- South Korea

- /

- Retail Distributors

- /

- KOSDAQ:A121440

Top 3 Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices like the S&P 500 and Nasdaq Composite reflecting strong annual gains despite recent volatility, investors are keenly observing economic indicators such as the Chicago PMI and GDP forecasts. In this context of fluctuating market dynamics, dividend stocks can offer a reliable income stream and potential stability for portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

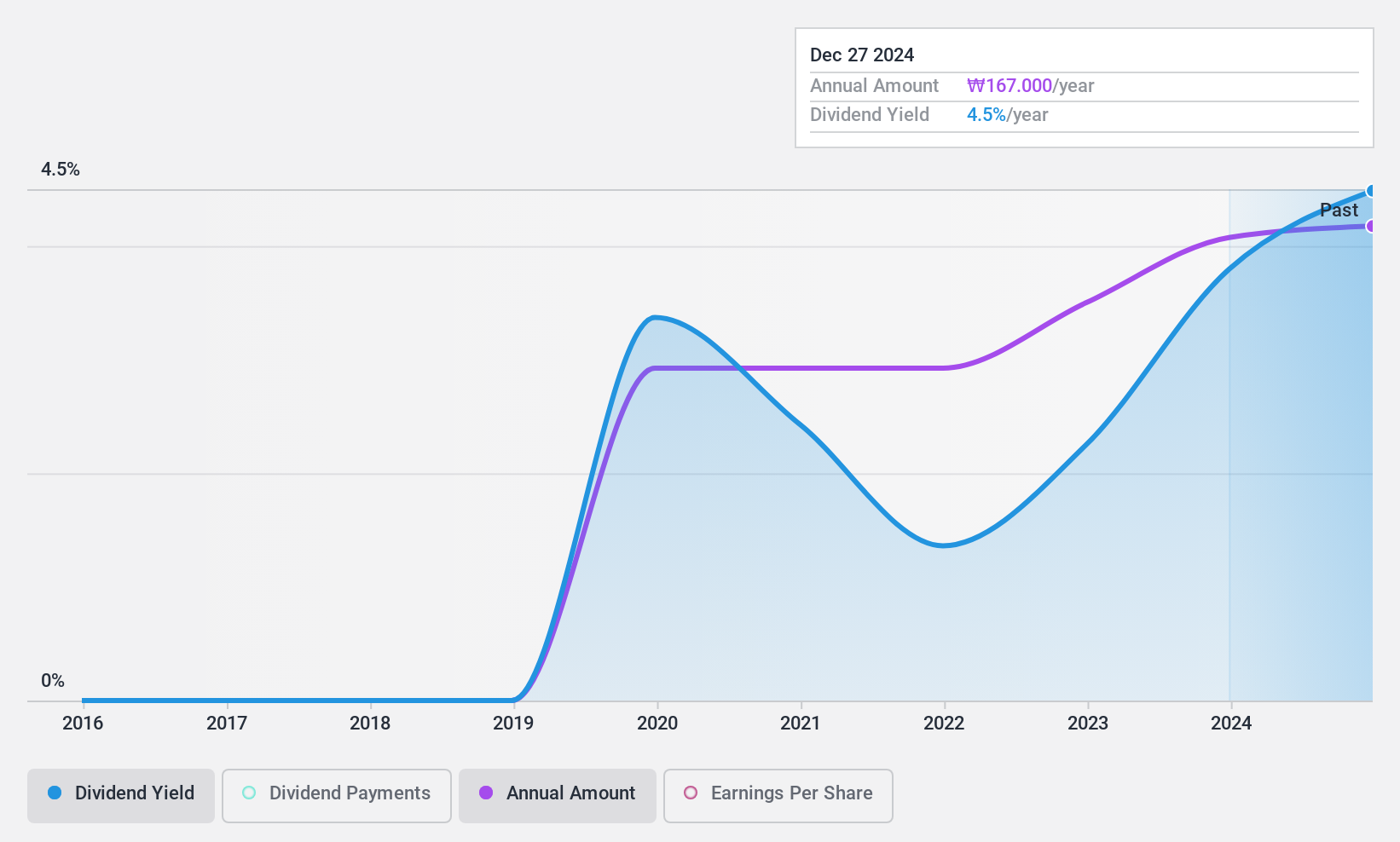

GOLFZON NEWDIN HOLDINGS (KOSDAQ:A121440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GOLFZON NEWDIN HOLDINGS Co., Ltd. operates in the golf, sports, health, and lifestyle sectors through its subsidiaries both in South Korea and internationally, with a market cap of ₩147.12 billion.

Operations: GOLFZON NEWDIN HOLDINGS Co., Ltd.'s revenue is primarily derived from its Distribution Business at ₩334.42 billion, followed by Landlord operations at ₩52.64 billion, Golf Course Rental at ₩7.48 billion, and Space Business and Others contributing ₩8.77 billion.

Dividend Yield: 4.7%

GOLFZON NEWDIN HOLDINGS offers a dividend yield in the top 25% of the KR market, supported by a low payout ratio of 15.5%, ensuring dividends are well covered by earnings and cash flows. Despite only five years of dividend history, payments have been stable and growing. Recent buybacks totaling KRW 4,999.81 million may signal management's confidence in financial health, complementing strong earnings growth with net income rising significantly year-over-year as reported for Q3 2024.

- Get an in-depth perspective on GOLFZON NEWDIN HOLDINGS' performance by reading our dividend report here.

- The valuation report we've compiled suggests that GOLFZON NEWDIN HOLDINGS' current price could be quite moderate.

Hyundai Marine & Fire Insurance (KOSE:A001450)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Marine & Fire Insurance Co., Ltd. operates as a provider of insurance services, with a market cap of ₩1.96 trillion.

Operations: Hyundai Marine & Fire Insurance Co., Ltd. generates revenue primarily from the financial industry, amounting to ₩1.47 trillion.

Dividend Yield: 8.2%

Hyundai Marine & Fire Insurance provides a top-tier dividend yield of 8.2% in the KR market, with dividends well covered by earnings and cash flows due to low payout ratios of 18.6% and 8.6%, respectively. Despite only five years of dividend history, payments have been volatile, impacting reliability perceptions. Recent Q3 earnings showed net income growth to KRW 933 billion for nine months ended September 2024 from KRW 663 billion a year ago, indicating robust financial performance amidst fluctuating quarterly results.

- Click to explore a detailed breakdown of our findings in Hyundai Marine & Fire Insurance's dividend report.

- In light of our recent valuation report, it seems possible that Hyundai Marine & Fire Insurance is trading behind its estimated value.

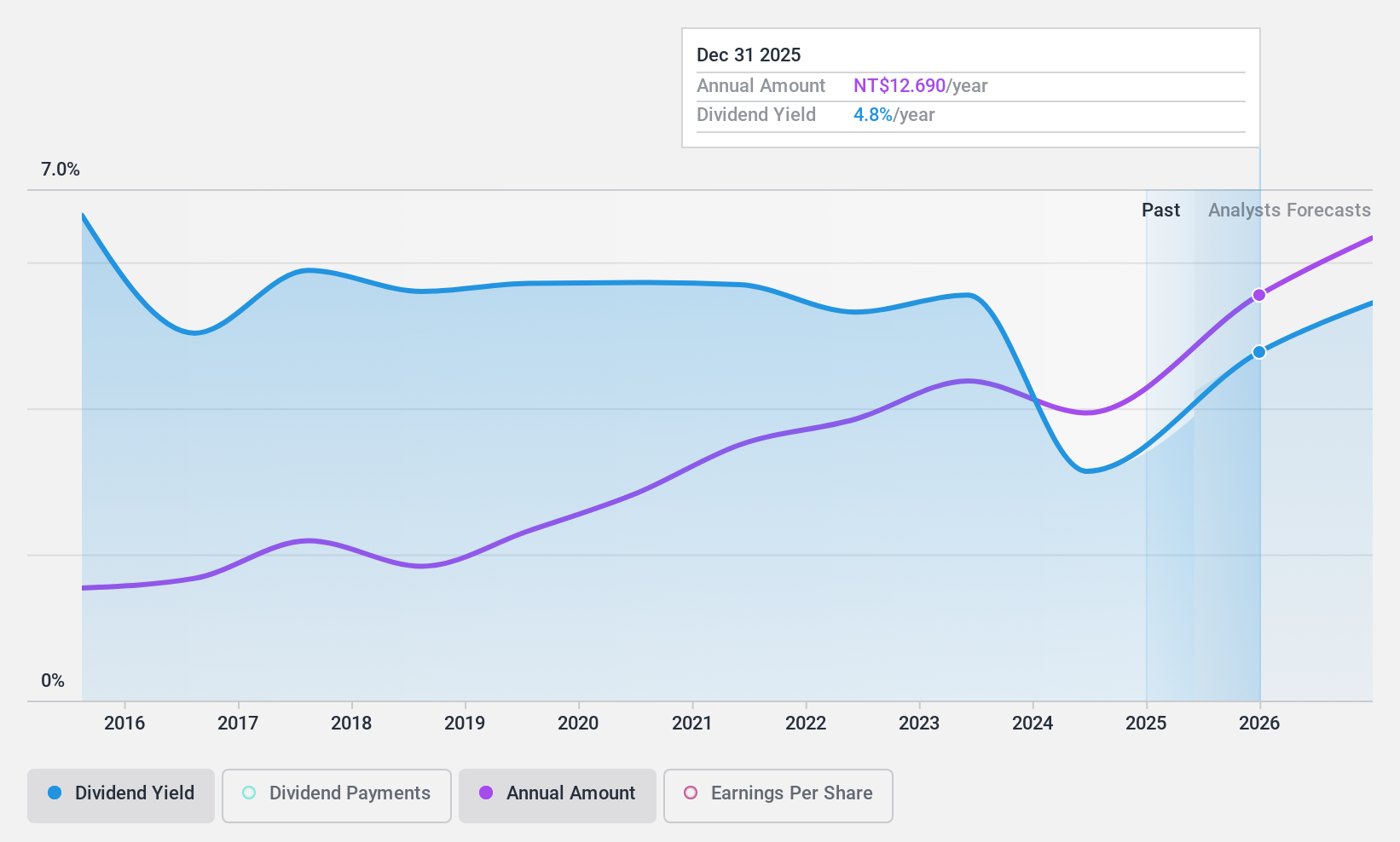

Topco ScientificLtd (TWSE:5434)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Topco Scientific Ltd. supplies precision materials, manufacturing equipment, and components for the semiconductor, LCD, and LED industries across Taiwan, China, and internationally with a market cap of NT$53.89 billion.

Operations: Topco Scientific Ltd.'s revenue is primarily derived from its Semiconductor and Electronic Materials Business Department, which generated NT$45.70 billion, followed by its Environmental Engineering Division with NT$6.85 billion.

Dividend Yield: 3.1%

Topco Scientific Ltd. offers a stable dividend history over the past decade, with dividends growing consistently. However, its high cash payout ratio of 907.2% suggests dividends aren't well covered by free cash flow, raising sustainability concerns despite a reasonable earnings payout ratio of 50.5%. The company trades at an attractive P/E ratio of 16.5x compared to the TW market average of 20.8x, indicating good relative value amidst recent revenue and net income growth in Q3 2024 results.

- Delve into the full analysis dividend report here for a deeper understanding of Topco ScientificLtd.

- According our valuation report, there's an indication that Topco ScientificLtd's share price might be on the cheaper side.

Summing It All Up

- Click through to start exploring the rest of the 1976 Top Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A121440

GOLFZON HOLDINGS

Through its subsidiaries, engages in the golf, sports, health, and lifestyle businesses in South Korea and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives