Dividend paying stocks like Leadtrend Technology Corporation (TPE:3588) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

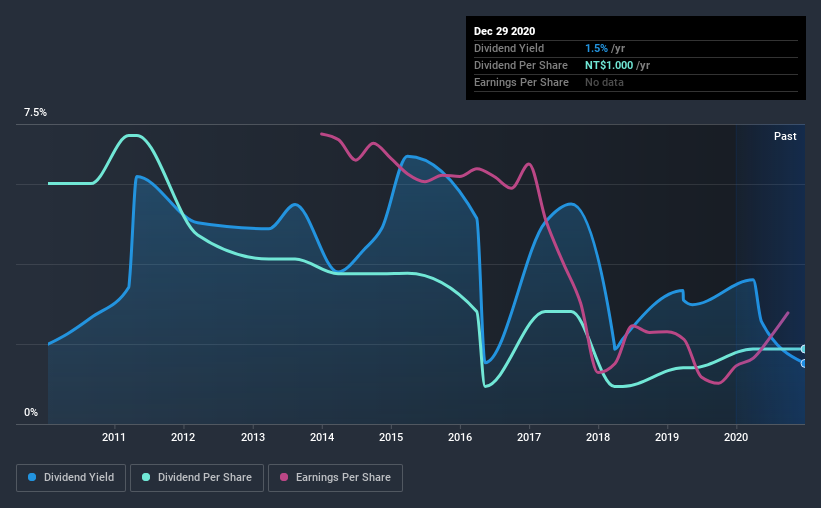

A 1.5% yield is nothing to get excited about, but investors probably think the long payment history suggests Leadtrend Technology has some staying power. That said, the recent jump in the share price will make Leadtrend Technology's dividend yield look smaller, even though the company prospects could be improving. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Leadtrend Technology paid out 104% of its profit as dividends, over the trailing twelve month period. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Leadtrend Technology paid out 92% of its free cash flow last year, which we think is concerning if cash flows do not improve. Cash is slightly more important than profit from a dividend perspective, but given Leadtrend Technology's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

With a strong net cash balance, Leadtrend Technology investors may not have much to worry about in the near term from a dividend perspective.

We update our data on Leadtrend Technology every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Leadtrend Technology's dividend payments. The dividend has been cut on at least one occasion historically. During the past 10-year period, the first annual payment was NT$3.2 in 2010, compared to NT$1.0 last year. The dividend has fallen 69% over that period.

We struggle to make a case for buying Leadtrend Technology for its dividend, given that payments have shrunk over the past 10 years.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. Leadtrend Technology's earnings per share have shrunk at 15% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Leadtrend Technology paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. In this analysis, Leadtrend Technology doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. To that end, Leadtrend Technology has 2 warning signs (and 1 which is concerning) we think you should know about.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading Leadtrend Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3588

Leadtrend Technology

Engages in research, development, production, manufacturing, and sale of analog integrated circuits in Taiwan, Mainland China, Korea and Other countries.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives