- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3357

Is TAI-TECH Advanced Electronics Co., Ltd. (GTSM:3357) A Smart Pick For Income Investors?

Could TAI-TECH Advanced Electronics Co., Ltd. (GTSM:3357) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

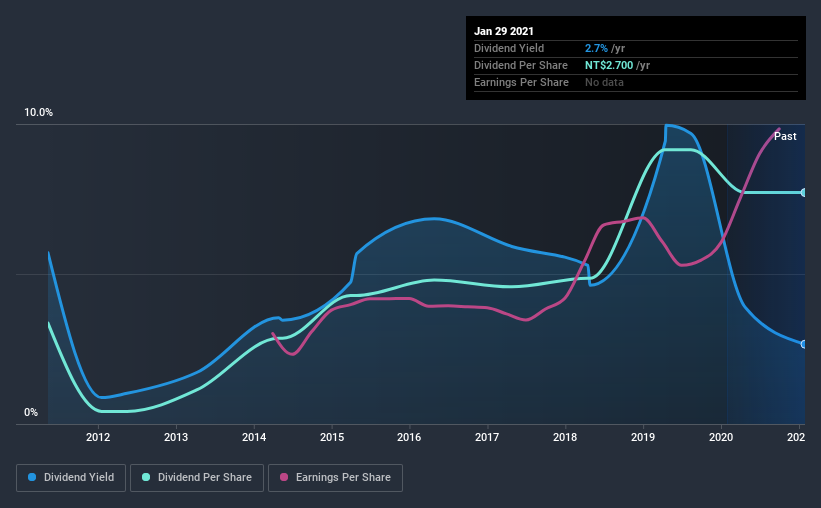

While TAI-TECH Advanced Electronics's 2.7% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 34% of TAI-TECH Advanced Electronics' profits were paid out as dividends in the last 12 months. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. TAI-TECH Advanced Electronics paid out 239% of its free cash flow last year, which we think is concerning if cash flows do not improve. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term. While TAI-TECH Advanced Electronics' dividends were covered by the company's reported profits, free cash flow is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Were it to repeatedly pay dividends that were not well covered by cash flow, this could be a risk to TAI-TECH Advanced Electronics' ability to maintain its dividend.

We update our data on TAI-TECH Advanced Electronics every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. TAI-TECH Advanced Electronics has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut on at least one occasion historically. During the past 10-year period, the first annual payment was NT$1.2 in 2011, compared to NT$2.7 last year. This works out to be a compound annual growth rate (CAGR) of approximately 8.7% a year over that time. The dividends haven't grown at precisely 8.7% every year, but this is a useful way to average out the historical rate of growth.

It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. TAI-TECH Advanced Electronics might have put its house in order since then, but we remain cautious.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's good to see TAI-TECH Advanced Electronics has been growing its earnings per share at 19% a year over the past five years. Earnings per share have been growing at a good rate, and the company is paying less than half its earnings as dividends. We generally think this is an attractive combination, as it permits further reinvestment in the business.

Conclusion

To summarise, shareholders should always check that TAI-TECH Advanced Electronics' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we like TAI-TECH Advanced Electronics' low dividend payout ratio, although we're a bit concerned that it paid out a substantially higher percentage of its free cash flow. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. In sum, we find it hard to get excited about TAI-TECH Advanced Electronics from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for TAI-TECH Advanced Electronics that investors should take into consideration.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you’re looking to trade TAI-TECH Advanced Electronics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TAI-TECH Advanced Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3357

TAI-TECH Advanced Electronics

Develops, manufactures, and sells magnetic materials and inductive components in Taiwan.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)