- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3224

Is MetaTech (AP) (GTSM:3224) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies MetaTech (AP) Inc. (GTSM:3224) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for MetaTech (AP)

What Is MetaTech (AP)'s Debt?

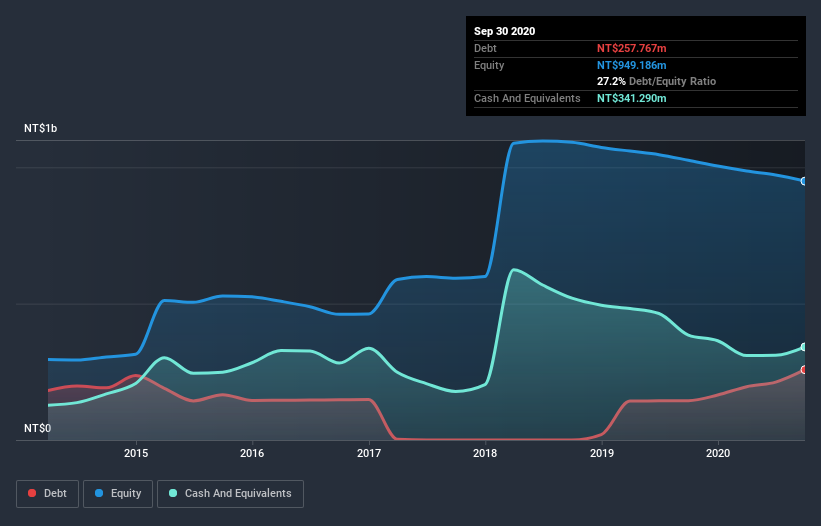

The image below, which you can click on for greater detail, shows that at September 2020 MetaTech (AP) had debt of NT$257.8m, up from NT$144.2m in one year. But it also has NT$341.3m in cash to offset that, meaning it has NT$83.5m net cash.

A Look At MetaTech (AP)'s Liabilities

The latest balance sheet data shows that MetaTech (AP) had liabilities of NT$303.4m due within a year, and liabilities of NT$274.0m falling due after that. Offsetting these obligations, it had cash of NT$341.3m as well as receivables valued at NT$346.7m due within 12 months. So it actually has NT$110.5m more liquid assets than total liabilities.

This surplus suggests that MetaTech (AP) has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that MetaTech (AP) has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since MetaTech (AP) will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year MetaTech (AP) wasn't profitable at an EBIT level, but managed to grow its revenue by 15%, to NT$1.6b. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is MetaTech (AP)?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months MetaTech (AP) lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through NT$78m of cash and made a loss of NT$74m. However, it has net cash of NT$83.5m, so it has a bit of time before it will need more capital. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for MetaTech (AP) you should be aware of, and 1 of them is a bit unpleasant.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade MetaTech (AP), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3224

MetaTech (AP)

Engages in the wholesale and retail of electronic products and equipment in Taiwan and internationally.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)