- Japan

- /

- Trade Distributors

- /

- TSE:8014

Exploring Universal Vision Biotechnology And Two Promising Small Cap Discoveries

Reviewed by Simply Wall St

In recent weeks, global markets have seen broad-based gains with smaller-cap indexes outperforming their larger counterparts, driven by positive economic indicators such as a drop in U.S. initial jobless claims and rising existing home sales. Amid this backdrop of optimism and market recovery, the search for promising small-cap stocks becomes even more pertinent as investors look to capitalize on potential growth opportunities in an evolving economic landscape. A good stock often combines strong fundamentals with the ability to adapt to changing market conditions, making it well-positioned for future success even amidst broader uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Universal Vision Biotechnology (TPEX:3218)

Simply Wall St Value Rating: ★★★★★☆

Overview: Universal Vision Biotechnology Co., Ltd. operates a chain of eye care clinics in Taiwan and China, with a market cap of NT$18.17 billion.

Operations: Universal Vision Biotechnology generates revenue primarily through its chain of eye care clinics in Taiwan and China. The company's financial performance is reflected in its market capitalization of NT$18.17 billion.

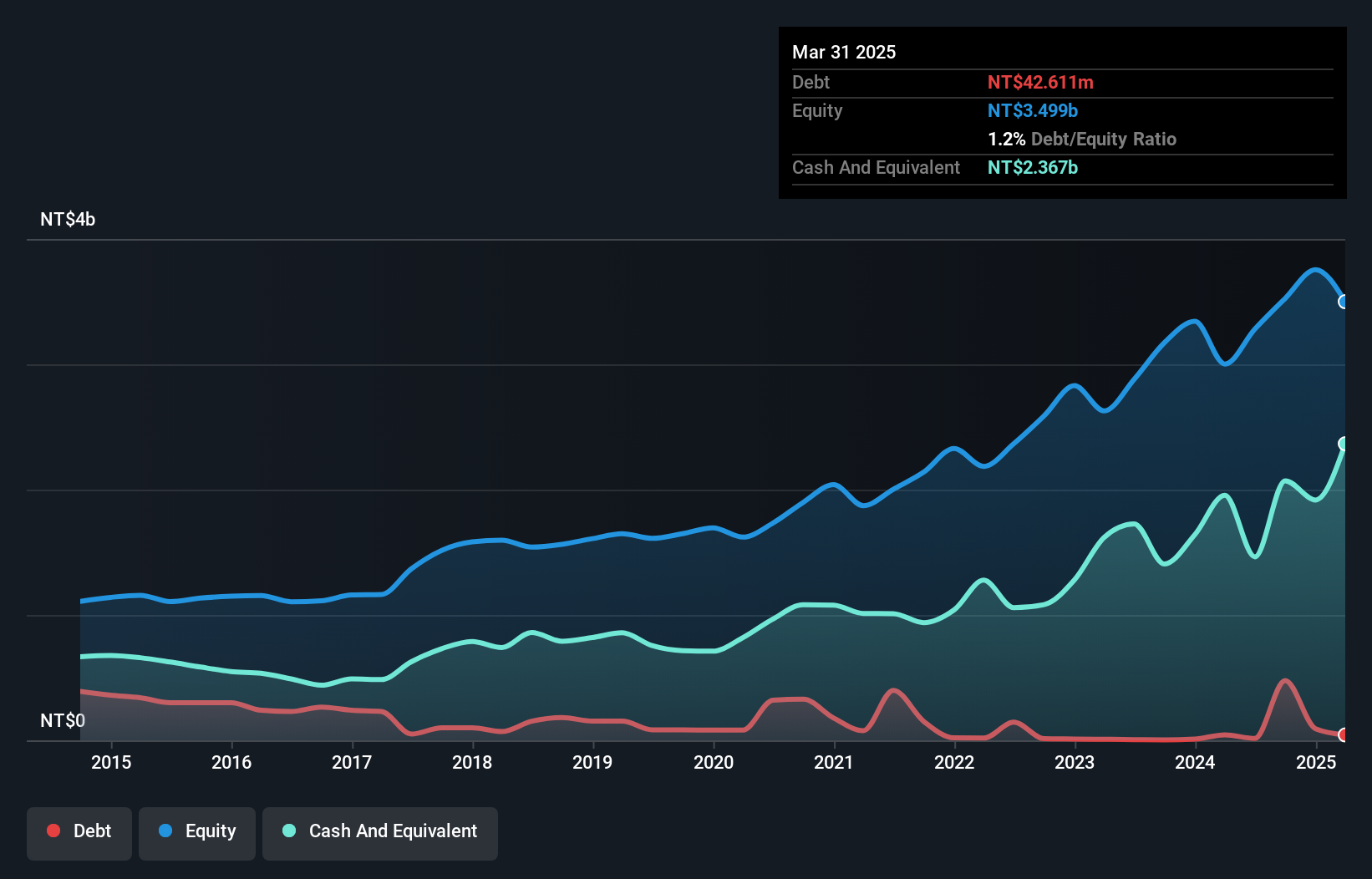

Universal Vision Biotechnology, a promising player in its field, has shown consistent earnings growth of 27.8% annually over the past five years, though recent figures indicate a slight dip in quarterly net income to TWD 243.65 million from TWD 266.28 million last year. Trading at an attractive valuation, it's currently estimated to be 50.7% below its fair value while maintaining high-quality earnings and positive free cash flow of TWD 1,221.36 million as of September 2024. Despite legal challenges dismissed by the Taiwan High Court recently, the company continues to forecast earnings growth at a steady pace of around 10% annually moving forward.

Brillian Network & Automation Integrated System (TPEX:6788)

Simply Wall St Value Rating: ★★★★★★

Overview: Brillian Network & Automation Integrated System Co. is a company focused on providing integrated network and automation solutions, with a market cap of NT$8.62 billion.

Operations: Brillian Network & Automation Integrated System generates revenue primarily from its integrated network and automation solutions. The company's market cap stands at NT$8.62 billion.

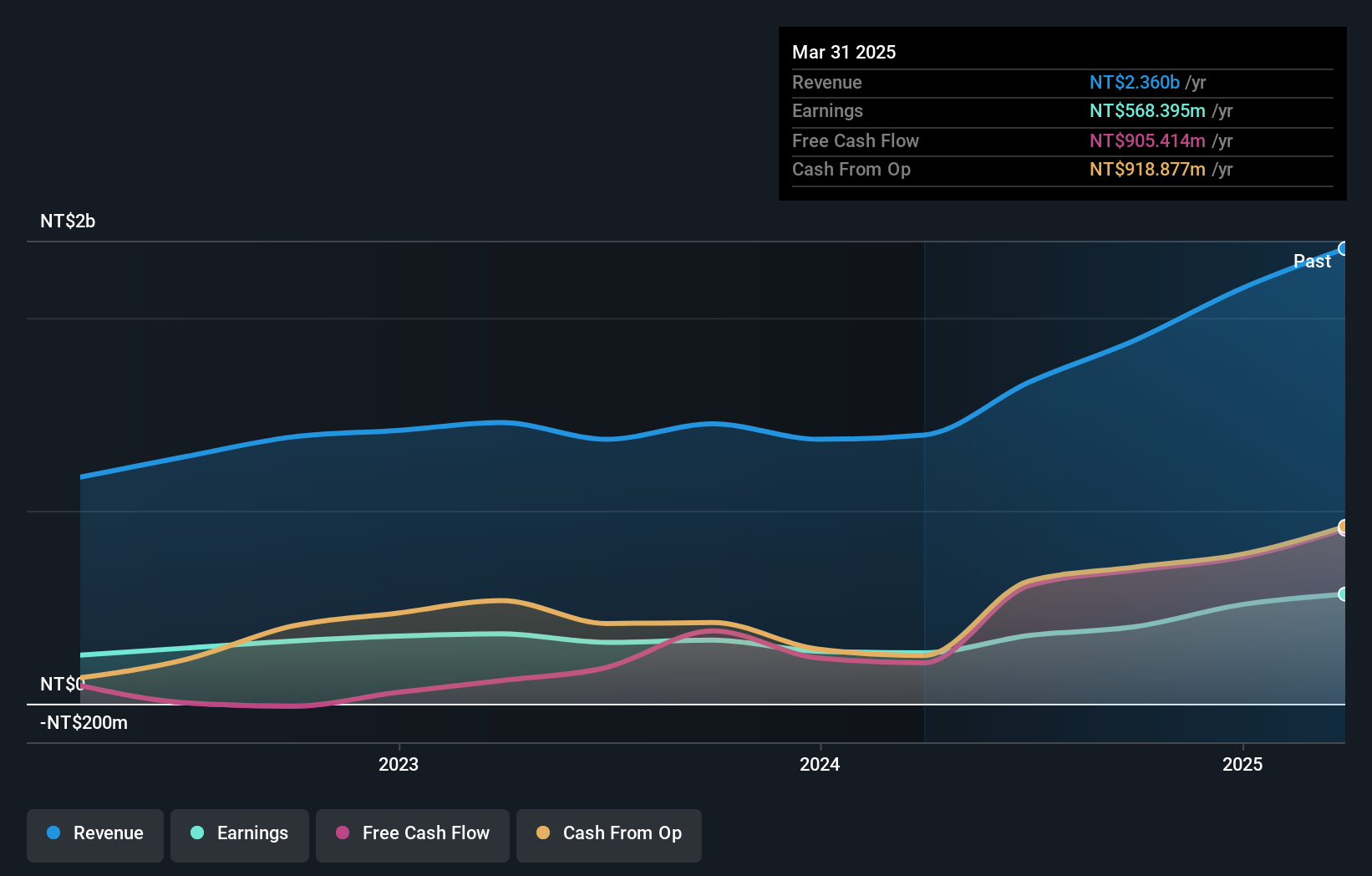

Brillian Network & Automation Integrated System, a nimble player in its field, showcased robust financial performance recently. Sales for the third quarter reached TWD 655.94 million, up from TWD 437.54 million the previous year, while net income climbed to TWD 137.59 million from TWD 92.07 million. The company seems to be capitalizing on industry trends with earnings growth of 21% over the past year, outpacing the semiconductor sector's average growth of 6%. Trading at a significant discount of approximately 45% below its fair value estimate suggests potential upside for investors seeking undervalued opportunities in this space.

Chori (TSE:8014)

Simply Wall St Value Rating: ★★★★★★

Overview: Chori Co., Ltd. operates in the textiles, chemicals, and machinery sectors both in China and globally, with a market capitalization of ¥98.46 billion.

Operations: Chori generates revenue primarily from its chemicals and textiles businesses, with ¥157.69 billion and ¥150.36 billion respectively. The machinery segment contributes a smaller portion at ¥1.12 billion.

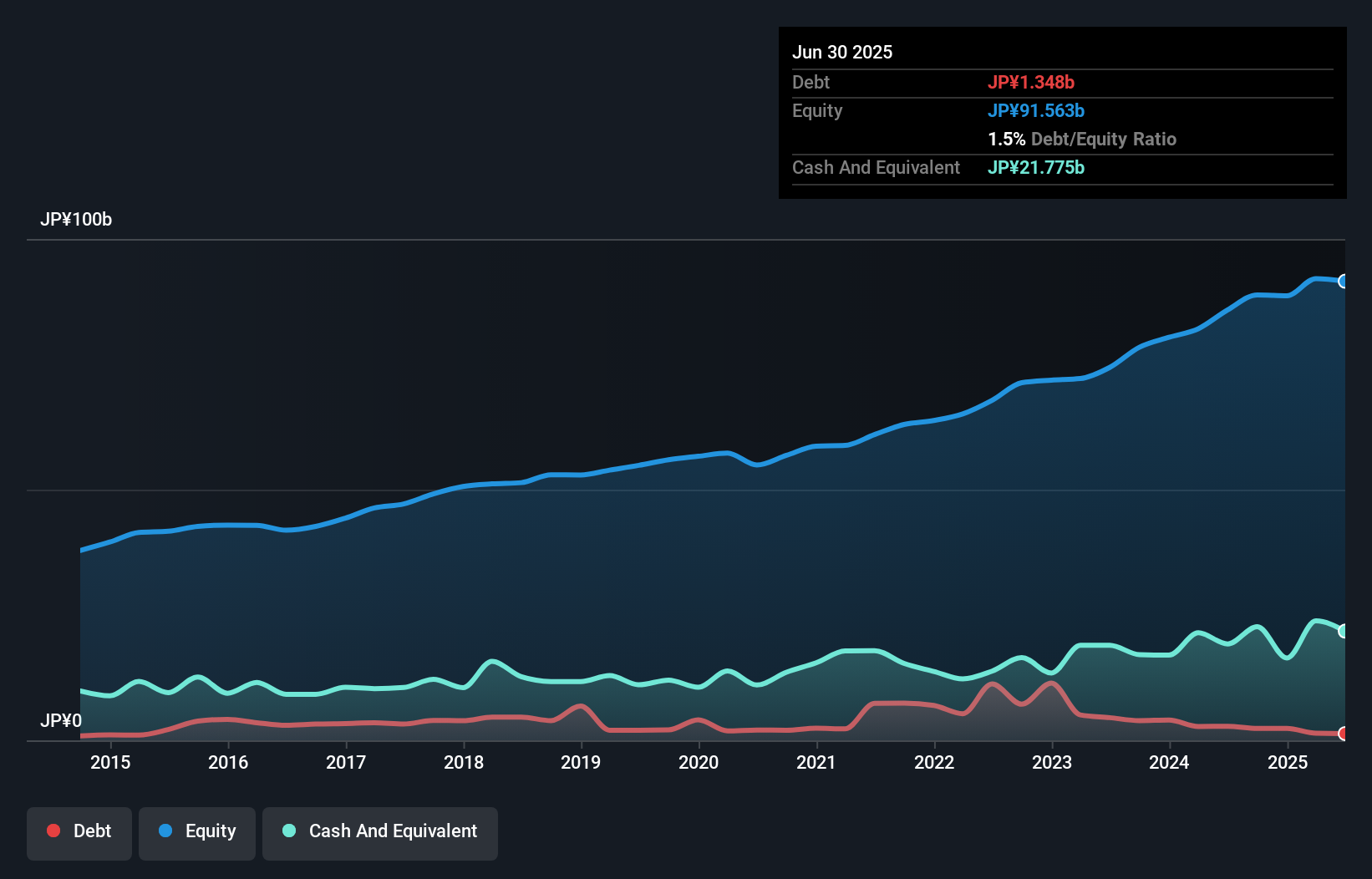

Chori, a promising player in the Trade Distributors sector, showcases robust financial health. Its earnings surged by 39% over the past year, outpacing industry growth of just 1.8%. The company is trading at approximately 61% below its estimated fair value, suggesting potential undervaluation. Over the last five years, Chori's debt to equity ratio improved significantly from 3.7% to 2.7%, reflecting prudent financial management. Additionally, it boasts high-quality earnings and more cash than total debt, indicating solid liquidity and reduced risk in covering interest payments with profits comfortably exceeding them.

- Click here and access our complete health analysis report to understand the dynamics of Chori.

Understand Chori's track record by examining our Past report.

Make It Happen

- Unlock our comprehensive list of 4636 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8014

Chori

Engages in textiles, chemicals, and machinery businesses in China and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives