- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3426

How Does Tai Shing Electronics Components Corporation (GTSM:3426) Fare As A Dividend Stock?

Dividend paying stocks like Tai Shing Electronics Components Corporation (GTSM:3426) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

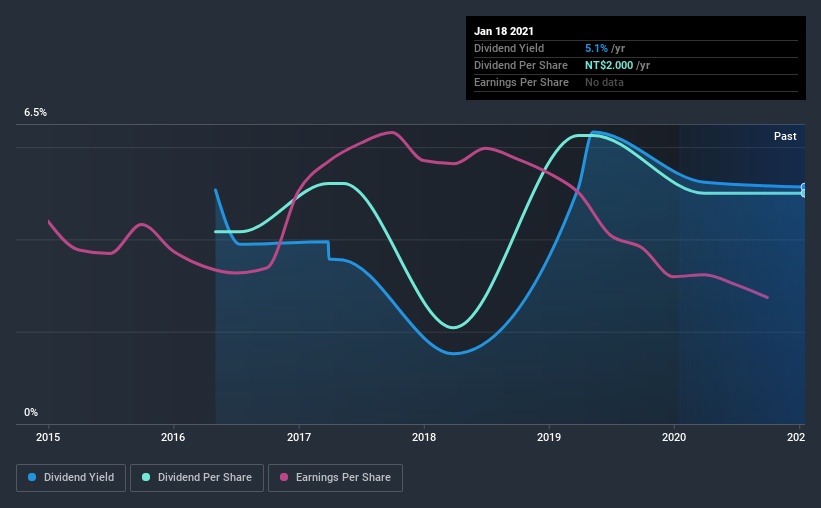

With a five-year payment history and a 5.1% yield, many investors probably find Tai Shing Electronics Components intriguing. It sure looks interesting on these metrics - but there's always more to the story. Some simple research can reduce the risk of buying Tai Shing Electronics Components for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Tai Shing Electronics Components paid out 105% of its profit as dividends. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Tai Shing Electronics Components paid out 145% of its free cash flow last year, which we think is concerning if cash flows do not improve. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. As Tai Shing Electronics Components' dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

While the above analysis focuses on dividends relative to a company's earnings, we do note Tai Shing Electronics Components' strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Tai Shing Electronics Components' latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that Tai Shing Electronics Components has been paying a dividend for the past five years. During the past five-year period, the first annual payment was NT$1.7 in 2016, compared to NT$2.0 last year. Dividends per share have grown at approximately 3.7% per year over this time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's not great to see that Tai Shing Electronics Components' have fallen at approximately 8.7% over the past five years. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're a bit uncomfortable with Tai Shing Electronics Components paying out a high percentage of both its cashflow and earnings. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. Using these criteria, Tai Shing Electronics Components looks quite suboptimal from a dividend investment perspective.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 4 warning signs for Tai Shing Electronics Components (2 are a bit unpleasant!) that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade Tai Shing Electronics Components, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tai Shing Electronics Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3426

Tai Shing Electronics Components

Researches, designs, develops, manufactures, and sells solenoids, and solenoid valve and relay products.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)