As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a cautious optimism, with indices like Japan's Nikkei 225 and China's CSI 300 posting gains amid expectations for economic stimulus measures. In this environment, dividend stocks in Asia can offer investors a combination of potential income stability and exposure to growth opportunities as regional economies navigate these shifting global dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.60% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.95% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.94% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.63% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.14% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.50% | ★★★★★★ |

Click here to see the full list of 1194 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Solidwizard Technology (TPEX:8416)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Solidwizard Technology Co., Ltd. offers software, hardware, and consulting service solutions in Taiwan and China with a market cap of NT$4.88 billion.

Operations: Solidwizard Technology Co., Ltd. generates revenue of NT$167.92 million from China and NT$1.38 billion from Taiwan.

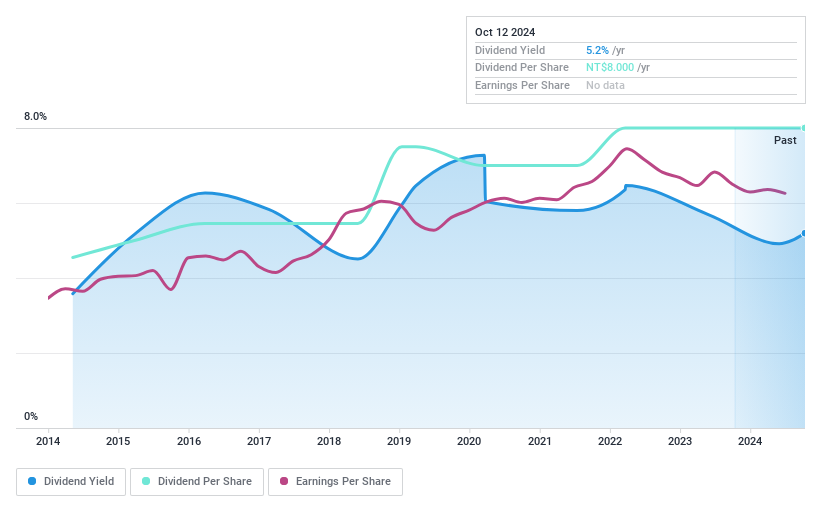

Dividend Yield: 4.6%

Solidwizard Technology's dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 72.7% and a cash payout ratio of 67%, respectively. Although its dividend yield of 4.62% is below the top quartile in Taiwan, the company has consistently increased dividends over the past decade without volatility. Recent financial results show modest growth in sales and net income, reinforcing its capacity to maintain stable dividends amidst ongoing profitability improvements.

- Click here to discover the nuances of Solidwizard Technology with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Solidwizard Technology shares in the market.

Sumitomo Electric Industries (TSE:5802)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Electric Industries, Ltd. is a global manufacturer and seller of electric wires and cables, with a market cap of ¥1.76 trillion.

Operations: Sumitomo Electric Industries, Ltd.'s revenue segments consist of Electronics at ¥375.88 million, Automotive Related Business at ¥2.70 billion, Environmental Energy Related Business at ¥1.07 billion, Industrial Materials Related Business at ¥372.07 million, and Information and Communications Related Business at ¥214.44 million.

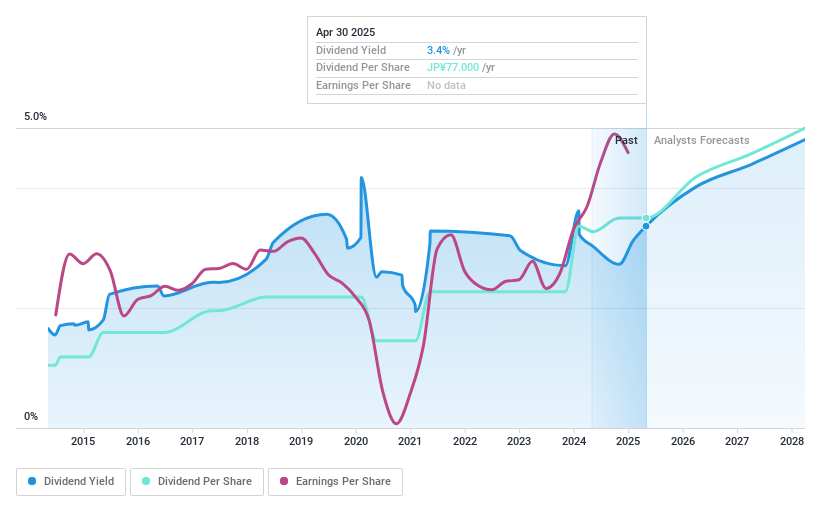

Dividend Yield: 3.4%

Sumitomo Electric Industries' dividend payments, while covered by earnings and cash flows with payout ratios of 36.9% and 40.9%, have been volatile over the past decade, lacking reliability. Despite trading at a significant discount to its estimated fair value, the stock's price has shown high volatility recently. The company's strategic collaboration on advanced optical transceiver modules could enhance future growth prospects but does not directly address dividend stability concerns for investors seeking consistent income streams.

- Navigate through the intricacies of Sumitomo Electric Industries with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Sumitomo Electric Industries' current price could be quite moderate.

Global Brands Manufacture (TWSE:6191)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Brands Manufacture Ltd. operates in Taiwan, focusing on printed circuit boards production and electronic manufacturing services, with a market cap of NT$28.54 billion.

Operations: Global Brands Manufacture Ltd.'s revenue is primarily derived from its Printed Circuit Board (PCB) segment, contributing NT$14.35 billion, and its Electronic Manufacturing Service (EMS) segment, which adds NT$7.81 billion.

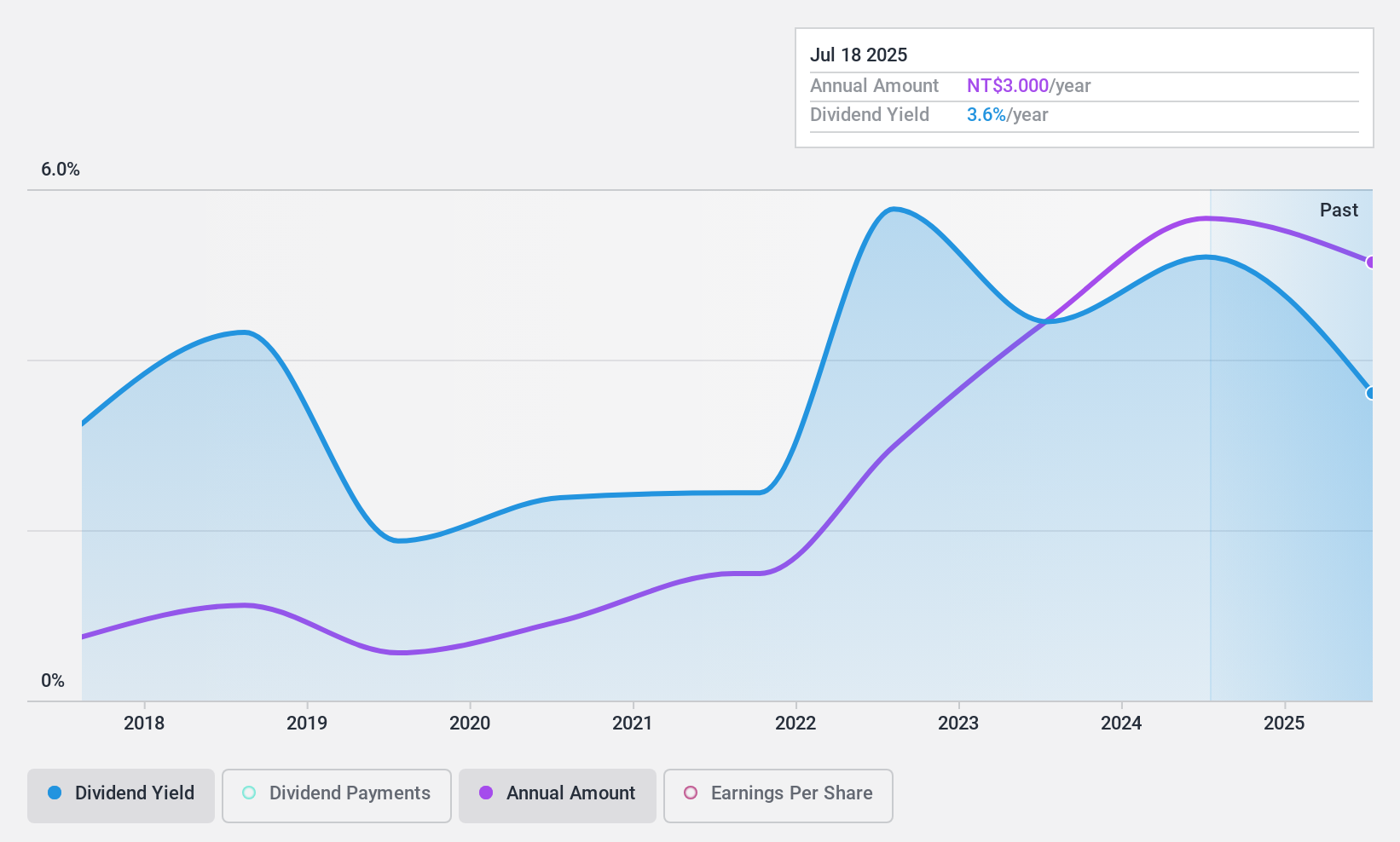

Dividend Yield: 5.5%

Global Brands Manufacture's dividends, covered by earnings and cash flows with payout ratios of 51% and 83.3%, respectively, have been volatile over its eight-year history. Although the stock trades at a discount to its estimated fair value, recent earnings showed a decline in sales and net income compared to the previous year. The proposed amendment of company bylaws may influence future operations but doesn't directly impact dividend stability for investors focusing on consistent returns.

- Delve into the full analysis dividend report here for a deeper understanding of Global Brands Manufacture.

- Our comprehensive valuation report raises the possibility that Global Brands Manufacture is priced lower than what may be justified by its financials.

Where To Now?

- Investigate our full lineup of 1194 Top Asian Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8416

Solidwizard Technology

Provides software, hardware, and consulting service solutions in Taiwan and China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives