- Taiwan

- /

- Semiconductors

- /

- TWSE:2369

The 13% return this week takes Lingsen Precision Industries' (TWSE:2369) shareholders five-year gains to 147%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Lingsen Precision Industries, Ltd. (TWSE:2369) stock is up an impressive 121% over the last five years. And in the last week the share price has popped 13%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Lingsen Precision Industries

Because Lingsen Precision Industries made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Lingsen Precision Industries can boast revenue growth at a rate of 3.5% per year. Put simply, that growth rate fails to impress. So we wouldn't have expected to see the share price to have lifted 17% for each year during that time, but that's what happened. While we wouldn't be overly concerned, it might be worth checking whether you think the fundamental business gains really justify the share price action. It may be that the market is pretty optimistic about Lingsen Precision Industries.

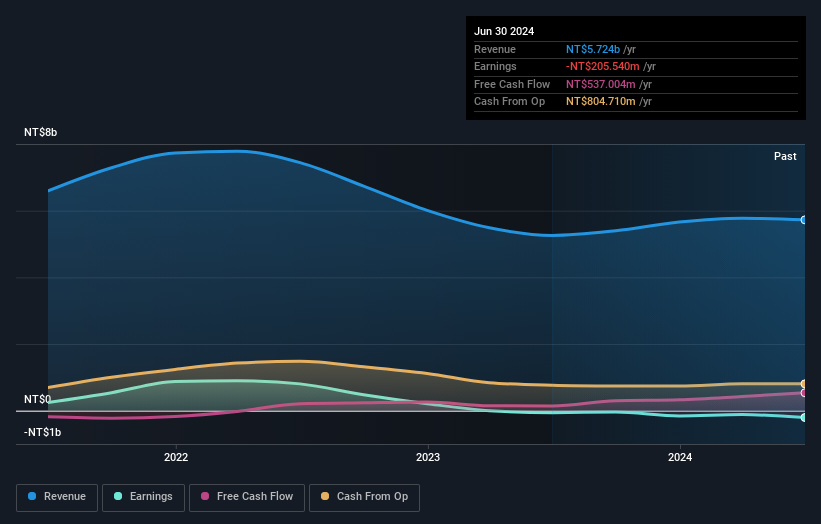

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Lingsen Precision Industries' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Lingsen Precision Industries the TSR over the last 5 years was 147%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Lingsen Precision Industries had a tough year, with a total loss of 11% (including dividends), against a market gain of about 47%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 20% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2369

Lingsen Precision Industries

Engages in the semiconductor business in Taiwan, rest of Asia, Europe, the Americas, and Africa.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives