Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Jih Lin Technology Co., Ltd. (TPE:5285) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Jih Lin Technology

What Is Jih Lin Technology's Net Debt?

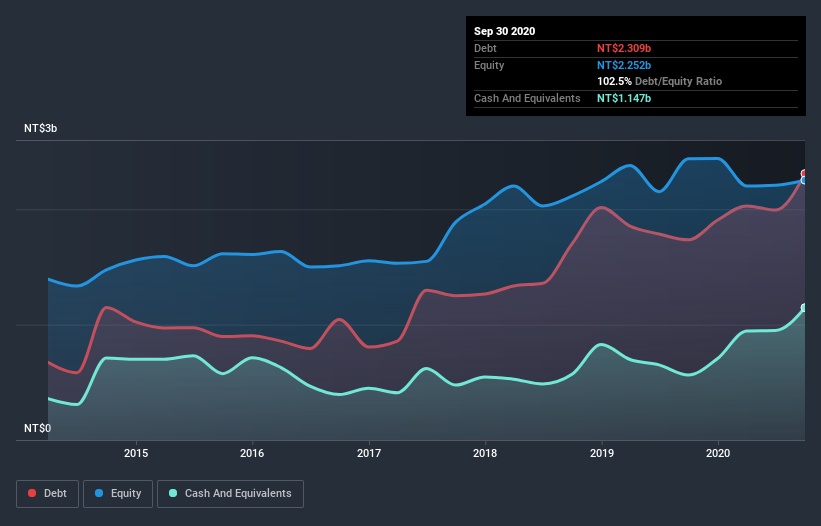

The image below, which you can click on for greater detail, shows that at September 2020 Jih Lin Technology had debt of NT$2.31b, up from NT$1.73b in one year. However, it does have NT$1.15b in cash offsetting this, leading to net debt of about NT$1.16b.

How Strong Is Jih Lin Technology's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Jih Lin Technology had liabilities of NT$1.05b due within 12 months and liabilities of NT$1.89b due beyond that. Offsetting these obligations, it had cash of NT$1.15b as well as receivables valued at NT$952.5m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$839.4m.

Of course, Jih Lin Technology has a market capitalization of NT$6.67b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Jih Lin Technology has net debt to EBITDA of 3.3 suggesting it uses a fair bit of leverage to boost returns. On the plus side, its EBIT was 8.5 times its interest expense, and its net debt to EBITDA, was quite high, at 3.3. Shareholders should be aware that Jih Lin Technology's EBIT was down 38% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Jih Lin Technology can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Jih Lin Technology recorded free cash flow of 27% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Jih Lin Technology's struggle to grow its EBIT had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. But on the bright side, its ability to to cover its interest expense with its EBIT isn't too shabby at all. Taking the abovementioned factors together we do think Jih Lin Technology's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Jih Lin Technology (of which 1 is potentially serious!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Jih Lin Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5285

Jih Lin Technology

Manufactures and sells lead frames and tooling products in Taiwan, China, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)