- Taiwan

- /

- Semiconductors

- /

- TWSE:3413

There's No Escaping Foxsemicon Integrated Technology Inc.'s (TWSE:3413) Muted Earnings Despite A 27% Share Price Rise

Foxsemicon Integrated Technology Inc. (TWSE:3413) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 41%.

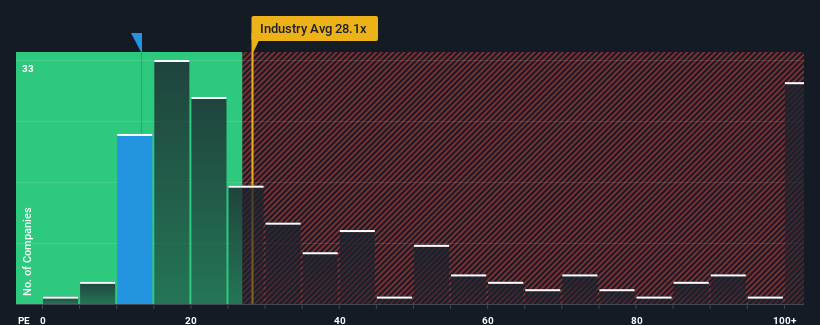

In spite of the firm bounce in price, Foxsemicon Integrated Technology's price-to-earnings (or "P/E") ratio of 13.2x might still make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 23x and even P/E's above 38x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Foxsemicon Integrated Technology has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Foxsemicon Integrated Technology

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Foxsemicon Integrated Technology would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. Still, the latest three year period has seen an excellent 37% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 1.5% during the coming year according to the dual analysts following the company. With the market predicted to deliver 23% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Foxsemicon Integrated Technology is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite Foxsemicon Integrated Technology's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Foxsemicon Integrated Technology's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Foxsemicon Integrated Technology is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Foxsemicon Integrated Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3413

Foxsemicon Integrated Technology

Engages in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration in Taiwan, the United States, China, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026