is Tainet Communication System's Cash Runway?

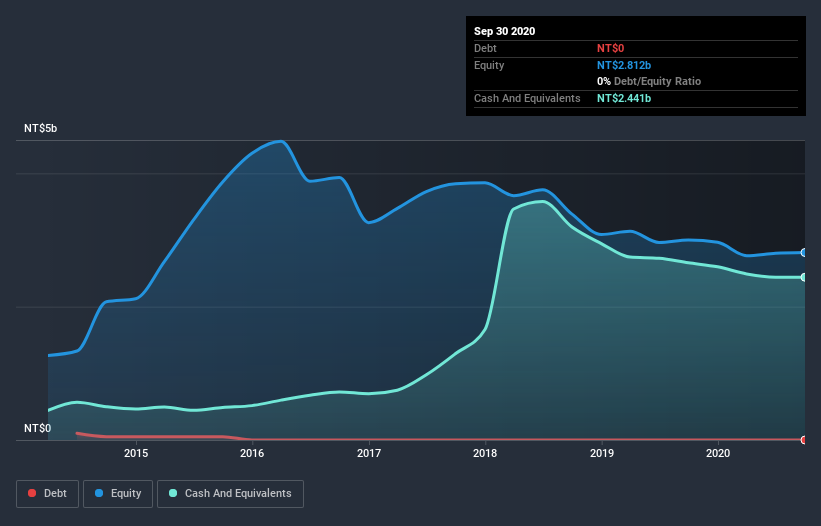

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at September 2020, Tainet Communication System had cash of NT$2.4b and no debt. Looking at the last year, the company burnt through NT$158m. So it had a very long cash runway of many years from September 2020. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Tainet Communication System Growing?

We reckon the fact that Tainet Communication System managed to shrink its cash burn by 27% over the last year is rather encouraging. But the revenue dip of 14% in the same period was a bit concerning. Considering both these factors, we're not particularly excited by its growth profile. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Tainet Communication System has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For Tainet Communication System To Raise More Cash For Growth?

We are certainly impressed with the progress Tainet Communication System has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Tainet Communication System has a market capitalisation of NT$1.7b and burnt through NT$158m last year, which is 9.5% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Tainet Communication System's Cash Burn?

As you can probably tell by now, we're not too worried about Tainet Communication System's cash burn. For example, we think its cash runway suggests that the company is on a good path. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Tainet Communication System (of which 1 shouldn't be ignored!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you decide to trade Tainet Communication System, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tainet Communication System might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4905

Tainet Communication System

Provides carrier class access equipment to telecommunication companies, service operators, and business users worldwide.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)