Undiscovered Gems And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week where most major stock indexes saw declines, the Nasdaq Composite stood out by reaching a new record high, while small-cap stocks underperformed larger peers as reflected in the Russell 2000 Index's continued lag behind the S&P 500. Amidst these market dynamics and economic indicators such as stalled inflation progress and a cooling labor market, investors are increasingly focused on identifying opportunities within smaller companies that may offer strong potential for growth. In this context, discovering lesser-known stocks with solid fundamentals and promising prospects can be particularly appealing to those looking to navigate current market conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Chilanga Cement | NA | 12.53% | 25.20% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

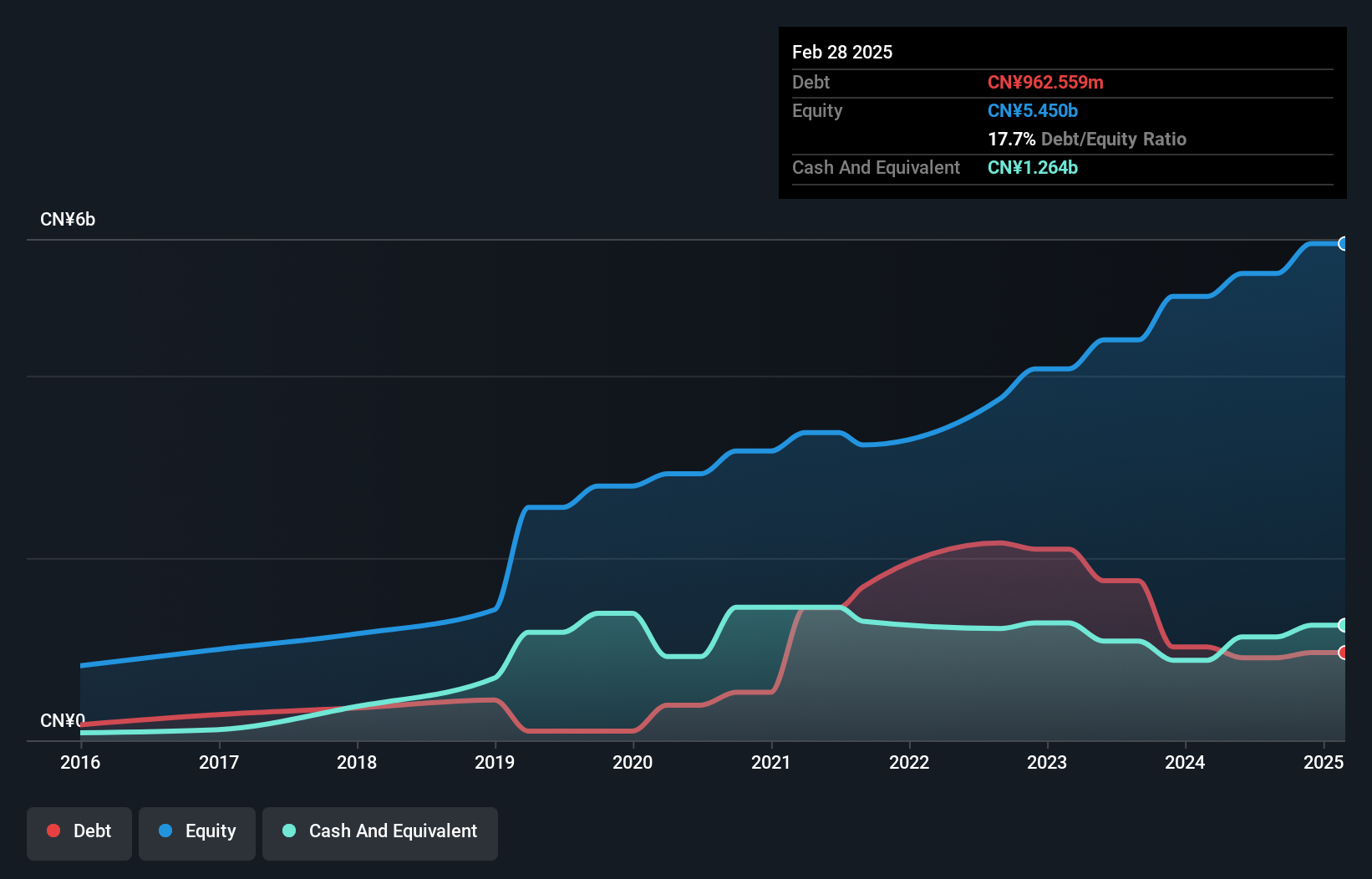

China Kepei Education Group (SEHK:1890)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Kepei Education Group Limited is an investment holding company that offers private vocational education services with a focus on profession-oriented and vocational training in China, and it has a market capitalization of HK$2.82 billion.

Operations: Kepei generates revenue primarily from its provision of education services, amounting to CN¥1.69 billion. The company's financial performance is highlighted by a focus on cost management and operational efficiency, contributing to its profitability metrics.

China Kepei Education Group, a smaller player in the education sector, has shown promising financial health with earnings growth of 11.4% over the past year, outpacing the Consumer Services industry average of 5.5%. The company reported net income of CNY 827.85 million for the year ending August 2024, up from CNY 743.3 million previously. It trades at a substantial discount to its estimated fair value by about 85.7%, suggesting potential undervaluation in comparison to industry peers. Furthermore, it maintains more cash than its total debt and covers interest payments well with EBIT at a robust 22x coverage ratio.

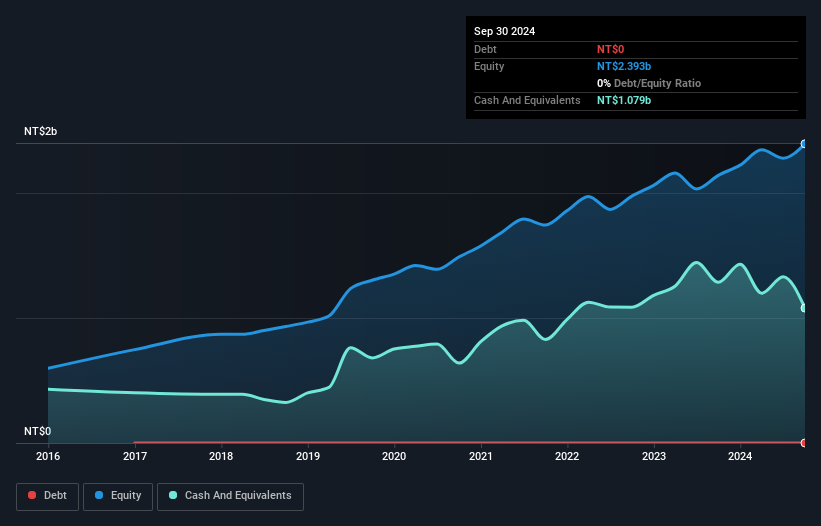

Keystone Microtech (TPEX:6683)

Simply Wall St Value Rating: ★★★★★★

Overview: Keystone Microtech Corporation operates in the semiconductor industry in Taiwan and internationally with a market capitalization of NT$9.78 billion.

Operations: Keystone Microtech generates revenue primarily from manufacturing and selling various test carriers for semiconductor wafer testing, amounting to NT$1.57 billion.

Keystone Microtech, a nimble player in the semiconductor space, showcases a promising trajectory with earnings growth of 16.4% over the past year, outpacing the industry’s 5.8%. The company reported third-quarter sales of TWD 451.35 million and net income of TWD 108.41 million, reflecting steady progress from last year’s figures. With no debt on its books for five years and a price-to-earnings ratio at 23.6x—below the industry average—Keystone seems well-positioned financially, though it lacks free cash flow positivity currently. Looking ahead, revenue is expected to grow by about 6% annually, hinting at sustained development potential.

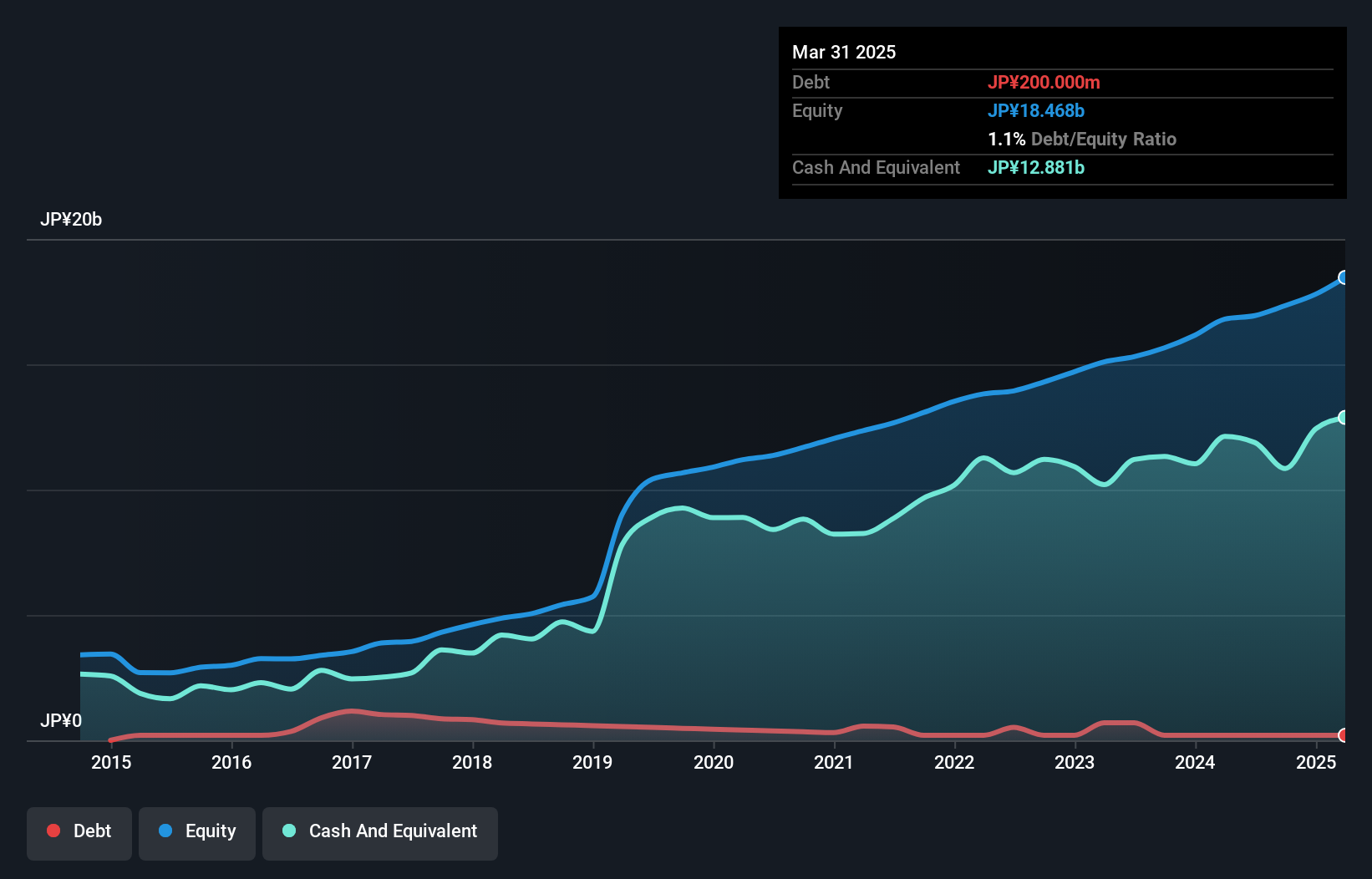

Comture (TSE:3844)

Simply Wall St Value Rating: ★★★★★☆

Overview: Comture Corporation offers cloud, digital, business platform and operation, and digital learning solutions in Japan with a market capitalization of ¥72.48 billion.

Operations: Comture Corporation generates revenue primarily from its Solution Services segment, which contributed ¥35.22 billion. The company's financial performance is influenced by its cost structure and operational efficiencies, with a focus on optimizing net profit margin.

Comture, a player in the IT sector, is trading at 20.3% below its estimated fair value, offering potential upside for investors. Over the past five years, its debt-to-equity ratio impressively decreased from 4.5 to 1.2, indicating prudent financial management. The company boasts high-quality earnings with significant non-cash components and reported a robust earnings growth of 14.6% last year, outpacing the IT industry's average of 9.7%. Despite recent share price volatility and insufficient data on interest coverage by EBIT, Comture remains profitable with positive free cash flow and announced a JPY 12 dividend per share for Q2 fiscal year ending March 2025.

- Take a closer look at Comture's potential here in our health report.

Explore historical data to track Comture's performance over time in our Past section.

Turning Ideas Into Actions

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4508 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3844

Comture

Provides cloud, digital, business, platform and operation, and digital learning solutions in Japan.

Flawless balance sheet with moderate growth potential.