These 4 Measures Indicate That Tatung System Technologies (GTSM:8099) Is Using Debt Safely

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Tatung System Technologies Inc. (GTSM:8099) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Tatung System Technologies

What Is Tatung System Technologies's Net Debt?

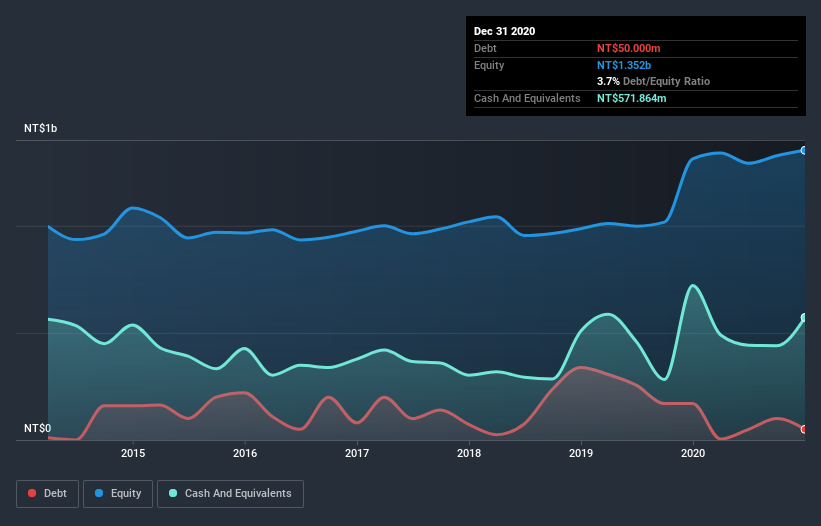

As you can see below, Tatung System Technologies had NT$50.0m of debt at December 2020, down from NT$170.0m a year prior. However, its balance sheet shows it holds NT$571.9m in cash, so it actually has NT$521.9m net cash.

How Strong Is Tatung System Technologies' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Tatung System Technologies had liabilities of NT$1.24b due within 12 months and liabilities of NT$165.7m due beyond that. On the other hand, it had cash of NT$571.9m and NT$959.8m worth of receivables due within a year. So it can boast NT$125.4m more liquid assets than total liabilities.

This surplus suggests that Tatung System Technologies has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Tatung System Technologies has more cash than debt is arguably a good indication that it can manage its debt safely.

Also good is that Tatung System Technologies grew its EBIT at 20% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Tatung System Technologies will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Tatung System Technologies has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Tatung System Technologies generated free cash flow amounting to a very robust 96% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Tatung System Technologies has net cash of NT$521.9m, as well as more liquid assets than liabilities. The cherry on top was that in converted 96% of that EBIT to free cash flow, bringing in NT$91m. So we don't think Tatung System Technologies's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Tatung System Technologies you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Tatung System Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tatung System Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8099

Tatung System Technologies

Engages in the design, research and development, and sale of computer software and hardware, and informatization and digital transformation services.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion