- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3689

These 4 Measures Indicate That U.D.Electronic (GTSM:3689) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that U.D.Electronic Corp. (GTSM:3689) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for U.D.Electronic

What Is U.D.Electronic's Debt?

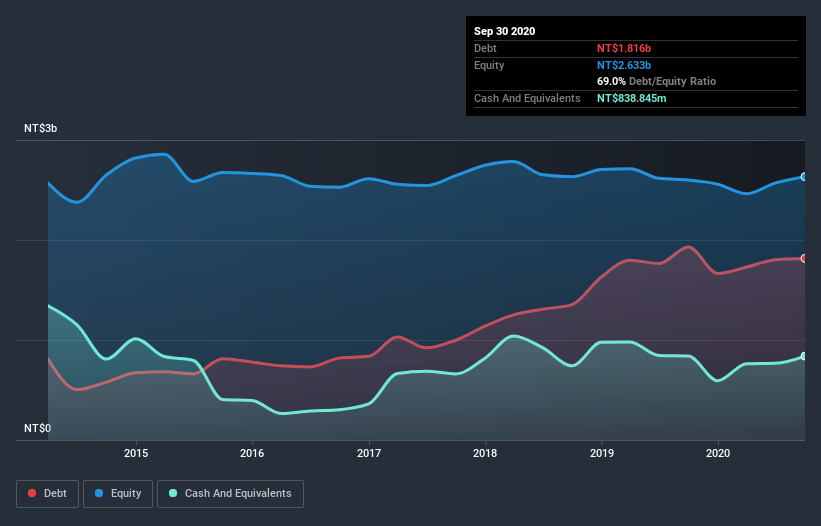

The image below, which you can click on for greater detail, shows that U.D.Electronic had debt of NT$1.82b at the end of September 2020, a reduction from NT$1.93b over a year. On the flip side, it has NT$838.8m in cash leading to net debt of about NT$976.9m.

How Strong Is U.D.Electronic's Balance Sheet?

According to the last reported balance sheet, U.D.Electronic had liabilities of NT$3.08b due within 12 months, and liabilities of NT$84.3m due beyond 12 months. Offsetting these obligations, it had cash of NT$838.8m as well as receivables valued at NT$1.53b due within 12 months. So its liabilities total NT$797.3m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since U.D.Electronic has a market capitalization of NT$2.01b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

U.D.Electronic has net debt worth 2.1 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.0 times the interest expense. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Notably, U.D.Electronic made a loss at the EBIT level, last year, but improved that to positive EBIT of NT$121m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since U.D.Electronic will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, U.D.Electronic actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

When it comes to the balance sheet, the standout positive for U.D.Electronic was the fact that it seems able to convert EBIT to free cash flow confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to handle its total liabilities. When we consider all the elements mentioned above, it seems to us that U.D.Electronic is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for U.D.Electronic (1 is a bit unpleasant) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade U.D.Electronic, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3689

U.D. Electronic

Researches, manufactures, and sells electronic components and materials, connectors, and products in Taiwan and China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026