- Taiwan

- /

- Semiconductors

- /

- TWSE:8104

The Market Lifts RiTdisplay Corporation (TWSE:8104) Shares 25% But It Can Do More

RiTdisplay Corporation (TWSE:8104) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 61%.

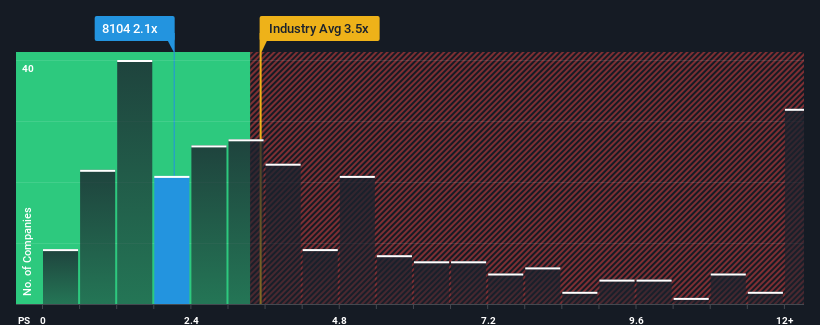

Although its price has surged higher, RiTdisplay may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.1x, considering almost half of all companies in the Semiconductor industry in Taiwan have P/S ratios greater than 3.5x and even P/S higher than 7x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for RiTdisplay

How RiTdisplay Has Been Performing

While the industry has experienced revenue growth lately, RiTdisplay's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on RiTdisplay will help you uncover what's on the horizon.How Is RiTdisplay's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as RiTdisplay's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 16% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 146,328,188% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 21,859%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that RiTdisplay's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift RiTdisplay's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at RiTdisplay's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 4 warning signs for RiTdisplay you should be aware of, and 1 of them is concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8104

RiTdisplay

Engages in the research, development, and manufacturing of PMOLED products in Taiwan and internationally.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives