Insider Confidence Drives November 2024's Top Growth Companies

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investor optimism is fueled by expectations of economic growth and favorable tax policies. In this buoyant environment, growth companies with substantial insider ownership can be particularly appealing, as high levels of insider investment often indicate strong confidence in a company's future prospects amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 32% |

| On Holding (NYSE:ONON) | 31% | 29.8% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

Sonata Software (NSEI:SONATSOFTW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sonata Software Limited, along with its subsidiaries, offers information technology services and solutions across the United States, Europe, the Middle East, Asia, India, and Australia with a market cap of ₹159.30 billion.

Operations: Sonata Software's revenue segments include information technology services and solutions provided across various regions, including the United States, Europe, the Middle East, Asia, India, and Australia.

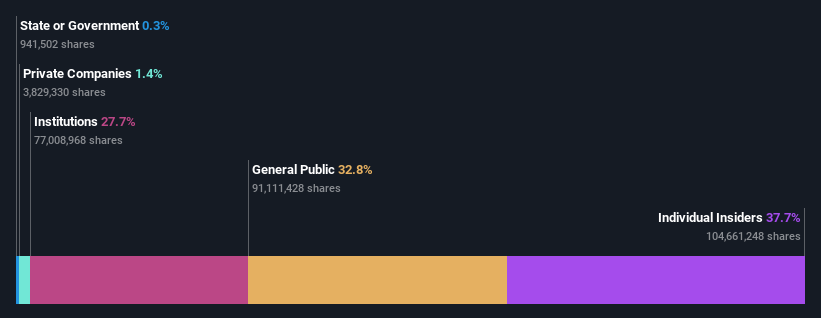

Insider Ownership: 37.7%

Earnings Growth Forecast: 31.3% p.a.

Sonata Software's growth prospects are supported by strategic partnerships with major corporations, enhancing its market presence and operational capabilities. Despite a recent decline in profit margins, earnings are forecast to grow significantly above the Indian market average. However, insider activity reveals substantial selling over the past quarter. The company's revenue growth is expected to outpace the broader Indian market, although it remains below 20% annually. Recent client wins underscore its expanding global footprint and service offerings.

- Unlock comprehensive insights into our analysis of Sonata Software stock in this growth report.

- Our expertly prepared valuation report Sonata Software implies its share price may be too high.

Winall Hi-tech Seed (SZSE:300087)

Simply Wall St Growth Rating: ★★★★★☆

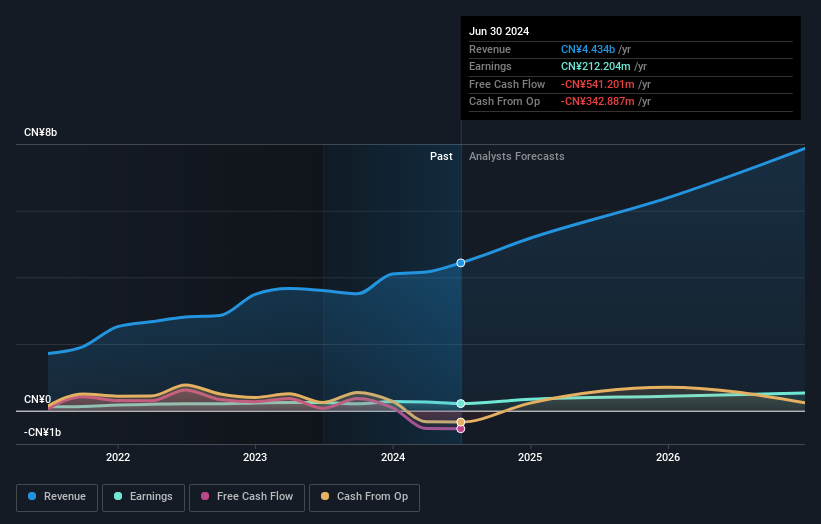

Overview: Winall Hi-tech Seed Co., Ltd. focuses on the research, development, breeding, promotion, and service of various crop seeds in China and internationally with a market cap of CN¥10.95 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 14.2%

Earnings Growth Forecast: 37.4% p.a.

Winall Hi-tech Seed faces challenges with a recent net loss of CNY 84.33 million, contrasting last year's profit, despite increased sales to CNY 2.06 billion. The company's earnings and revenue are forecast to grow significantly above the market average, with expected annual growth rates of 37.4% and 23.3%, respectively. However, its dividend coverage is weak due to insufficient free cash flows, and there is no substantial insider trading activity reported in the past three months.

- Click to explore a detailed breakdown of our findings in Winall Hi-tech Seed's earnings growth report.

- Upon reviewing our latest valuation report, Winall Hi-tech Seed's share price might be too optimistic.

Silergy (TWSE:6415)

Simply Wall St Growth Rating: ★★★★☆☆

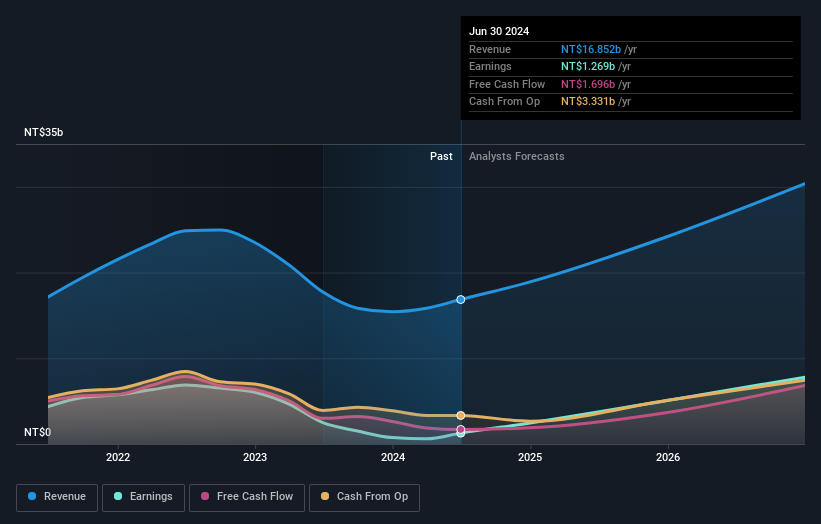

Overview: Silergy Corp. designs, manufactures, and sells integrated circuit products and provides related technical services in China and internationally, with a market cap of NT$173.21 billion.

Operations: The company's revenue is primarily derived from its semiconductors segment, totaling NT$16.85 billion.

Insider Ownership: 14.3%

Earnings Growth Forecast: 39.1% p.a.

Silergy's earnings are projected to grow significantly at 39.1% annually, outperforming the Taiwanese market's average growth of 19.4%. Despite this, revenue growth is expected to be slower than 20% per year. The company has not reported substantial insider trading in the past three months and faces share price volatility. Recent financial results show a notable turnaround with TWD 560.6 million net income in Q2 compared to a loss last year, though profit margins have decreased from 14% to 7.5%.

- Click here to discover the nuances of Silergy with our detailed analytical future growth report.

- The analysis detailed in our Silergy valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Gain an insight into the universe of 1515 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Winall Hi-tech Seed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300087

Winall Hi-tech Seed

Engages in the research and development, breeding, promotion, and service of various crop seeds in China and internationally.

High growth potential with adequate balance sheet.