- Taiwan

- /

- Semiconductors

- /

- TPEX:6640

None Hidden Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets continue to reach record highs, with U.S. small-cap indices like the Russell 2000 hitting new peaks, investor sentiment remains buoyed by domestic policy developments and geopolitical events. Amid this backdrop of robust market activity and economic indicators, identifying promising small-cap stocks becomes crucial for investors seeking potential growth opportunities in an ever-evolving landscape. A good stock in today's environment often combines strong fundamentals with resilience to external shocks, making it a compelling choice for those looking to capitalize on emerging trends within the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shanghai Bloom Technology (SHSE:603325)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Bloom Technology Inc. specializes in providing pneumatic conveying and processing equipment for powder materials in China, with a market capitalization of CN¥5.58 billion.

Operations: The company generates revenue primarily from its pneumatic conveying and processing equipment for powder materials. It has a market capitalization of CN¥5.58 billion.

Shanghai Bloom Technology, a smaller player in the tech industry, shows promising financials despite some challenges. Over the past year, earnings grew by 1.8%, surpassing the Machinery industry's -0.4% growth rate. The company trades at 72.1% below its estimated fair value and has high-quality earnings with more cash than total debt, indicating sound financial health. Recent figures reveal sales of CNY 581 million for nine months in 2024 compared to CNY 760 million last year, with net income slightly lower at CNY 169 million from CNY 177 million previously. Earnings per share dropped to CNY 2.61 from CNY 3.55 last year, reflecting some pressure on profitability but maintaining a positive outlook for future growth prospects given its competitive position and undervaluation potential.

Prosperity Dielectrics (TPEX:6173)

Simply Wall St Value Rating: ★★★★★☆

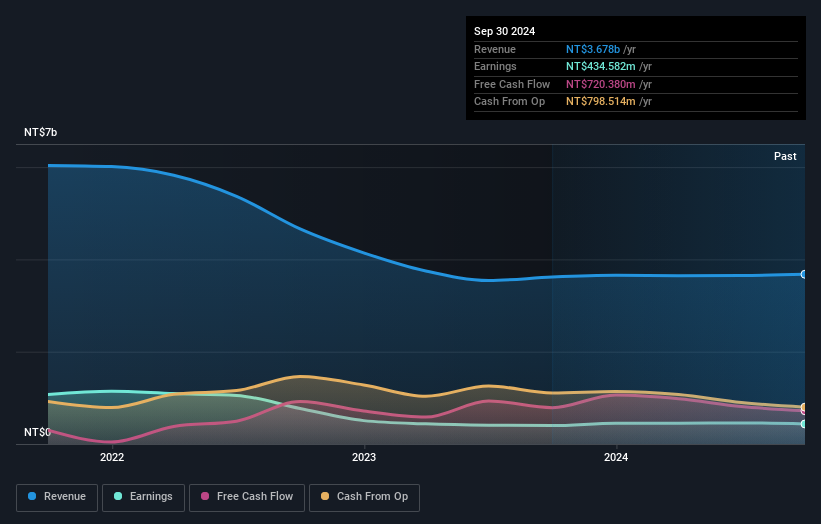

Overview: Prosperity Dielectrics Co., Ltd. manufactures, processes, and sells ceramic dielectric powders and multilayer ceramic chip capacitors across Asia, the United States, and Europe with a market capitalization of NT$8.55 billion.

Operations: The company generates revenue primarily from the Taiwan Department (NT$3.25 billion) and the China Segment (NT$1.89 billion), with adjustments and write-offs affecting overall figures by NT$-1.46 billion.

Prosperity Dielectrics, a company operating in the electronics industry, has shown mixed performance recently. In the past year, its earnings grew by 9%, surpassing the industry's 7.8% growth rate. However, over five years, earnings have decreased by an average of 13.6% annually. The firm reported sales of TWD 975 million for Q3 2024, slightly up from TWD 949 million last year; yet net income fell to TWD 89 million from TWD 112 million previously. With a price-to-earnings ratio of 19.7x below Taiwan's market average of 21x and positive free cash flow, it presents both opportunities and challenges for investors seeking value in smaller companies within this sector.

Gallant Micro. Machining (TPEX:6640)

Simply Wall St Value Rating: ★★★★★☆

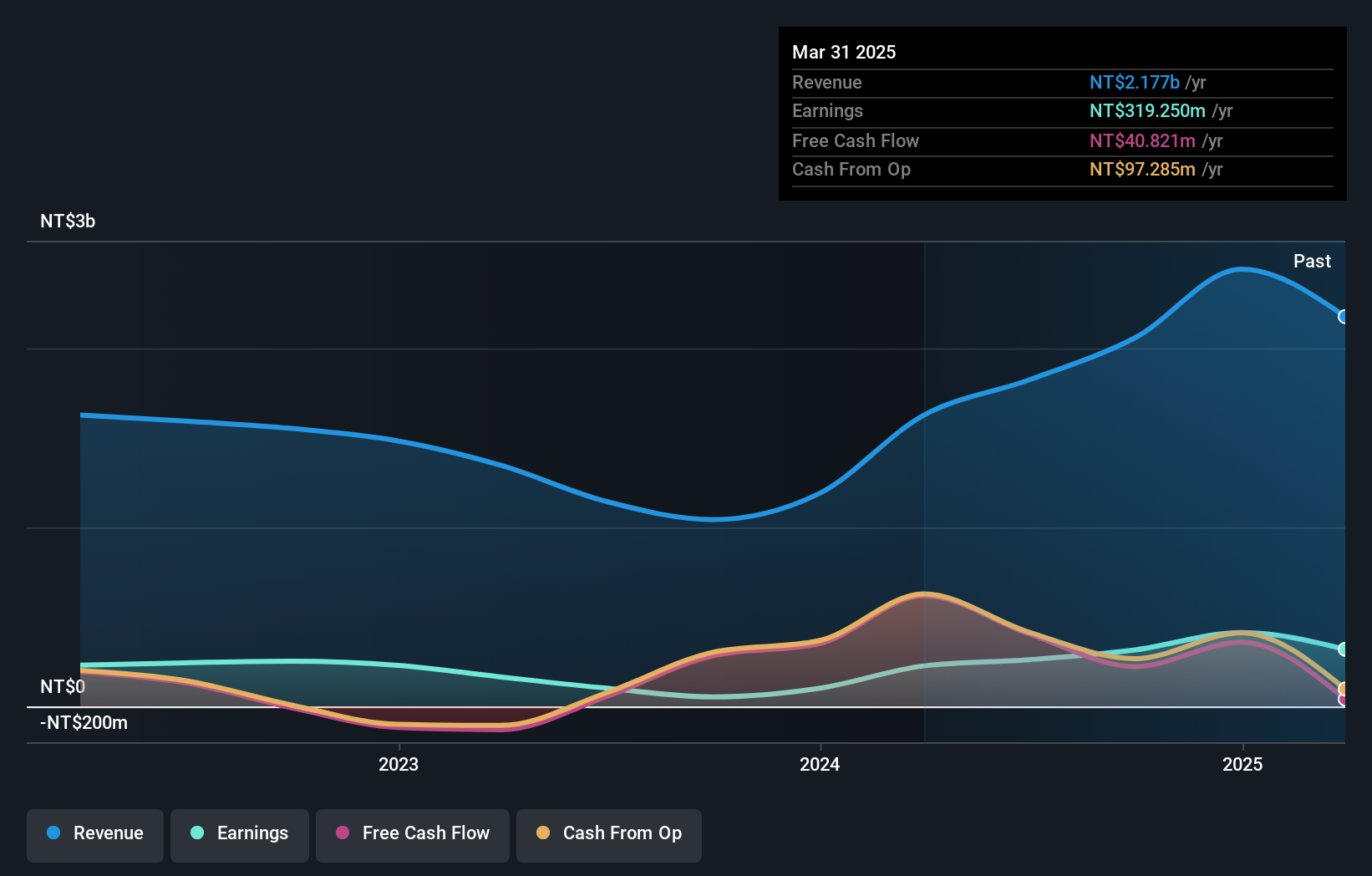

Overview: Gallant Micro. Machining Co., LTD. specializes in the design, manufacture, and sale of packaging and inspection equipment for semiconductor manufacturing across Taiwan, Southeast Asia, and China, with a market cap of NT$23.13 billion.

Operations: Gallant Micro. Machining Co., LTD. generates revenue primarily from Gallant Micro. Machining Co., Ltd. with NT$1.75 billion and KMC Corporation contributing NT$584.94 million, focusing on packaging and inspection equipment for the semiconductor industry in key Asian markets.

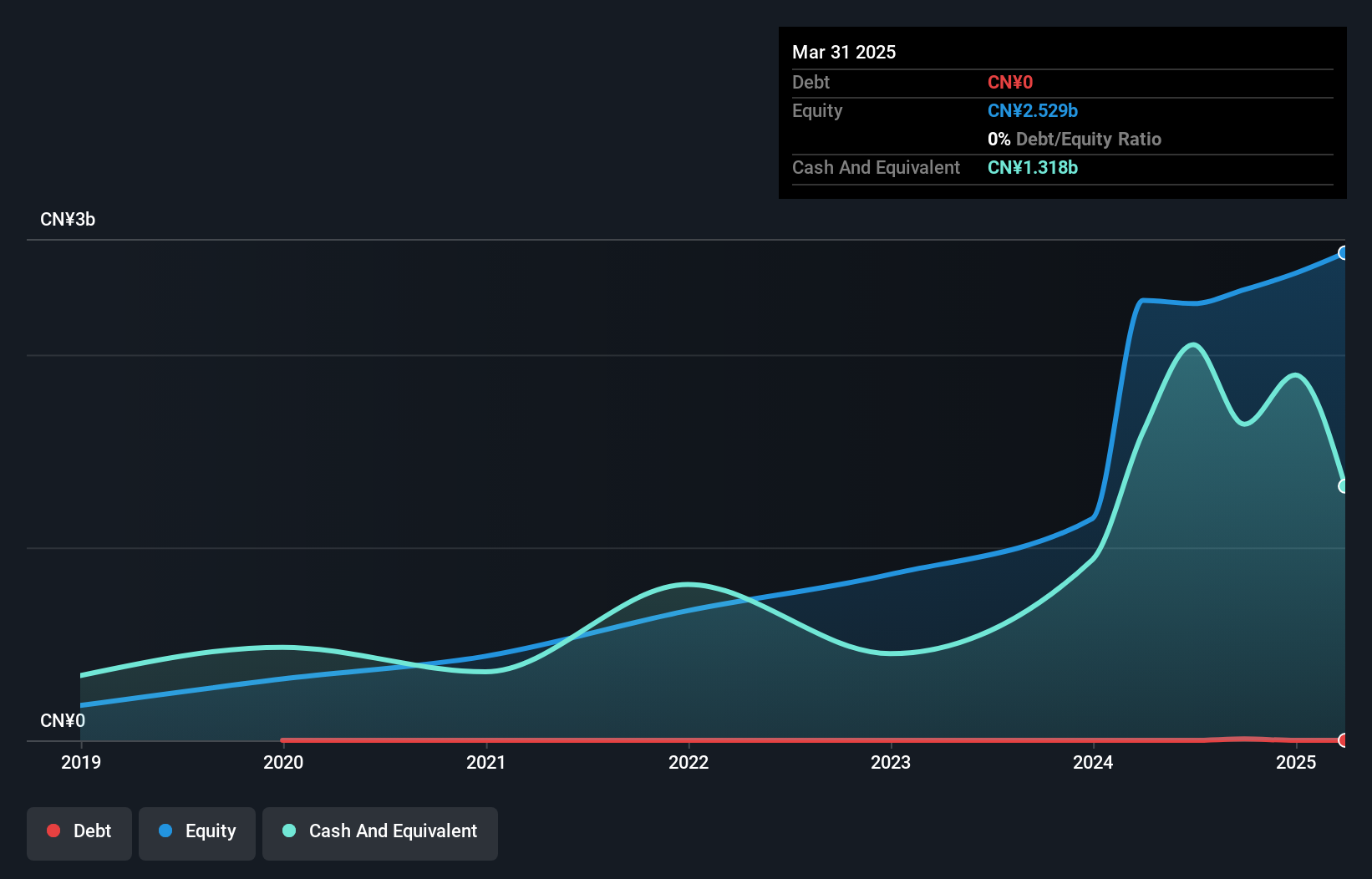

Gallant Micro. Machining, a nimble player in the semiconductor sector, has showcased impressive growth with earnings soaring by 497% over the past year, significantly outpacing the industry average of 5.9%. The company's recent inclusion in the S&P Global BMI Index highlights its rising prominence. For Q3 2024, sales reached TWD 474 million compared to TWD 238 million last year, while net income jumped to TWD 57 million from TWD 3 million previously. Despite a volatile share price recently, Gallant Micro's financial health appears robust with satisfactory debt levels and positive free cash flow contributing to its solid standing.

- Get an in-depth perspective on Gallant Micro. Machining's performance by reading our health report here.

Learn about Gallant Micro. Machining's historical performance.

Where To Now?

- Get an in-depth perspective on all 4640 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6640

Gallant Micro. Machining

Designs, manufactures, and sells front-end and back-end packaging and inspection equipment for manufacturing semiconductors in Taiwan, Southeast Asia, and China.

Solid track record with excellent balance sheet.