In the wake of recent global market dynamics, where U.S. stocks have rallied to record highs on expectations of economic growth and tax reforms following a "red sweep," investors are increasingly seeking stability amid potential inflationary pressures and evolving fiscal policies. As interest rates adjust and markets react to geopolitical shifts, dividend stocks offer a compelling option for those looking for consistent income streams in an uncertain environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.32% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.32% | ★★★★★☆ |

Click here to see the full list of 1936 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:AVPGY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi operates in Turkey, focusing on real estate development, leasing, and business administration, with a market cap of TRY19.55 billion.

Operations: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi generates revenue through its activities in real estate development, leasing, and business administration.

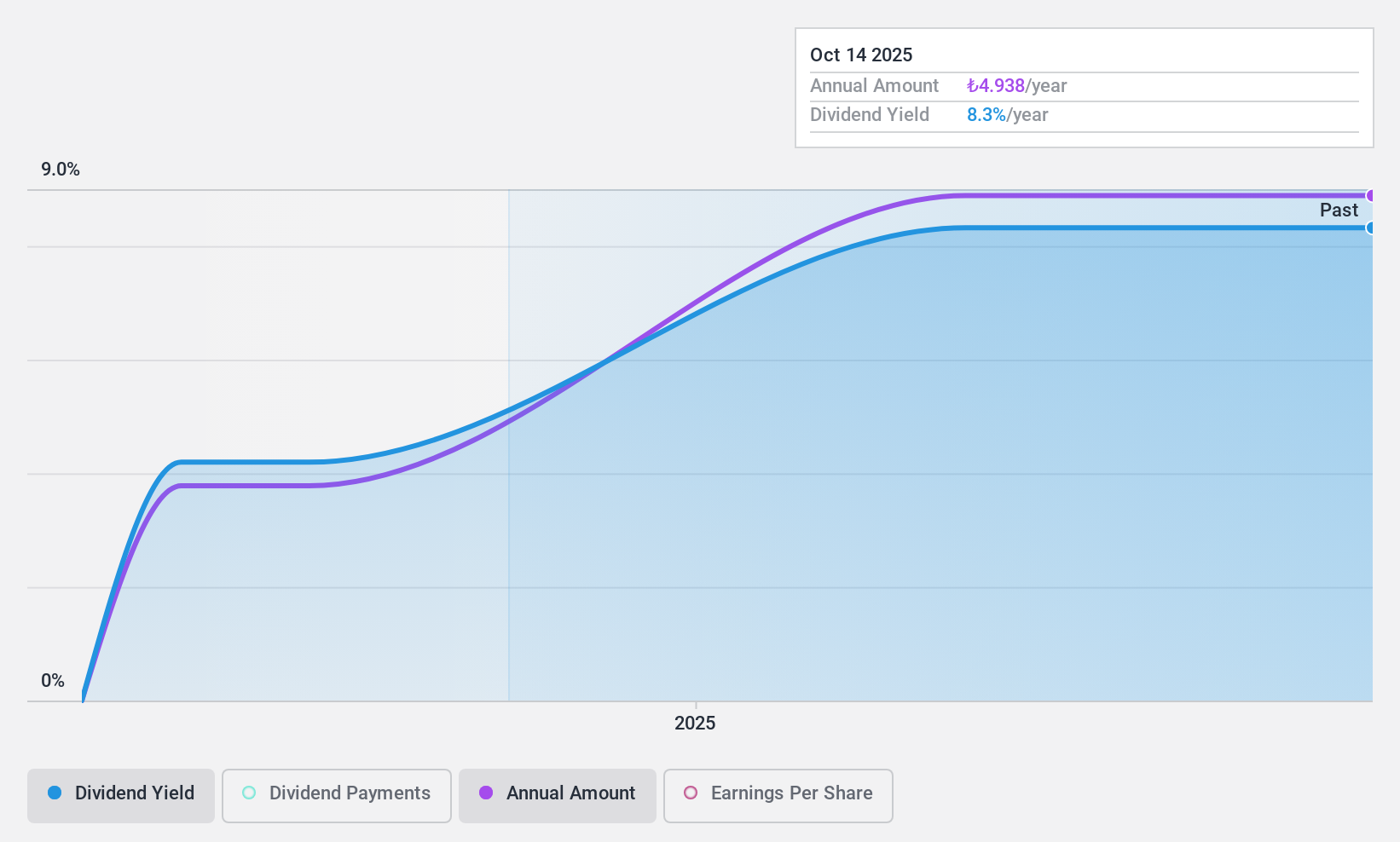

Dividend Yield: 4.3%

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi's recent earnings show a significant turnaround, with a net income of TRY 75.88 million in Q3 compared to a loss last year, and strong nine-month figures. Despite recent dividend initiation, the payout ratio of 55.9% suggests dividends are well-covered by earnings and cash flows (65.8%). The stock trades at an attractive valuation, offering a dividend yield of 4.3%, among the top in Turkey's market.

- Get an in-depth perspective on Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi's performance by reading our dividend report here.

- Our valuation report here indicates Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi may be undervalued.

ENN Natural GasLtd (SHSE:600803)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENN Natural Gas Co., Ltd. operates in natural gas distribution, trading, storage, transportation, production, and engineering in China with a market cap of CN¥60.47 billion.

Operations: ENN Natural Gas Co., Ltd. generates revenue through its activities in natural gas distribution, trading, storage, transportation, production, and engineering within China.

Dividend Yield: 3.4%

ENN Natural Gas Ltd.'s dividends are supported by a low payout ratio of 27.3% and a cash payout ratio of 38.5%, indicating strong coverage by earnings and cash flows. Despite this, the dividend track record is unstable, with less than ten years of payments characterized by volatility over 20%. Recent financial performance shows growth in net income to CNY 3.49 billion for the first nine months of 2024, up from CNY 3.10 billion last year.

- Click here to discover the nuances of ENN Natural GasLtd with our detailed analytical dividend report.

- Our expertly prepared valuation report ENN Natural GasLtd implies its share price may be lower than expected.

Sino-American Silicon Products (TPEX:5483)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sino-American Silicon Products Inc. specializes in the research, development, design, production, and sale of semiconductor silicon materials and components, rheostats, and optical and communications wafer materials with a market cap of NT$100.11 billion.

Operations: Sino-American Silicon Products Inc.'s revenue is primarily derived from its Semiconductor Business Group, which contributes NT$69.61 billion, and its Renewable Energy Division, which adds NT$7.28 billion.

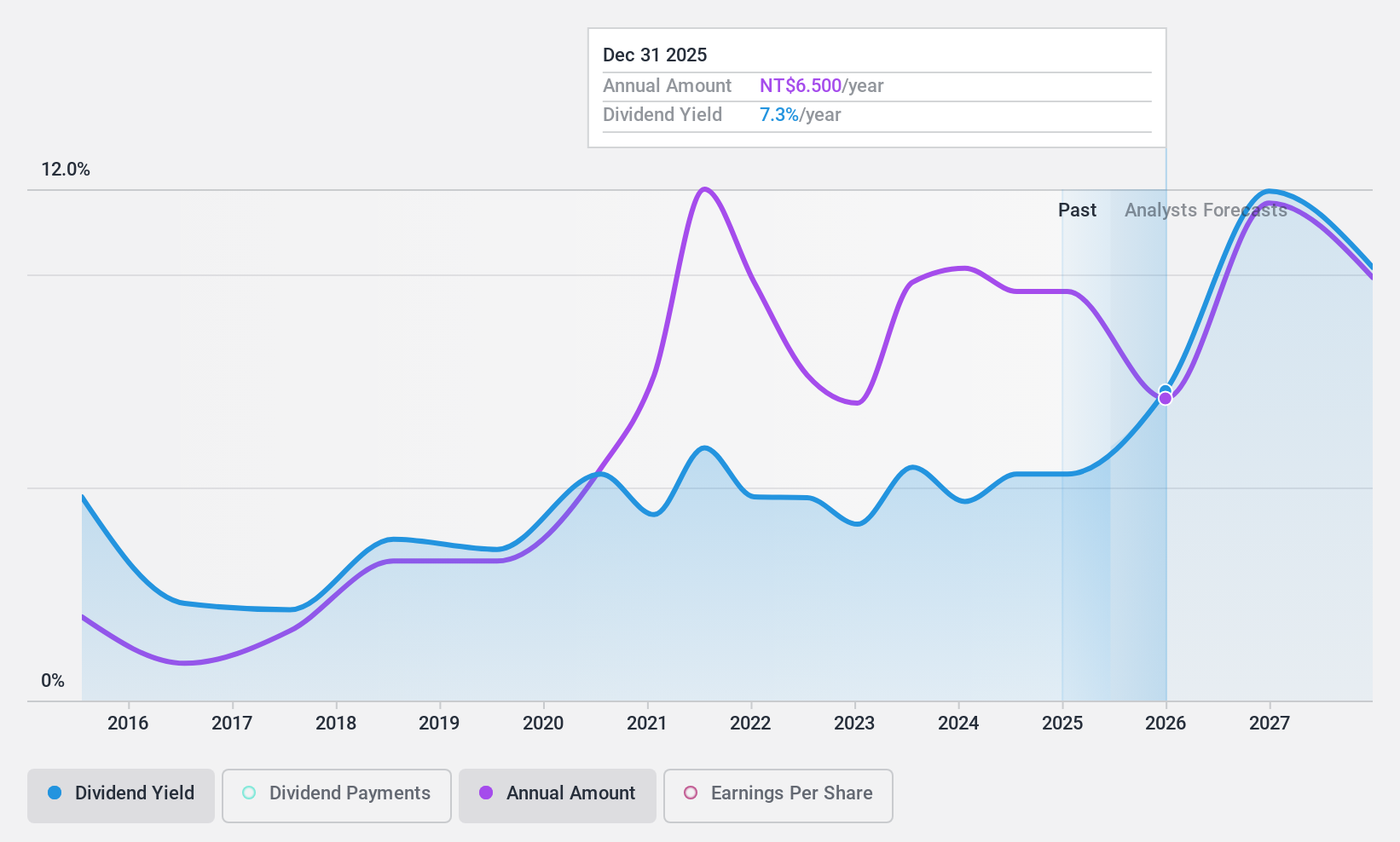

Dividend Yield: 5.4%

Sino-American Silicon Products faces challenges as its dividend payments, while in the top 25% of payers in Taiwan, are not supported by free cash flows and have been unreliable over the past decade. Despite trading at a significant discount to estimated fair value and having a low payout ratio of 35.3%, recent shareholder dilution and volatile dividend history pose risks. The company recently filed a TWD 9.10 billion follow-on equity offering, indicating potential capital needs.

- Delve into the full analysis dividend report here for a deeper understanding of Sino-American Silicon Products.

- Upon reviewing our latest valuation report, Sino-American Silicon Products' share price might be too pessimistic.

Key Takeaways

- Dive into all 1936 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AVPGY

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi

Engages in the real estate development, leasing, and business administration activities in Turkey.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives