- Taiwan

- /

- Semiconductors

- /

- TPEX:3264

Global Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As global markets navigate a volatile landscape marked by escalating trade tensions and fluctuating consumer sentiment, investors are increasingly looking for stability amidst uncertainty. In such an environment, dividend stocks can offer a reliable income stream and potential resilience against market swings, making them an attractive consideration for those seeking to balance risk with steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.03% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.86% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.09% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.17% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.39% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.52% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★★ |

Click here to see the full list of 1509 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Ardentec (TPEX:3264)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardentec Corporation offers semiconductor testing solutions for memory, logic, and mixed-signal ICs to various clients globally, with a market cap of NT$33.17 billion.

Operations: Ardentec Corporation's revenue is primarily derived from providing semiconductor testing solutions to integrated device manufacturers, wafer foundry companies, and fabless design firms across regions including the United States, Taiwan, Singapore, Korea, China, and Europe.

Dividend Yield: 3.4%

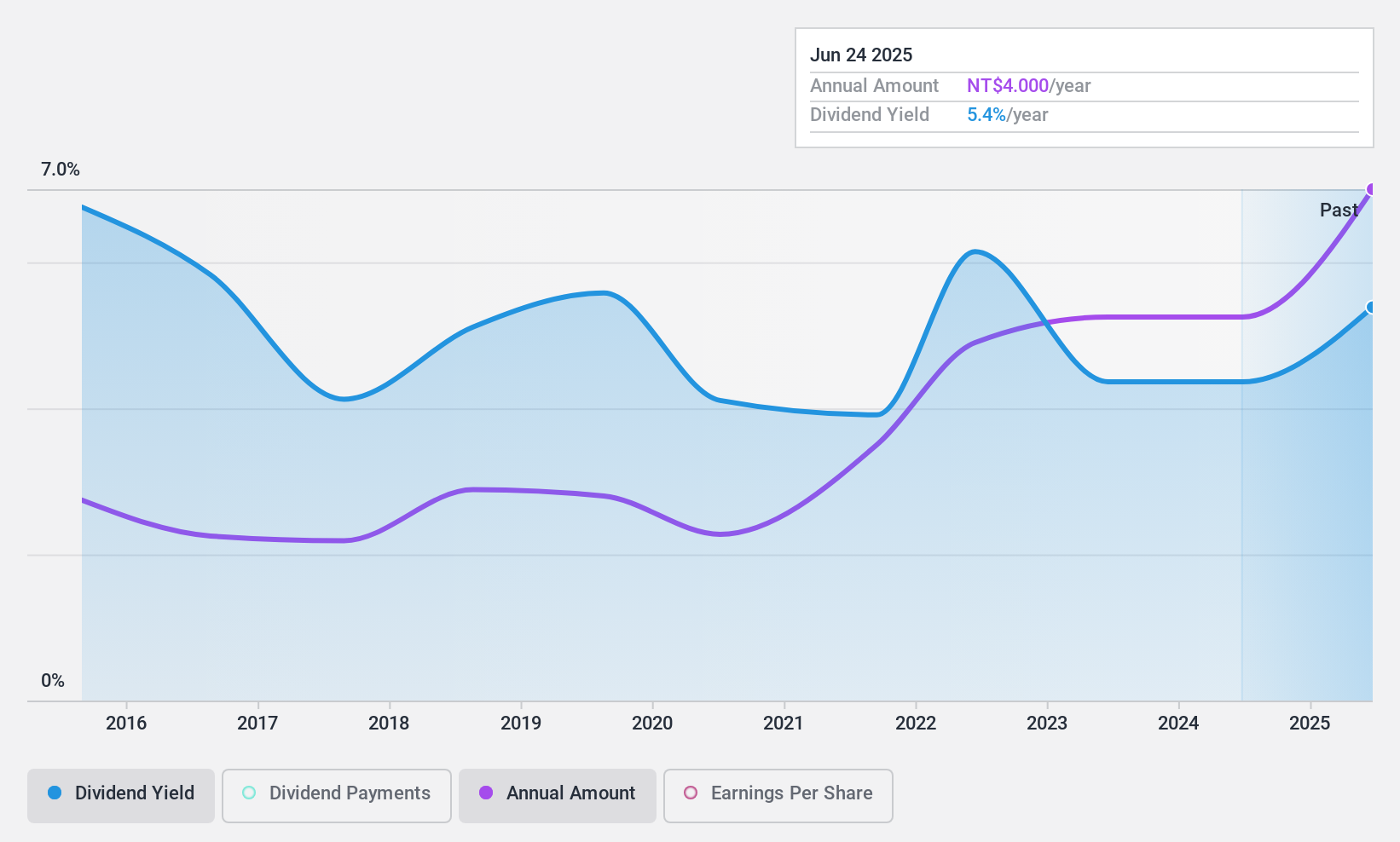

Ardentec Corporation's recent dividend announcement of TWD 4 per share for 2024 reflects a commitment to shareholder returns, though its dividend yield of 3.42% is below the top quartile in Taiwan. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 52.4% and 46.4%, respectively, indicating sustainability despite past volatility in payments. Recent earnings showed a decline in sales and net income, which may impact future dividend stability.

- Click to explore a detailed breakdown of our findings in Ardentec's dividend report.

- According our valuation report, there's an indication that Ardentec's share price might be on the expensive side.

Quanta Computer (TWSE:2382)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a company that manufactures and sells notebook computers across Asia, the Americas, Europe, and internationally, with a market cap of NT$878.83 billion.

Operations: Quanta Computer Inc.'s revenue from the Electronics Sector amounts to NT$3.05 billion.

Dividend Yield: 5.7%

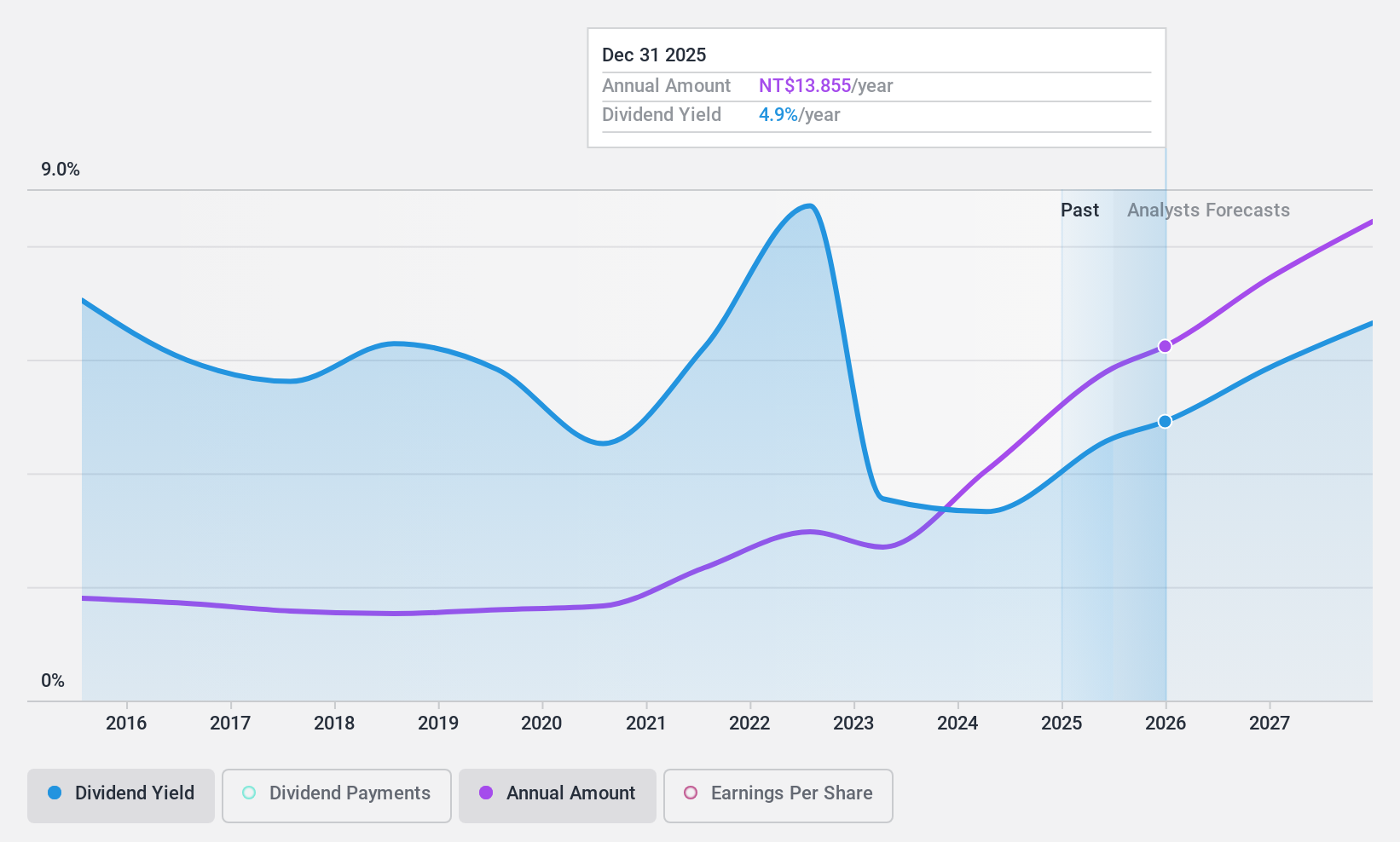

Quanta Computer's dividend yield of 5.71% ranks in the top 25% of Taiwan's market, but it is not well covered by free cash flow despite a payout ratio of 83.9%. The company's dividends have been stable and reliable over the past decade, with consistent growth. Recent earnings results showed significant sales and net income increases for 2024, improving from TWD 1,085 billion to TWD 1,410 billion in sales and enhancing dividend coverage by earnings.

- Dive into the specifics of Quanta Computer here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Quanta Computer is priced lower than what may be justified by its financials.

Sitronix Technology (TWSE:8016)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sitronix Technology Corporation designs, manufactures, and supplies integrated circuits and memory chips across several countries including Hong Kong, Vietnam, South Korea, Taiwan, and India with a market cap of NT$23.19 billion.

Operations: Sitronix Technology Corporation generates its revenue primarily from the semiconductors segment, amounting to NT$17.83 billion.

Dividend Yield: 6%

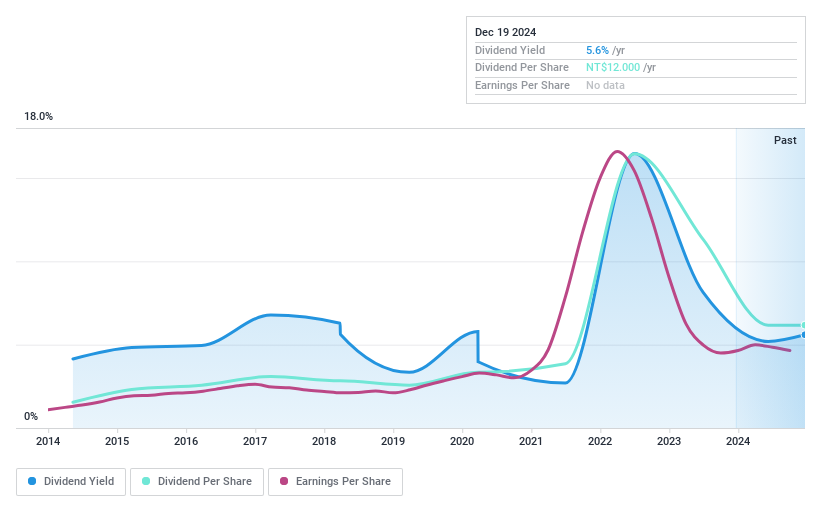

Sitronix Technology's dividend yield of 6% is among the top 25% in Taiwan, supported by a payout ratio of 77.8%, indicating coverage by earnings. The cash payout ratio stands at 66.2%, suggesting dividends are also backed by cash flows. However, the company's dividend history has been volatile, with notable annual drops exceeding 20%. Despite this instability, Sitronix's price-to-earnings ratio of 12.9x suggests it may offer good value compared to the market average of 17.2x.

- Unlock comprehensive insights into our analysis of Sitronix Technology stock in this dividend report.

- Our valuation report unveils the possibility Sitronix Technology's shares may be trading at a premium.

Key Takeaways

- Unlock our comprehensive list of 1509 Top Global Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3264

Ardentec

Provides semiconductor testing solutions in memory, logic, and mixed-signal ICs to integrated device manufacturers, pure play wafer foundry companies, and fabless design companies in the United States, Taiwan, Singapore, Korea, China, Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives