- Taiwan

- /

- Semiconductors

- /

- TWSE:3592

3 Reliable Dividend Stocks To Consider With Up To 9.5% Yield

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors have witnessed fluctuations across various sectors, with financials and energy benefiting from deregulation hopes while healthcare and electric vehicle shares faced setbacks. Amidst this backdrop of volatility, dividend stocks stand out as a potential source of steady income, offering stability through regular payouts even when market conditions are unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.79% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.82% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

China Hongqiao Group (SEHK:1378)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Hongqiao Group Limited is an investment holding company that manufactures and sells aluminum products in the People's Republic of China and Indonesia, with a market cap of HK$115.79 billion.

Operations: China Hongqiao Group Limited generates revenue of CN¥141.48 billion from its manufacture and sales of aluminum products.

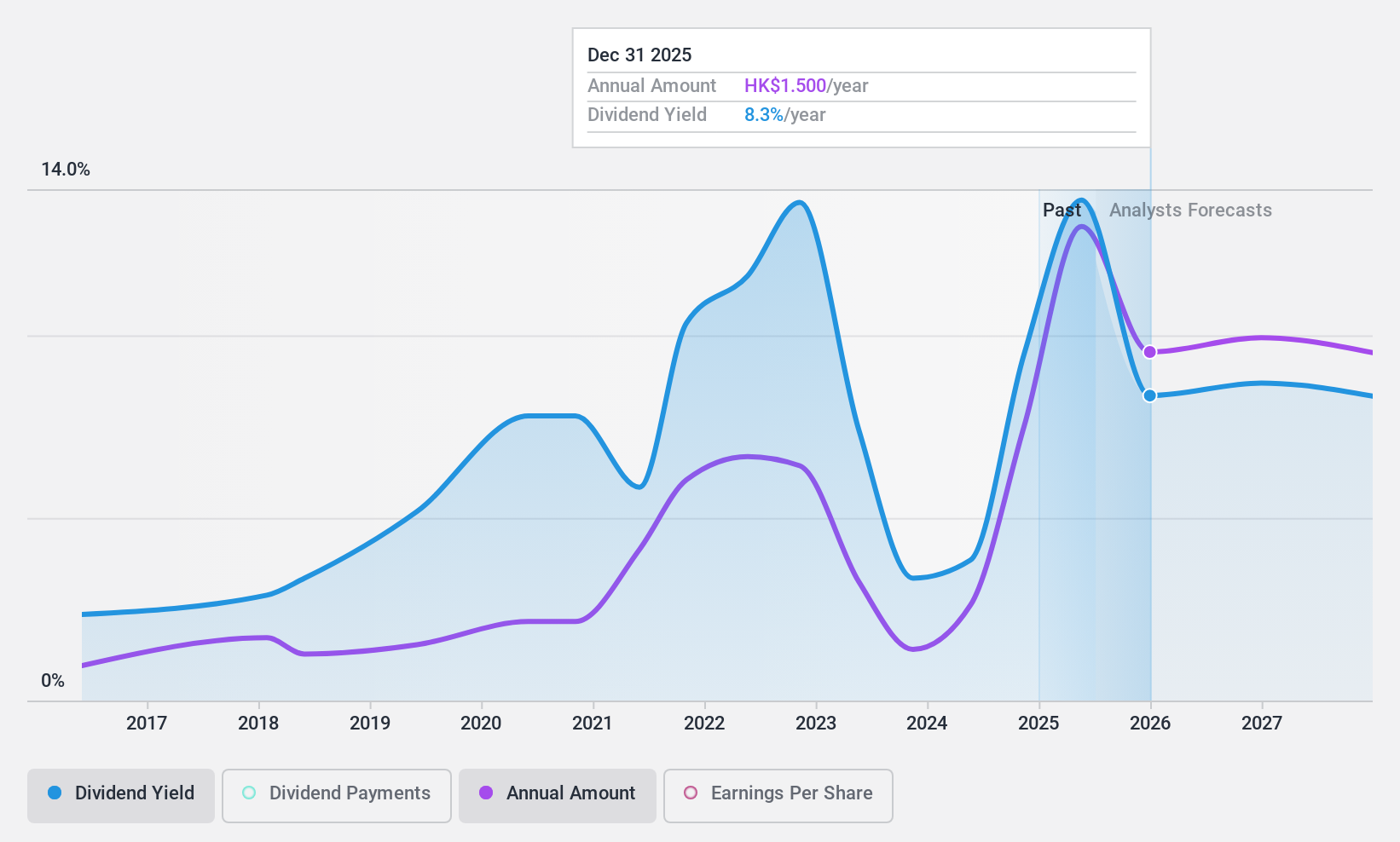

Dividend Yield: 9.3%

China Hongqiao Group's dividend profile shows mixed signals. While its dividend yield is in the top 25% of the Hong Kong market, and payments are well covered by earnings (42.3% payout ratio) and cash flows (48.6%), its track record over the past decade has been volatile with unreliable payments. Recently, an interim dividend of HK59 cents per share was declared for H1 2024, indicating a potential positive shift in stability.

- Click here and access our complete dividend analysis report to understand the dynamics of China Hongqiao Group.

- Our valuation report unveils the possibility China Hongqiao Group's shares may be trading at a discount.

Fufeng Group (SEHK:546)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fufeng Group Limited is an investment holding company that manufactures and sells fermentation-based food additives, as well as biochemical and starch-based products in China and internationally, with a market cap of approximately HK$11.36 billion.

Operations: Fufeng Group Limited generates its revenue primarily from Food Additives at CN¥13.85 billion, followed by Animal Nutrition at CN¥9.00 billion, High-End Amino Acid products at CN¥2.22 billion, and Colloid products at CN¥2.09 billion.

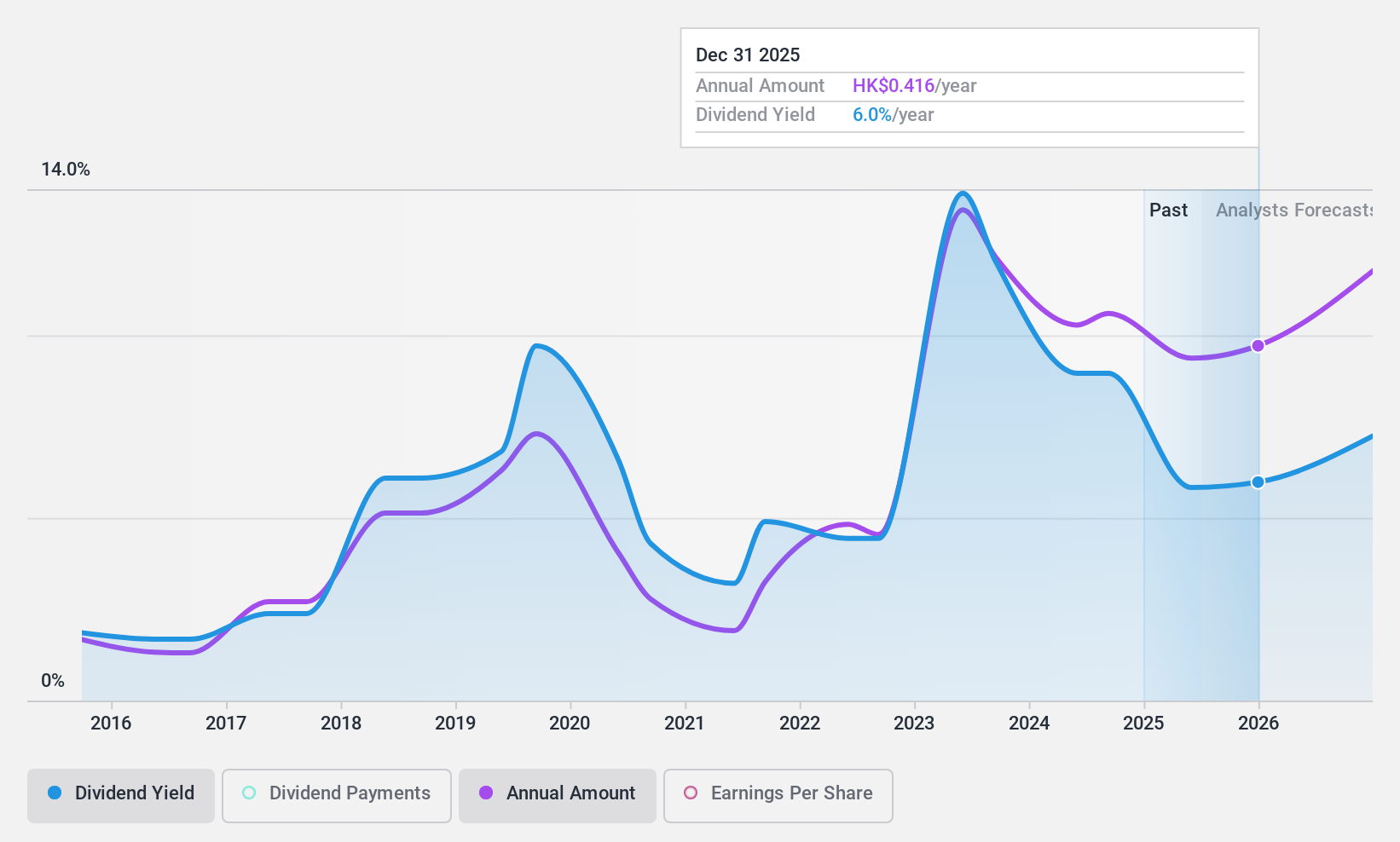

Dividend Yield: 9.5%

Fufeng Group's dividend situation is complex. Despite a high yield of 9.54%, dividends are not well covered by free cash flows, though they are adequately supported by earnings with a 33% payout ratio. The company has experienced volatility in its dividend payments over the past decade. Recent announcements include a decreased interim dividend of HKD 0.16 per share for H1 2024 and a special dividend of HKD 0.02 per share, reflecting ongoing adjustments in their payout strategy amidst fluctuating earnings performance.

- Click to explore a detailed breakdown of our findings in Fufeng Group's dividend report.

- Our comprehensive valuation report raises the possibility that Fufeng Group is priced lower than what may be justified by its financials.

Raydium Semiconductor (TWSE:3592)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Raydium Semiconductor Corporation offers integrated circuit (IC) solutions both in Taiwan and internationally, with a market capitalization of NT$25.87 billion.

Operations: Raydium Semiconductor Corporation generates revenue primarily through the development, design, and sale of integrated circuits, amounting to NT$23.60 billion.

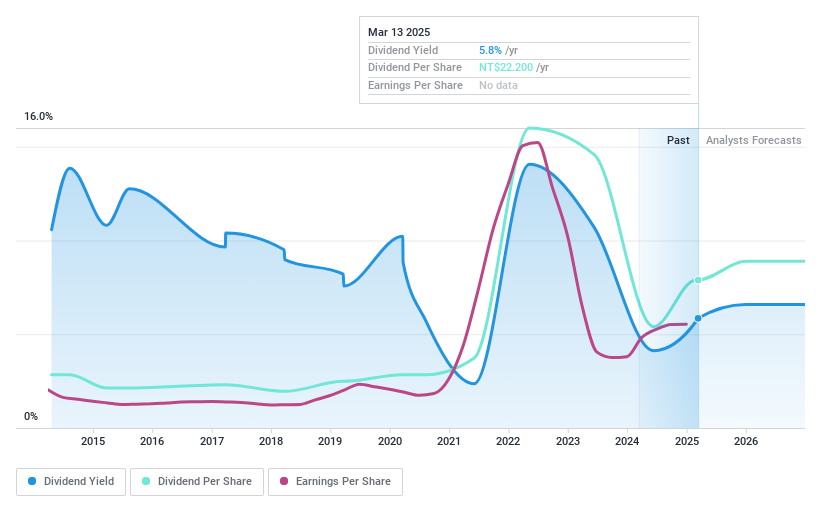

Dividend Yield: 4.2%

Raydium Semiconductor's dividend profile shows mixed attributes. While dividends are covered by earnings and cash flows, with payout ratios of 55.1% and 47.9% respectively, the track record is unstable due to volatility over the past decade. The current yield of 4.21% is slightly below top-tier levels in Taiwan's market. Despite this, Raydium benefits from a strong financial performance with recent net income growth and trading at a discount to its fair value estimate.

- Take a closer look at Raydium Semiconductor's potential here in our dividend report.

- Our expertly prepared valuation report Raydium Semiconductor implies its share price may be lower than expected.

Next Steps

- Delve into our full catalog of 1968 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3592

Raydium Semiconductor

Designs, develops, and sells of integrate circuits (IC) in Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet, undervalued and pays a dividend.