As global markets navigate a complex landscape, including rate cuts by the European Central Bank and fluctuating oil prices, investors are keenly observing sectors that show resilience and potential for growth. In this environment, companies with high insider ownership often attract attention due to the alignment of interests between management and shareholders, which can be particularly appealing in times of market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Fujian Aonong Biological Technology Group Incorporation (SHSE:603363)

Simply Wall St Growth Rating: ★★★★★☆

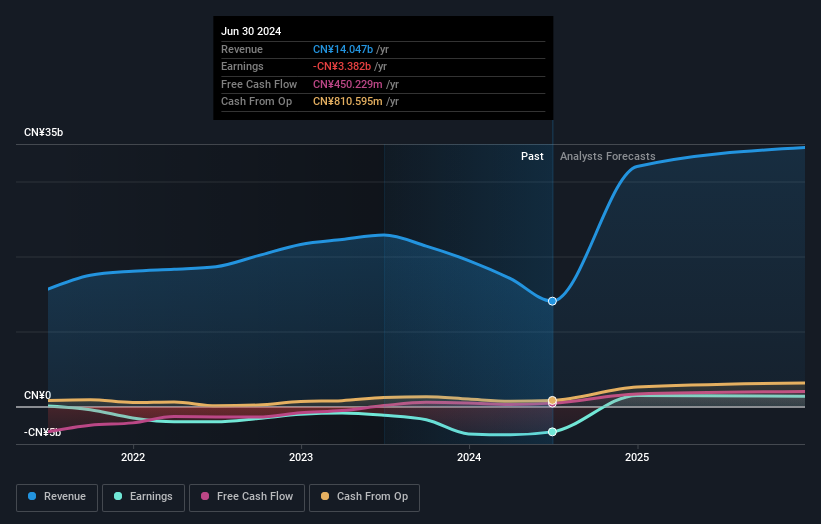

Overview: Fujian Aonong Biological Technology Group Incorporation Limited operates in various sectors including feed, pig raising, food, supply chain services, agricultural internet, and bio-pharmaceuticals both in China and internationally with a market cap of approximately CN¥2.80 billion.

Operations: The company generates revenue from its operations in feed, pig raising, food, supply chain services, agricultural internet, and bio-pharmaceutical sectors across China and international markets.

Insider Ownership: 11.4%

Earnings Growth Forecast: 130.2% p.a.

Fujian Aonong Biological Technology Group is trading at a substantial discount compared to its estimated fair value, with forecasts indicating revenue growth of 44.9% annually, outpacing the Chinese market. Despite negative shareholders' equity and recent losses of CNY 540.01 million for the half-year ending June 2024, the company is expected to turn profitable within three years, suggesting potential for above-average market growth in profitability.

- Dive into the specifics of Fujian Aonong Biological Technology Group Incorporation here with our thorough growth forecast report.

- According our valuation report, there's an indication that Fujian Aonong Biological Technology Group Incorporation's share price might be on the cheaper side.

SDI (TWSE:2351)

Simply Wall St Growth Rating: ★★★★☆☆

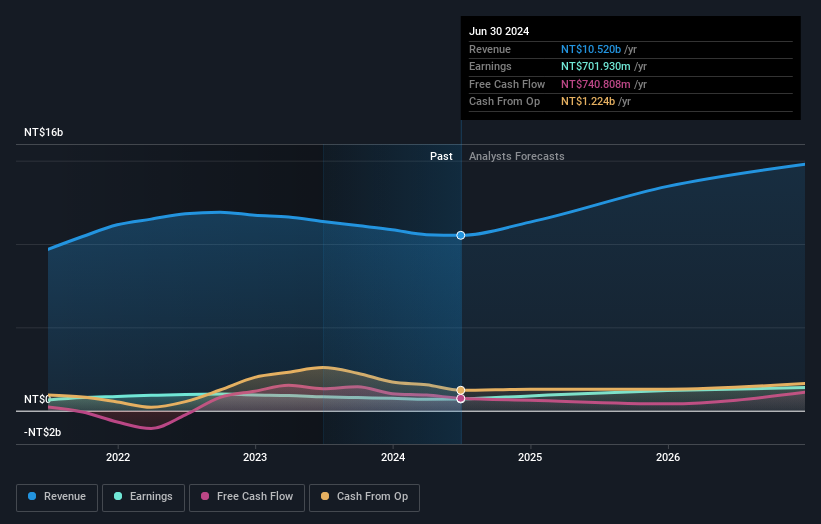

Overview: SDI Corporation operates in the manufacturing and sale of semiconductor lead frames, LED lead frames, stationery and office products, and high precision dies across Taiwan, China, Japan, Malaysia, and internationally with a market cap of NT$24.04 billion.

Operations: The company's revenue is primarily derived from its electronic product parts segment, which accounts for NT$9.52 billion, and stationery supplies, contributing NT$1.92 billion.

Insider Ownership: 23.9%

Earnings Growth Forecast: 27.6% p.a.

SDI Corporation's earnings are forecast to grow significantly at 27.6% annually, surpassing the Taiwanese market's growth rate. Despite a volatile share price and lack of recent insider trading activity, the company trades at 33.1% below its estimated fair value. Revenue is expected to rise by 14.3% per year, outpacing the market average of 12.1%. Analysts agree on a potential stock price increase of 24.4%, though dividend stability remains an issue.

- Unlock comprehensive insights into our analysis of SDI stock in this growth report.

- In light of our recent valuation report, it seems possible that SDI is trading behind its estimated value.

Visco Vision (TWSE:6782)

Simply Wall St Growth Rating: ★★★★★☆

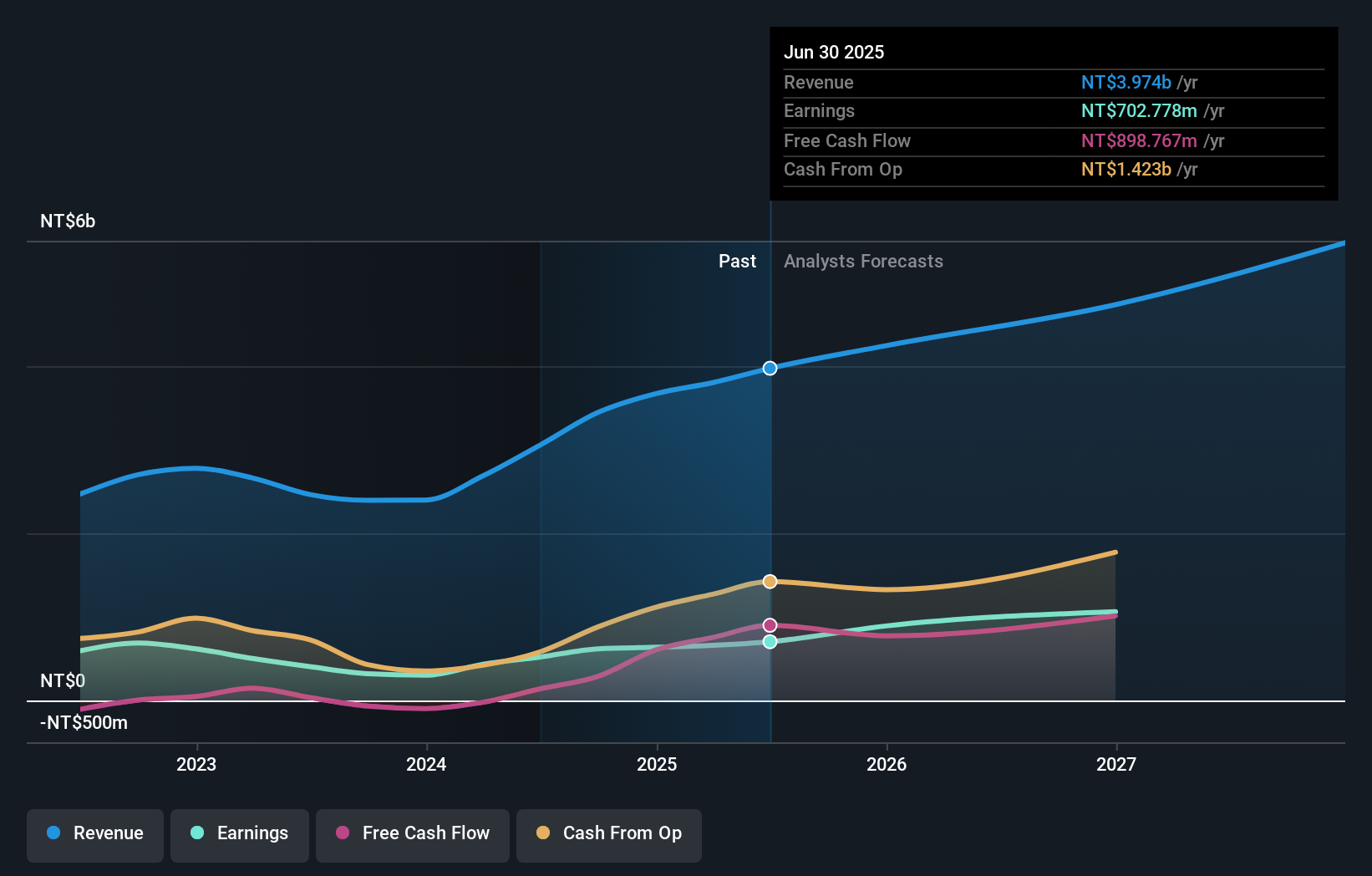

Overview: Visco Vision Inc. manufactures and sells silicone hydrogel contact lenses across Asia, Europe, and the Americas, with a market cap of NT$14.18 billion.

Operations: The company generates revenue primarily from the manufacturing and trading of disposable contact lenses, amounting to NT$3.06 billion.

Insider Ownership: 23.6%

Earnings Growth Forecast: 33.5% p.a.

Visco Vision's earnings are projected to grow significantly at 33.5% annually, outpacing the Taiwanese market. Despite a highly volatile share price and no recent insider trading activity, it trades at 61.9% below its estimated fair value. Analysts predict a stock price increase of 35.4%. Recent financials show strong performance with second-quarter sales reaching TWD 905.07 million and net income increasing to TWD 143.83 million from TWD 56.89 million year-over-year, indicating robust growth potential.

- Take a closer look at Visco Vision's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Visco Vision's share price might be too pessimistic.

Seize The Opportunity

- Get an in-depth perspective on all 1489 Fast Growing Companies With High Insider Ownership by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603363

Fujian Aonong Biological Technology Group Incorporation

Engages in the feed, pig raising, food, supply chain services, agricultural internet, bio-pharmaceutical, and other businesses in China and internationally.

Slightly overvalued with imperfect balance sheet.