In a week marked by tariff uncertainties and mixed economic signals, global markets have shown resilience, with the S&P 500 experiencing only a slight decline despite broader challenges. As investors navigate these turbulent waters, dividend stocks like TOCALOLtd offer potential stability and income, making them an attractive consideration in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

TOCALOLtd (TSE:3433)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TOCALO Co., Ltd. specializes in developing surface modifying technologies both in Japan and internationally, with a market capitalization of ¥106.31 billion.

Operations: TOCALO Co., Ltd.'s revenue segments are not specified in the provided text.

Dividend Yield: 3.7%

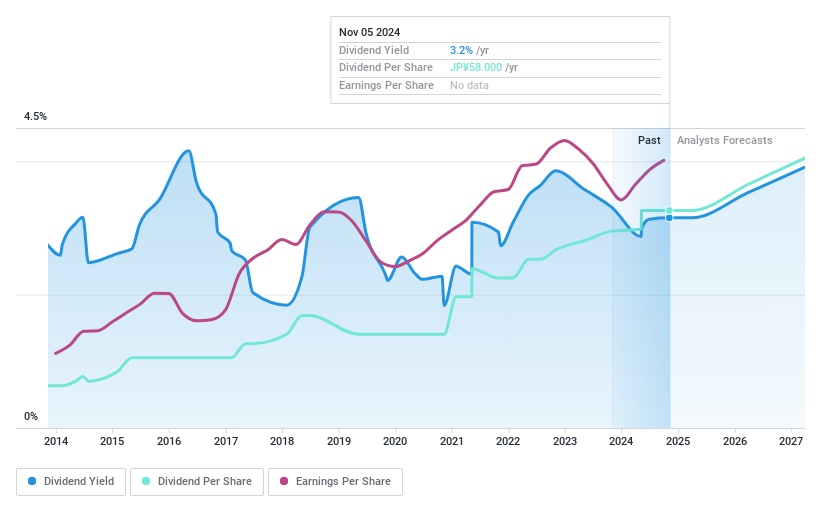

TOCALO Ltd. recently raised its earnings and dividend guidance, expecting a JPY 35.00 per share dividend for the fiscal year ending March 31, 2025. Despite stable and reliable dividends over the past decade, its high cash payout ratio (4616.5%) suggests dividends are not well covered by cash flows, raising sustainability concerns. However, with a low payout ratio of 21.3%, dividends remain well covered by earnings, supported by recent strong performance in semiconductor-related sales.

- Click here to discover the nuances of TOCALOLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that TOCALOLtd is priced higher than what may be justified by its financials.

i-mobileLtd (TSE:6535)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: i-mobile Co., Ltd. operates in the Internet advertising sector in Japan with a market capitalization of ¥28.50 billion.

Operations: i-mobile Co., Ltd. generates revenue primarily from its Consumer Service segment, which accounts for ¥14.52 billion, and its Internet Advertising Business segment, contributing ¥2.69 billion.

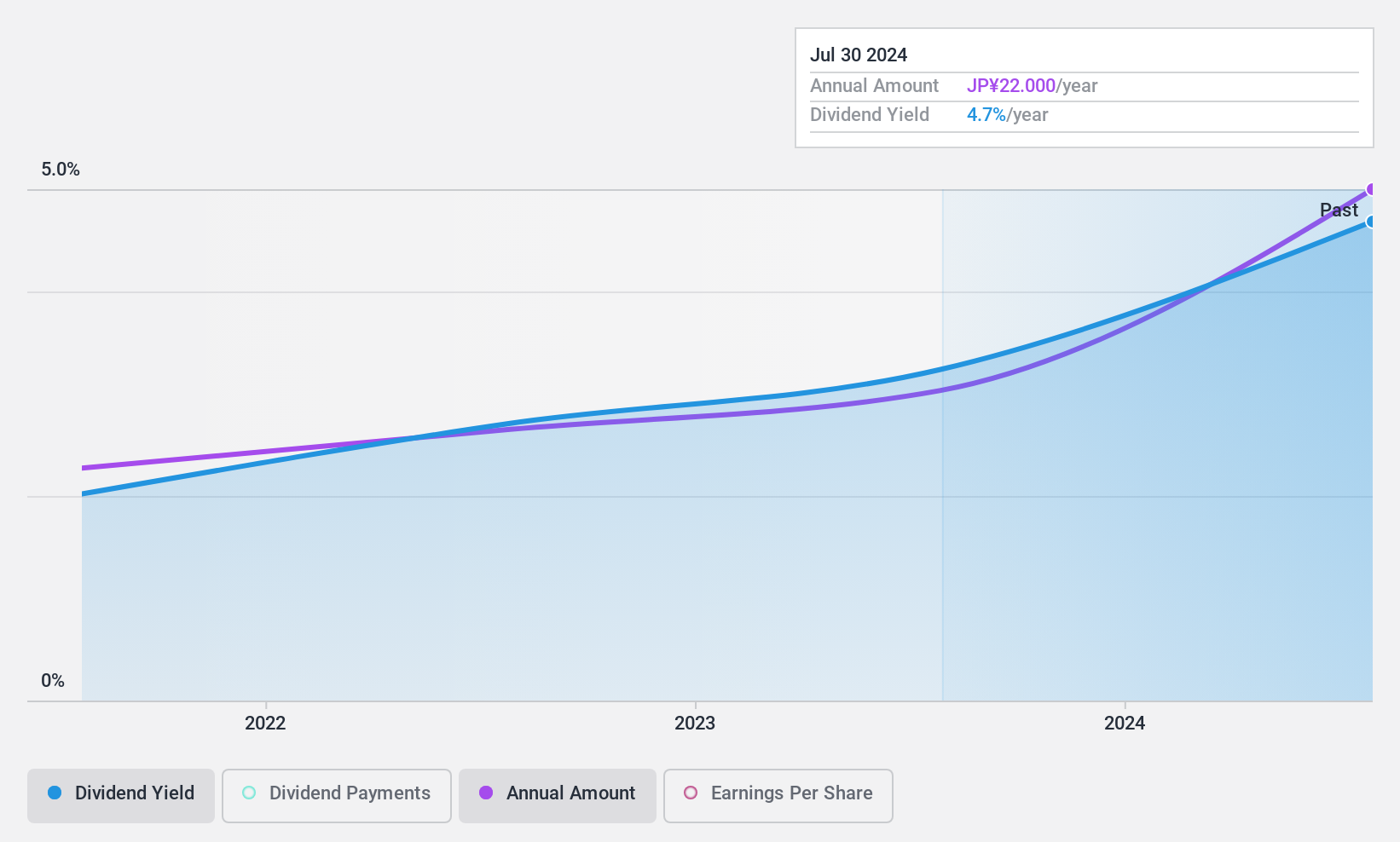

Dividend Yield: 5.3%

i-mobile Ltd. offers a compelling dividend profile, trading at 62.7% below its estimated fair value, with a dividend yield of 5.26%, placing it in the top 25% of JP market payers. Despite having paid dividends for less than ten years, payments have been stable and reliable over four years of growth. The company's payout ratios indicate sustainability, with dividends covered by earnings (72.3%) and cash flows (45%), though profit margins have declined recently from last year’s figures.

- Dive into the specifics of i-mobileLtd here with our thorough dividend report.

- Our valuation report here indicates i-mobileLtd may be undervalued.

Fitipower Integrated Technology (TWSE:4961)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fitipower Integrated Technology Inc. specializes in the research, design, development, production, and sale of display screen integrated circuits (ICs) and power management ICs in Taiwan with a market cap of NT$28.20 billion.

Operations: Fitipower Integrated Technology Inc. generates revenue of NT$17.82 billion from its R&D, production, and sales of integrated circuits.

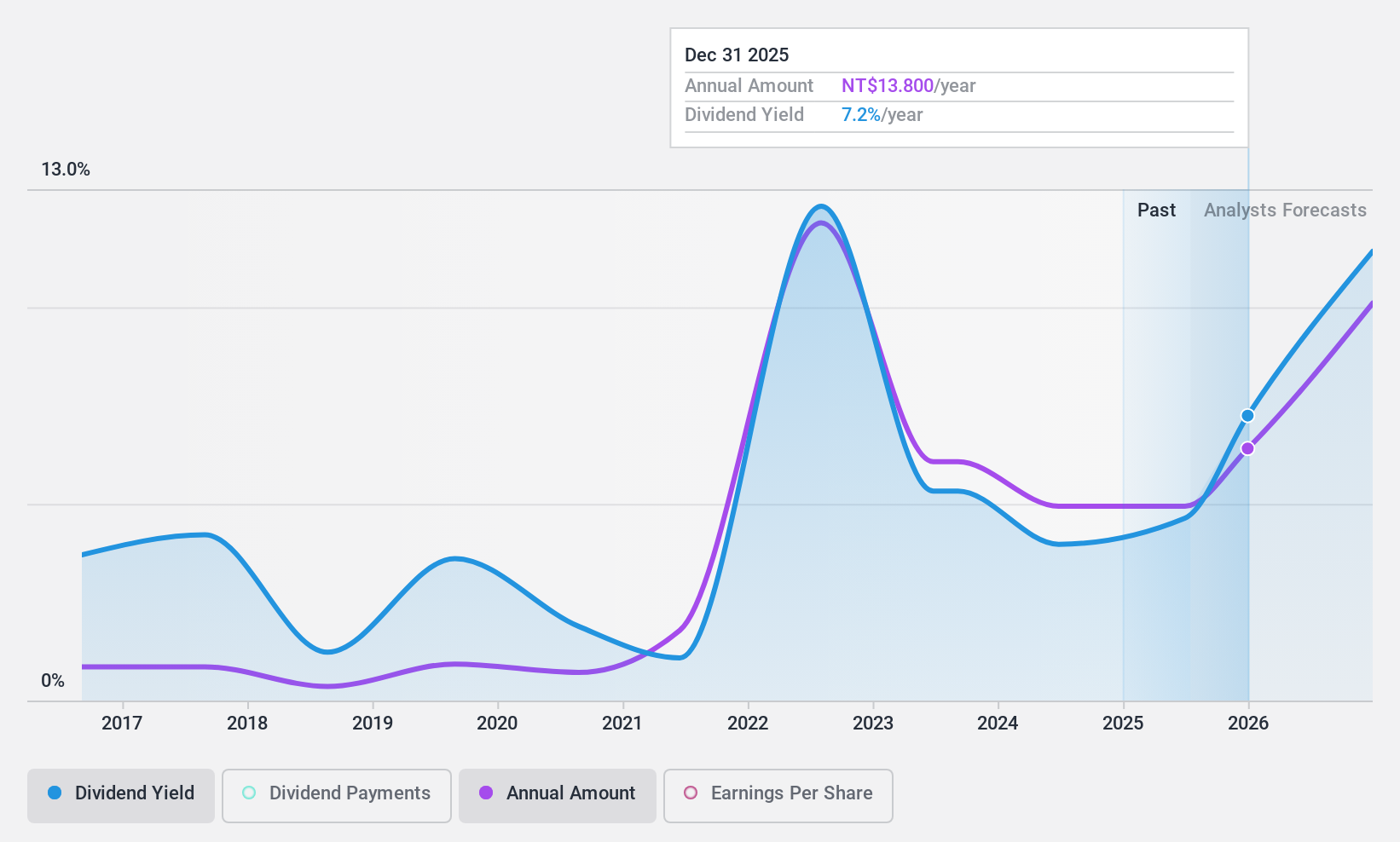

Dividend Yield: 4.6%

Fitipower Integrated Technology's dividend yield of 4.57% ranks in the top 25% of the TW market but is not well covered by cash flows, with a high cash payout ratio of 239.8%. While dividends have increased over the past decade, they remain volatile and unreliable. The company's price-to-earnings ratio of 13.9x suggests good value relative to the TW market average, though sustainability concerns persist due to insufficient free cash flow coverage.

- Navigate through the intricacies of Fitipower Integrated Technology with our comprehensive dividend report here.

- Our expertly prepared valuation report Fitipower Integrated Technology implies its share price may be lower than expected.

Key Takeaways

- Delve into our full catalog of 1962 Top Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOCALOLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3433

TOCALOLtd

Develops surface modifying technologies in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives