As December 2024 unfolds, global markets are grappling with cautious Federal Reserve commentary and political uncertainties, which have contributed to declines in major U.S. indices, particularly affecting smaller-cap stocks. Despite these challenges, the resilience of the U.S. economy is underscored by strong growth and positive jobs data, offering a backdrop for investors seeking potential opportunities in undiscovered gems within the small-cap sector. In this environment, a good stock might be one that demonstrates solid fundamentals and growth potential despite broader market volatility or economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Top Union Electronics | 1.25% | 6.67% | 17.52% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Union Coop | NA | -4.69% | -14.06% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sichuan Shudao Equipment & TechnologyLtd (SZSE:300540)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sichuan Shudao Equipment & Technology Co., Ltd. operates within the general equipment manufacturing industry and has a market capitalization of CN¥3.85 billion.

Operations: Shudao Equipment & Technology generates revenue primarily from the general equipment manufacturing segment, amounting to CN¥818.07 million. The company's financial data reflects a focus on this core segment without diversification into other areas.

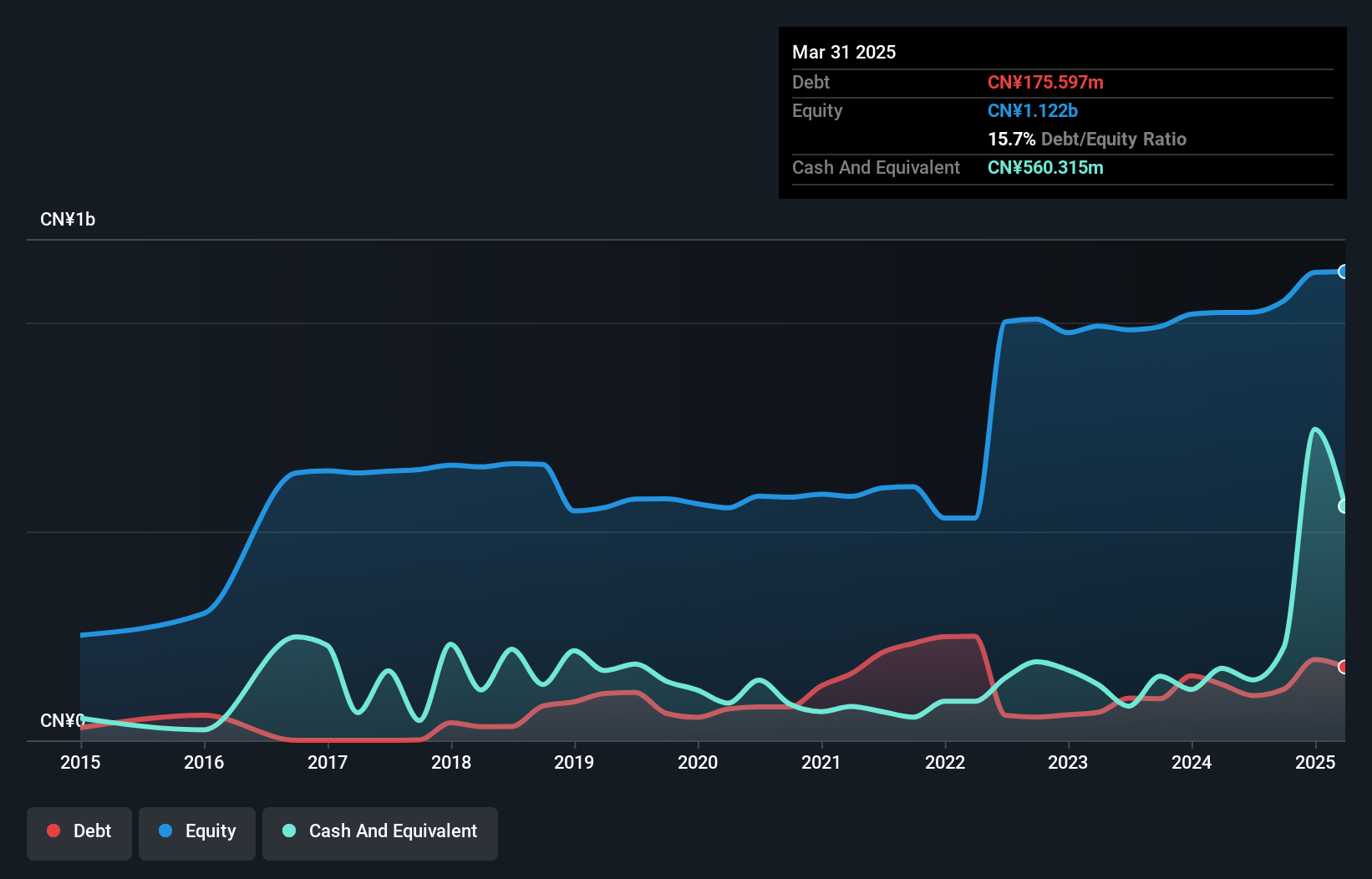

Sichuan Shudao Equipment & Technology Ltd. shows promising signs with its recent profitability, marking a significant turnaround in the past year. The company's debt to equity ratio has slightly increased to 11.6% over five years, yet it maintains more cash than total debt, which suggests financial resilience. Despite not being free cash flow positive, the firm reported a notable rise in net income to CNY 23.19 million for the nine months ending September 2024, up from CNY 13.87 million previously. Earnings per share also improved to CNY 0.1433 from CNY 0.0863 last year, indicating strong earnings growth potential moving forward.

- Click here to discover the nuances of Sichuan Shudao Equipment & TechnologyLtd with our detailed analytical health report.

Understand Sichuan Shudao Equipment & TechnologyLtd's track record by examining our Past report.

Mitsuba (TSE:7280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mitsuba Corporation manufactures and sells automotive, motorcycle, and micro mobility products across Asia, the Americas, Europe, Africa, and China with a market cap of ¥41.26 billion.

Operations: Mitsuba Corporation generates its revenue primarily from Transportation Equipment-Related Operations, contributing ¥327.18 billion, and Information Service Operations, adding ¥18.27 billion. The company's financial model is significantly supported by these segments within the diverse geographic markets it serves.

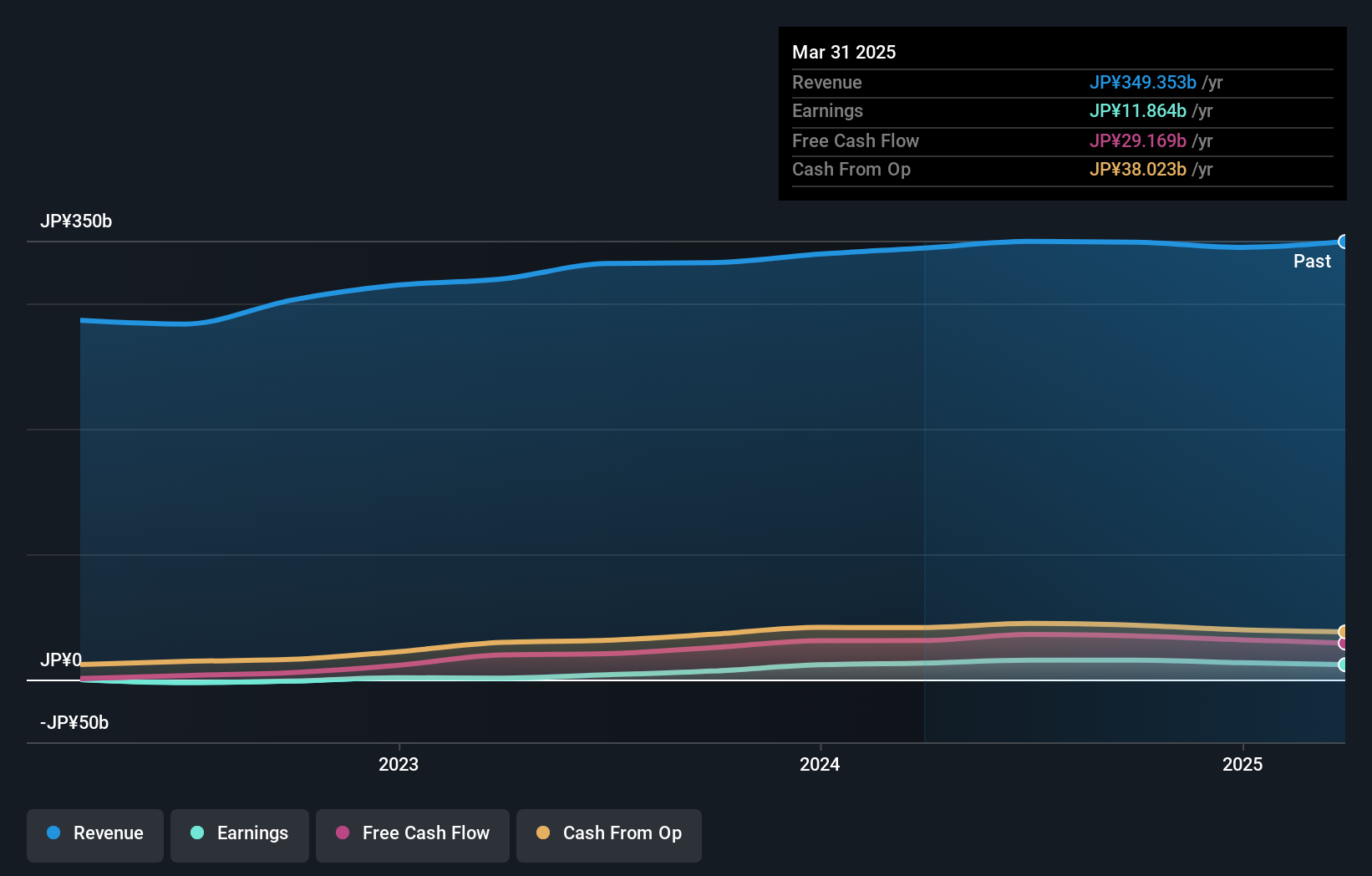

Mitsuba, a smaller player in the auto components industry, seems to offer intriguing prospects despite some challenges. Trading at 91% below its estimated fair value, it appears undervalued. The company's net debt to equity ratio stands at a high 56.3%, though interest payments are well-covered with EBIT covering them 305 times over. Recent earnings growth of 128% outpaced the industry average of 3.8%, showcasing strong performance and high-quality earnings. However, Mitsuba has revised its fiscal year guidance downward due to shifting production and sales trends among major customers, projecting net sales of ¥338 billion (US$2.31 billion) and operating profit of ¥18.5 billion (US$126 million).

- Click here and access our complete health analysis report to understand the dynamics of Mitsuba.

Explore historical data to track Mitsuba's performance over time in our Past section.

Eternal Materials (TWSE:1717)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eternal Materials Co., Ltd. is engaged in the manufacturing and sale of resin materials, electronic materials, and related products, with a market cap of NT$33.40 billion.

Operations: Eternal Materials generates revenue from three primary segments: synthetic resin (NT$23.49 billion), special materials (NT$12.83 billion), and electronic materials (NT$13.93 billion). The company has a net profit margin trend worth noting, reflecting its ability to manage costs relative to its revenue streams effectively.

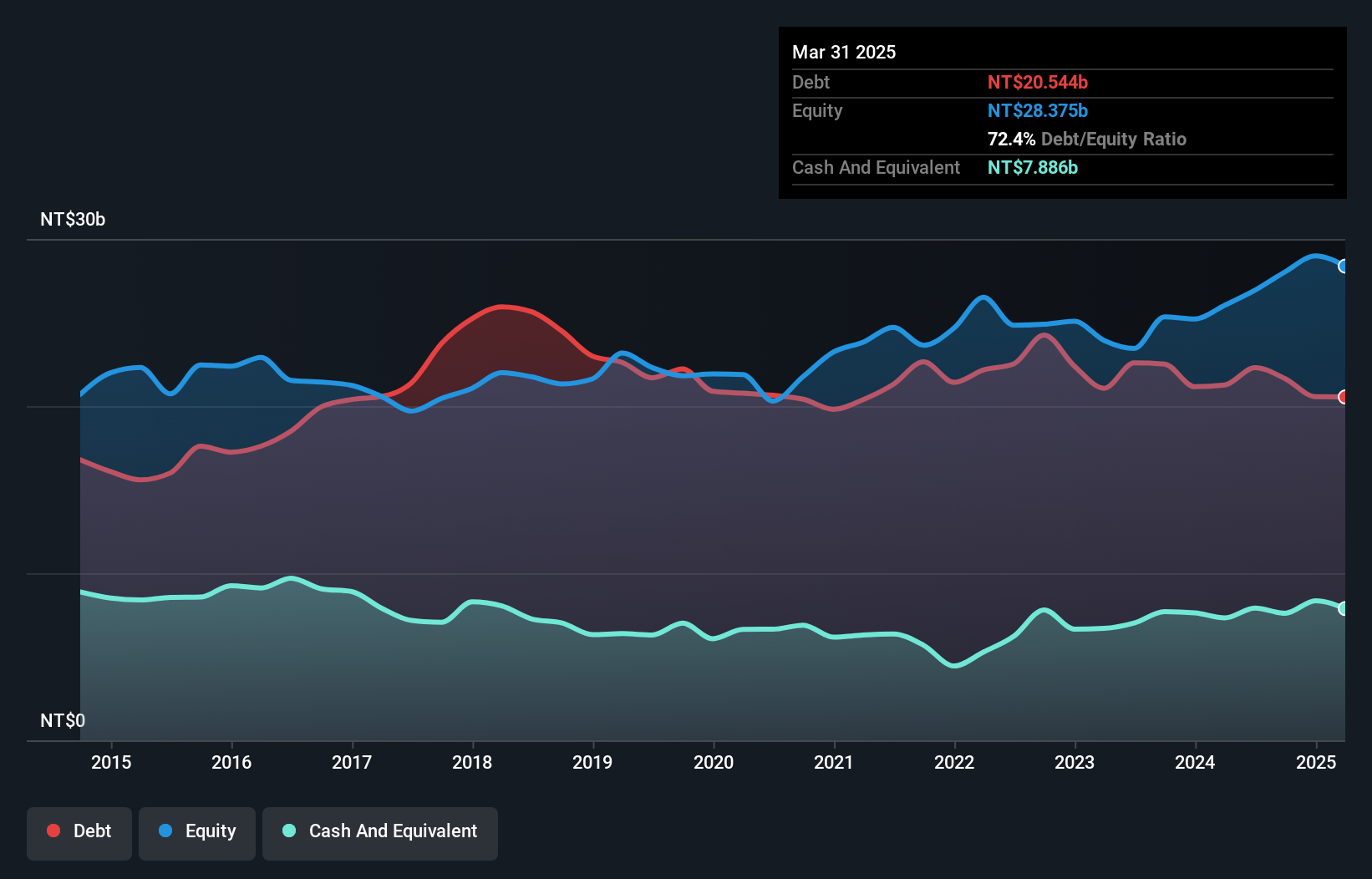

Eternal Materials, a relatively small player in the chemicals industry, showcases high-quality earnings with a notable 21.6% growth over the past year, surpassing the industry's 14.3%. The company's net debt to equity ratio stands at 50.1%, which is considered high but has improved from 101.9% over five years. Despite this leverage concern, interest payments are well covered by EBIT at 7.2x coverage. Recent results indicate sales of TWD 11 billion for Q3 and net income of TWD 457 million, reflecting a dip from last year's TWD 600 million but an overall nine-month improvement in earnings per share to TWD 1.14 from TWD 0.93.

- Get an in-depth perspective on Eternal Materials' performance by reading our health report here.

Gain insights into Eternal Materials' past trends and performance with our Past report.

Next Steps

- Delve into our full catalog of 4632 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300540

Sichuan Shudao Equipment & TechnologyLtd

Sichuan Shudao Equipment & Technology Co.,Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives