- China

- /

- Communications

- /

- SZSE:300394

Global Market Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

Amidst a backdrop of trade uncertainties and mixed performances across major indices, global markets are navigating a complex economic landscape. With central banks adjusting monetary policies and sectors like information technology facing challenges, investors may find opportunities in stocks that appear to be trading below their estimated values. Identifying such stocks often involves looking for companies with strong fundamentals, potential for growth despite current market pressures, and resilience in the face of economic headwinds.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥73.48 | CN¥146.20 | 49.7% |

| LPP (WSE:LPP) | PLN15500.00 | PLN30684.54 | 49.5% |

| Lindab International (OM:LIAB) | SEK187.40 | SEK372.28 | 49.7% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.88 | CN¥41.67 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.52 | €7.04 | 50% |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥6.70 | CN¥13.27 | 49.5% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.38 | €6.73 | 49.7% |

| Swire Properties (SEHK:1972) | HK$16.20 | HK$32.26 | 49.8% |

| Sunstone Development (SHSE:603612) | CN¥16.82 | CN¥33.29 | 49.5% |

| MedinCell (ENXTPA:MEDCL) | €14.47 | €28.62 | 49.4% |

Here we highlight a subset of our preferred stocks from the screener.

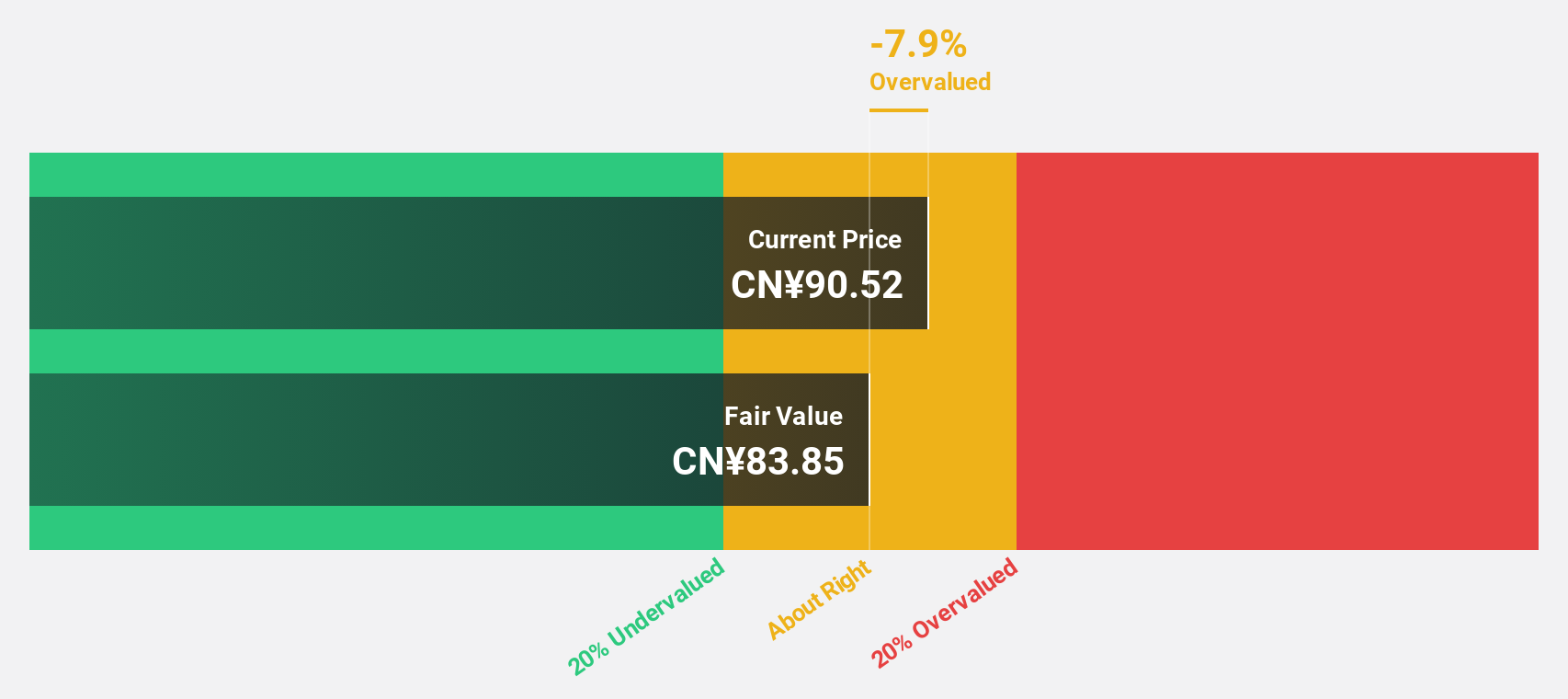

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. is engaged in the research, development, production, and sale of optical communication transceiver modules and optical devices in China, with a market cap of CN¥88.45 billion.

Operations: Zhongji Innolight generates revenue primarily through its optical communication transceiver modules and optical devices in China.

Estimated Discount To Fair Value: 45.7%

Zhongji Innolight is trading at CN¥83.52, significantly below its estimated fair value of CN¥153.87, indicating undervaluation based on discounted cash flow analysis. With a high forecasted revenue growth rate of 22.5% annually and robust earnings growth of 23.2% per year, it presents strong cash flow potential despite market volatility. Recent financials show substantial improvement with Q1 2025 net income rising to CN¥1,582.88 million from CN¥1,009.27 million a year earlier.

- The growth report we've compiled suggests that Zhongji Innolight's future prospects could be on the up.

- Dive into the specifics of Zhongji Innolight here with our thorough financial health report.

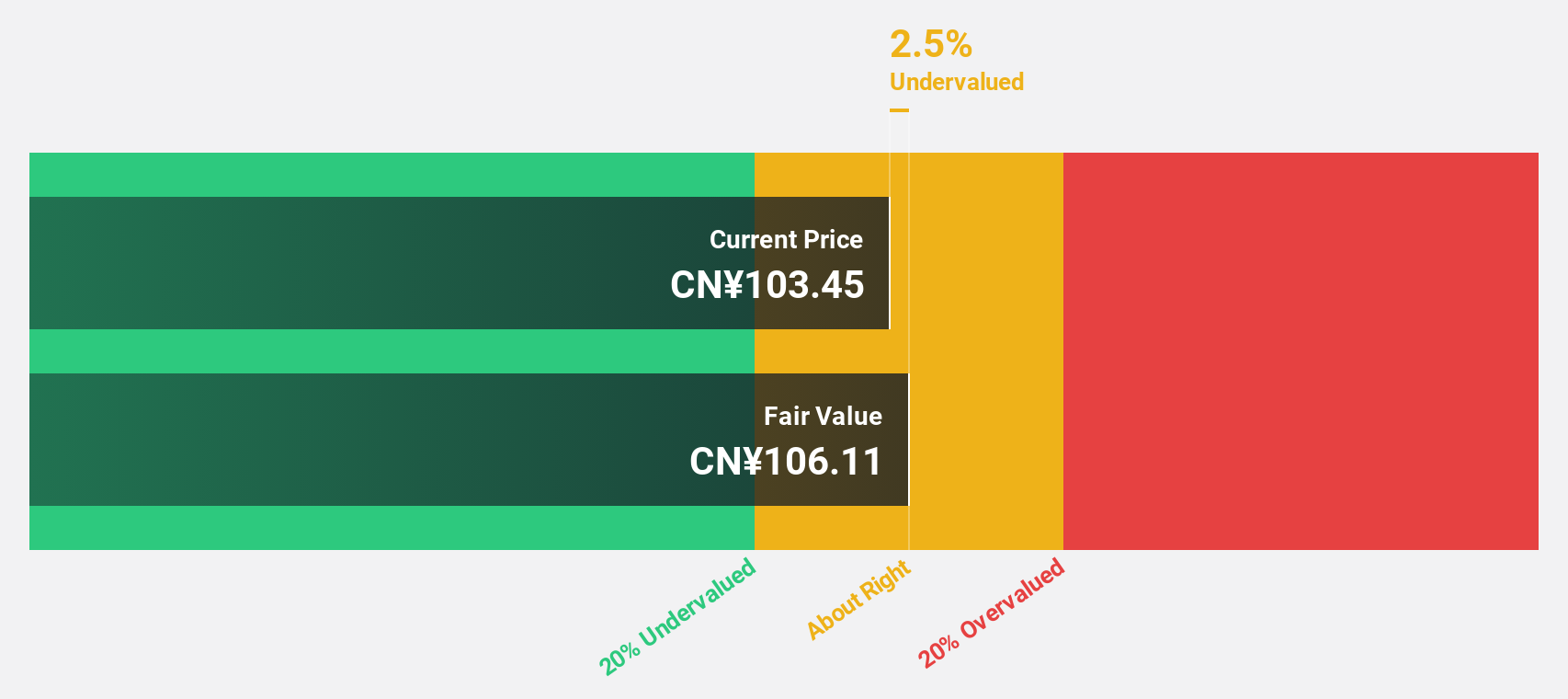

Suzhou TFC Optical Communication (SZSE:300394)

Overview: Suzhou TFC Optical Communication Co., Ltd. (SZSE:300394) operates in the optical communication industry with a market cap of CN¥37.39 billion.

Operations: The company's revenue segments are not provided in the available text.

Estimated Discount To Fair Value: 42.2%

Suzhou TFC Optical Communication is trading at CN¥72.5, well below its estimated fair value of CN¥125.38, highlighting its undervaluation based on discounted cash flow analysis. The company reported significant financial growth with 2024 sales reaching CNY 3.25 billion and net income at CNY 1.34 billion, compared to the previous year. Strategic partnerships and a forecasted annual earnings growth rate of over 30% underscore strong future cash flow potential despite recent share price volatility.

- Insights from our recent growth report point to a promising forecast for Suzhou TFC Optical Communication's business outlook.

- Get an in-depth perspective on Suzhou TFC Optical Communication's balance sheet by reading our health report here.

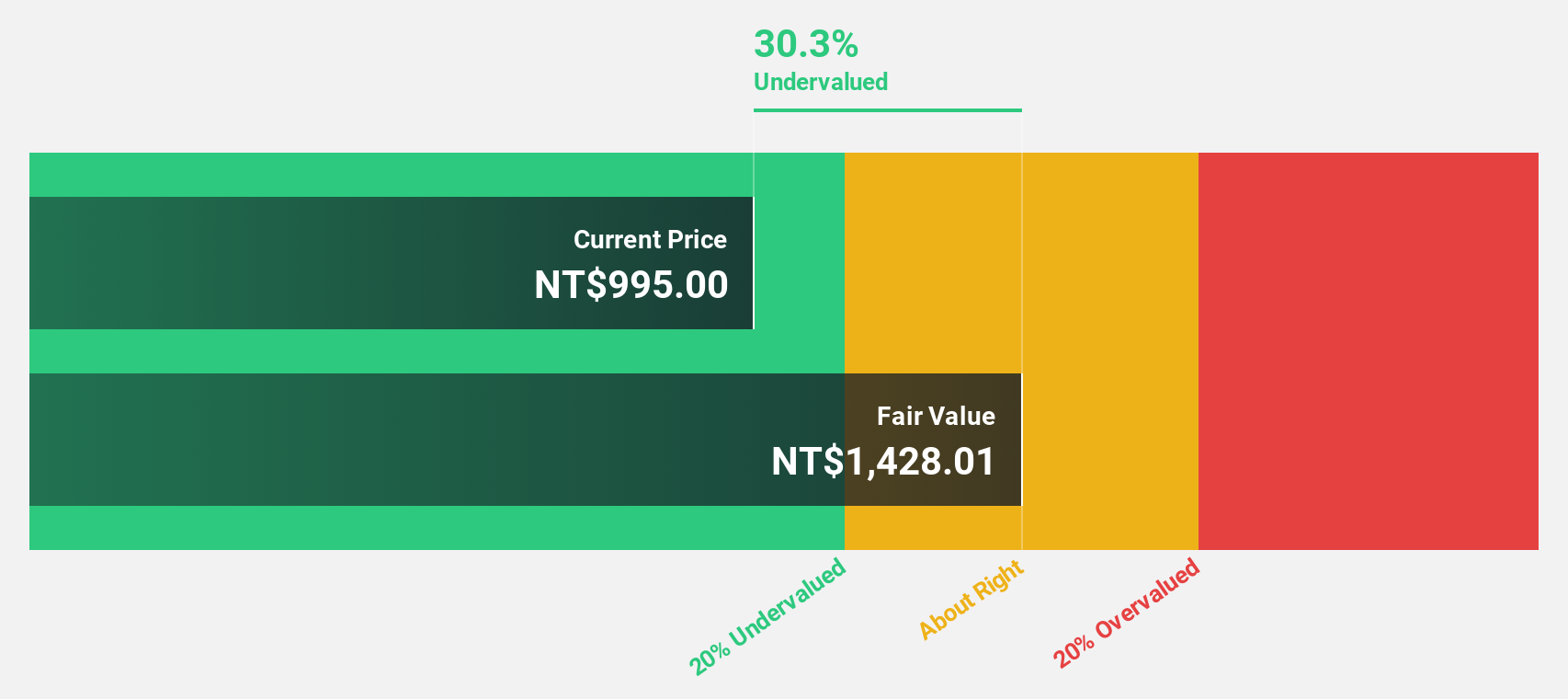

Taiwan Semiconductor Manufacturing (TWSE:2330)

Overview: Taiwan Semiconductor Manufacturing Company Limited, with a market cap of NT$21.16 trillion, operates globally in the manufacturing, packaging, testing, and sales of integrated circuits and other semiconductor devices.

Operations: The company's revenue primarily comes from its Foundry segment, which generated NT$3.14 billion.

Estimated Discount To Fair Value: 44.5%

Taiwan Semiconductor Manufacturing is trading at NT$866, significantly below its estimated fair value of NT$1559.07, suggesting undervaluation based on discounted cash flow analysis. Recent revenue growth has been robust, with March 2025 net revenue reaching TWD 285.96 billion compared to TWD 195.21 billion a year ago. The company anticipates Q2 2025 revenues between US$28.4 billion and US$29.2 billion, supported by strategic U.S. investments enhancing future cash flow potential despite slower-than-20% projected annual earnings growth.

- In light of our recent growth report, it seems possible that Taiwan Semiconductor Manufacturing's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Taiwan Semiconductor Manufacturing's balance sheet health report.

Taking Advantage

- Gain an insight into the universe of 468 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300394

Suzhou TFC Optical Communication

Suzhou TFC Optical Communication Co., Ltd.

Exceptional growth potential with solid track record and pays a dividend.

Market Insights

Community Narratives