- Taiwan

- /

- Semiconductors

- /

- TPEX:6138

3 Dividend Stocks To Consider With Yields Up To 3.7%

Reviewed by Simply Wall St

In a week marked by record highs for major indices like the Dow Jones Industrial Average and S&P 500, global markets are navigating a complex landscape influenced by geopolitical developments and domestic policy changes. Amidst these dynamics, dividend stocks have gained attention as investors seek stable income streams in an environment where economic stability is prioritized. When considering dividend stocks, it's important to focus on companies with strong financial health and consistent payout histories, especially in times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.91% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.86% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Anpec Electronics (TPEX:6138)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anpec Electronics Corporation designs, tests, produces, and markets mixed-signal power chips and sensors in Taiwan and internationally, with a market cap of NT$12.47 billion.

Operations: Anpec Electronics Corporation generates its revenue primarily from the Semiconductors segment, totaling NT$6.09 billion.

Dividend Yield: 3.2%

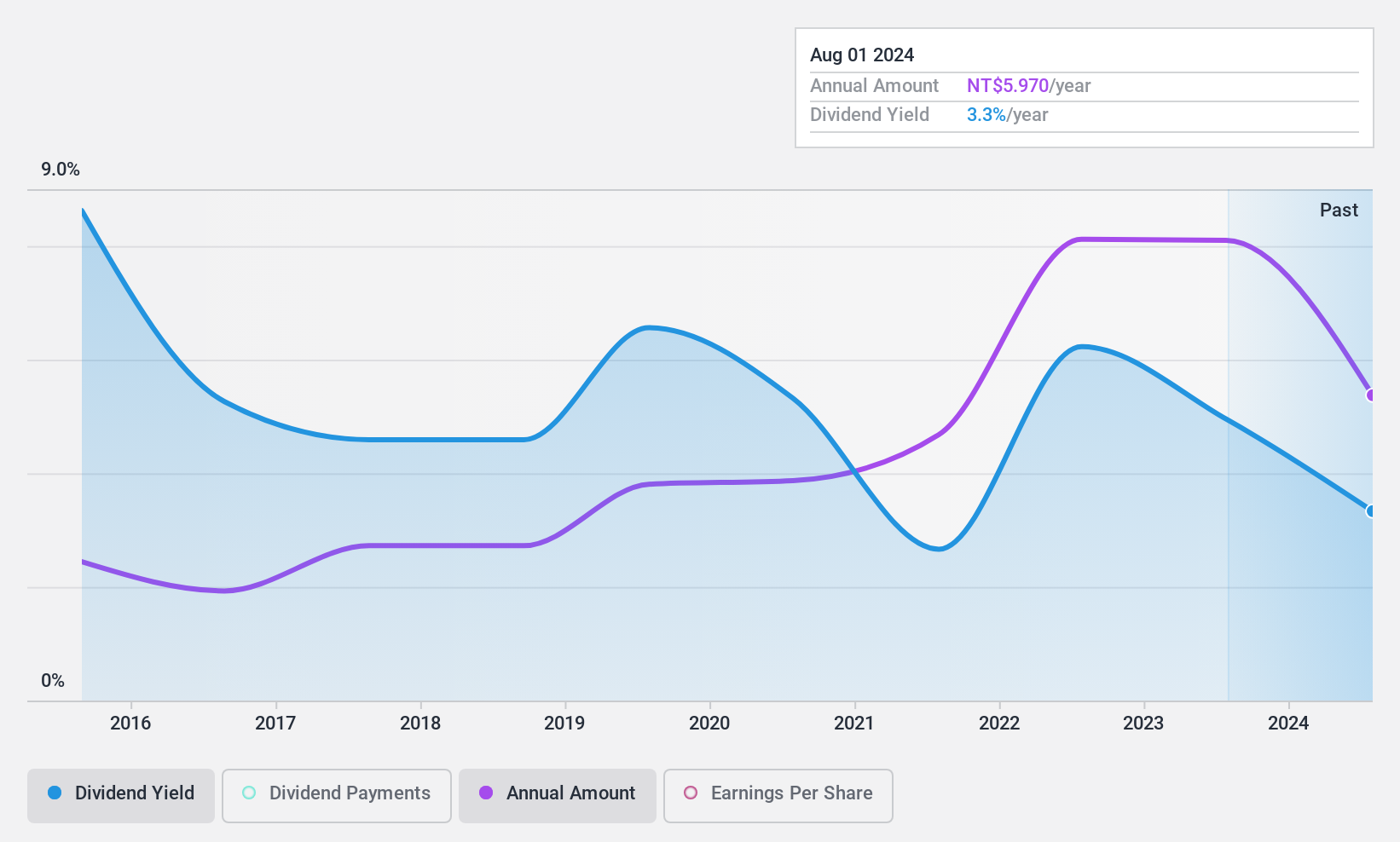

Anpec Electronics reported strong Q3 2024 results with sales of TWD 1.61 billion and net income of TWD 196.42 million, reflecting improved profitability. Despite a reasonable payout ratio (62%) and cash payout ratio (47.9%), its dividend yield of 3.22% is below the top tier in Taiwan, and its dividend history is unreliable due to volatility over the past decade. However, dividends have grown over ten years, indicating potential for future stability if earnings continue to rise.

- Click here to discover the nuances of Anpec Electronics with our detailed analytical dividend report.

- Our valuation report here indicates Anpec Electronics may be undervalued.

Sakata INX (TSE:4633)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sakata INX Corporation manufactures and sells various printing inks and auxiliary agents both in Japan and internationally, with a market cap of ¥78.92 billion.

Operations: Sakata INX Corporation's revenue segments include the manufacture and sale of various printing inks and auxiliary agents in Japan and internationally.

Dividend Yield: 3.7%

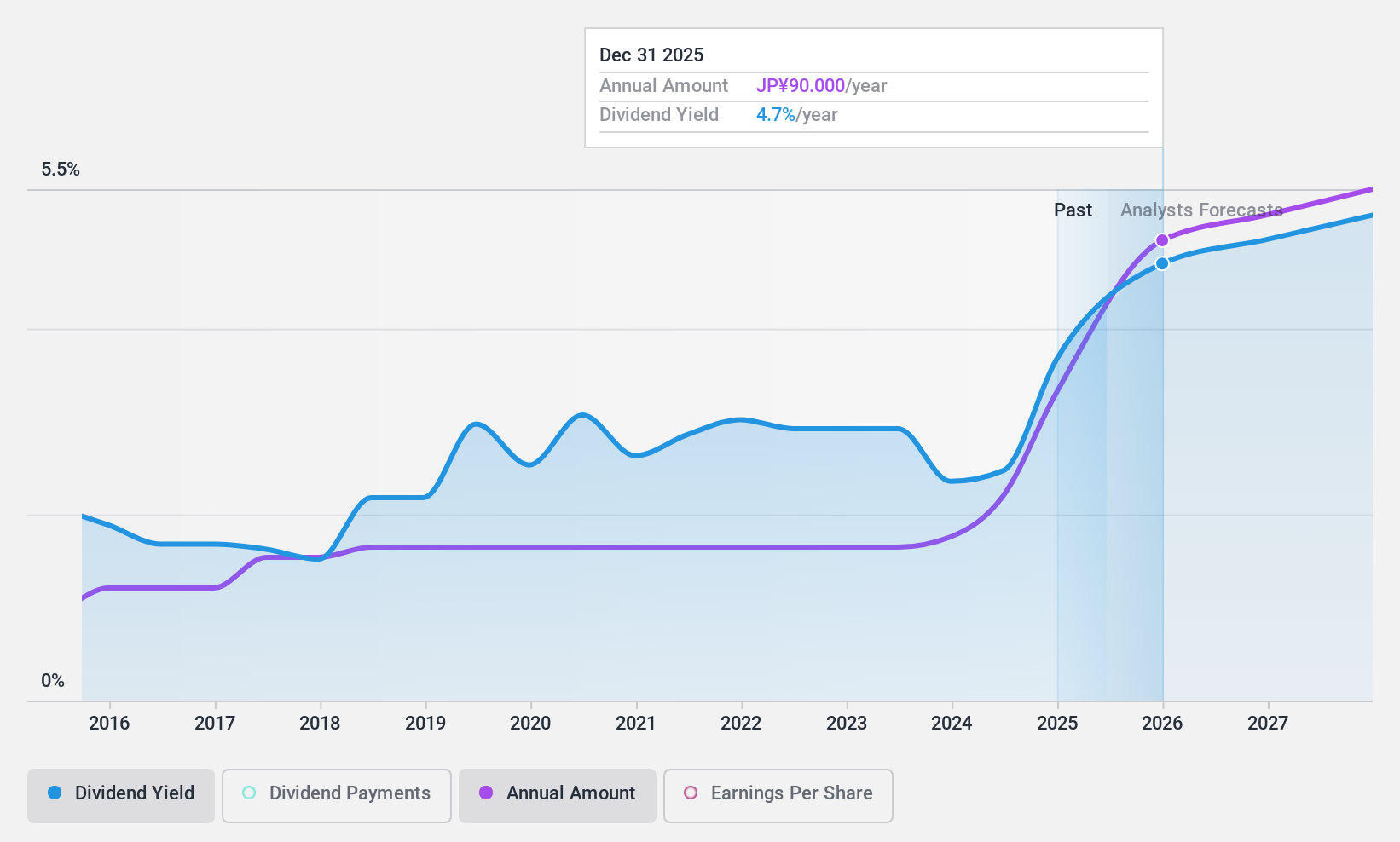

Sakata INX offers a stable dividend yield of 3.72%, slightly below Japan's top tier, but its payout ratios are low, with earnings at 24.5% and cash flows at 28.4%, ensuring sustainability. The company has consistently increased dividends over the past decade without volatility, supported by robust earnings growth of 14.9% annually over five years and future forecasts of 7.61% per year, providing a reliable income stream for investors seeking value in the market.

- Dive into the specifics of Sakata INX here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Sakata INX is priced lower than what may be justified by its financials.

Realtek Semiconductor (TWSE:2379)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Realtek Semiconductor Corp., along with its subsidiaries, focuses on the research, development, production, and sale of integrated circuits and related application software across Taiwan, Asia, and globally with a market cap of NT$251.30 billion.

Operations: Realtek Semiconductor Corp.'s revenue is primarily derived from its Microcircuit and Related Application Software segment, amounting to NT$109.63 billion.

Dividend Yield: 3%

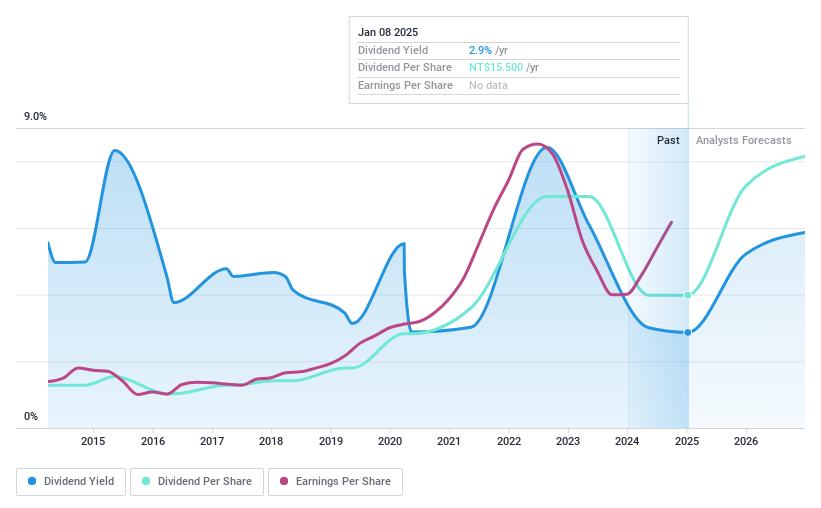

Realtek Semiconductor's dividend yield of 3.05% is lower than Taiwan's top-tier payers, but its payout ratios are sustainable, with earnings coverage at 56.5% and cash flow coverage at 43.3%. Despite a volatile dividend history over the past decade, recent robust earnings growth—net income rose to TWD 4.37 billion in Q3 2024—suggests potential for future stability in dividends, supported by continued strong financial performance and undervaluation relative to fair value estimates.

- Click here and access our complete dividend analysis report to understand the dynamics of Realtek Semiconductor.

- Insights from our recent valuation report point to the potential undervaluation of Realtek Semiconductor shares in the market.

Taking Advantage

- Investigate our full lineup of 1947 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6138

Anpec Electronics

Engages in the design, testing, production, and marketing of mixed-signal power chips and sensors in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.