- Taiwan

- /

- Semiconductors

- /

- TPEX:3680

Top Growth Companies With High Insider Ownership January 2025

Reviewed by Simply Wall St

As we enter the new year, global markets have shown mixed signals, with U.S. consumer confidence declining and major stock indexes experiencing moderate gains driven by large-cap growth stocks. In this fluctuating environment, companies with strong growth potential and high insider ownership can offer unique insights into their stability and future prospects, as insiders often have a vested interest in the company's success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

F-Secure Oyj (HLSE:FSECURE)

Simply Wall St Growth Rating: ★★★★☆☆

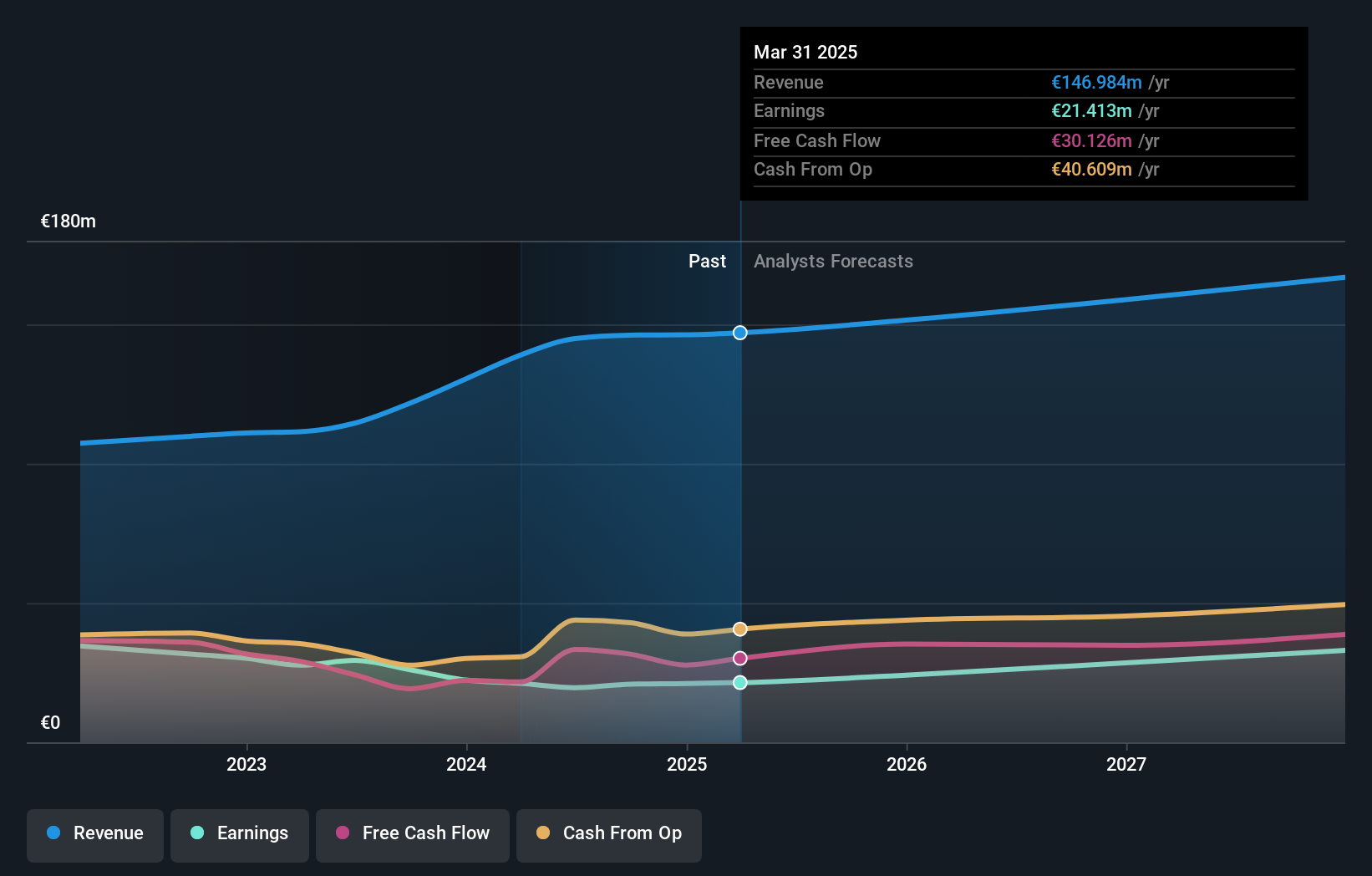

Overview: F-Secure Oyj is a cybersecurity company that operates both in Finland and internationally, with a market cap of €313.01 million.

Operations: The company's revenue primarily comes from its Consumer Security segment, which generated €146.13 million.

Insider Ownership: 37%

Earnings Growth Forecast: 16% p.a.

F-Secure Oyj's growth trajectory is supported by its strategic financial targets, with earnings projected to grow at 16% annually, outpacing the Finnish market. Despite a dip in profit margins from 21.4% to 14.3%, the company remains undervalued, trading at 52.4% below fair value estimates. Recent earnings reports show steady revenue growth and improved net income for Q3 and nine months of 2024. However, interest payments are not well covered by earnings, indicating potential financial strain.

- Click here to discover the nuances of F-Secure Oyj with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, F-Secure Oyj's share price might be too pessimistic.

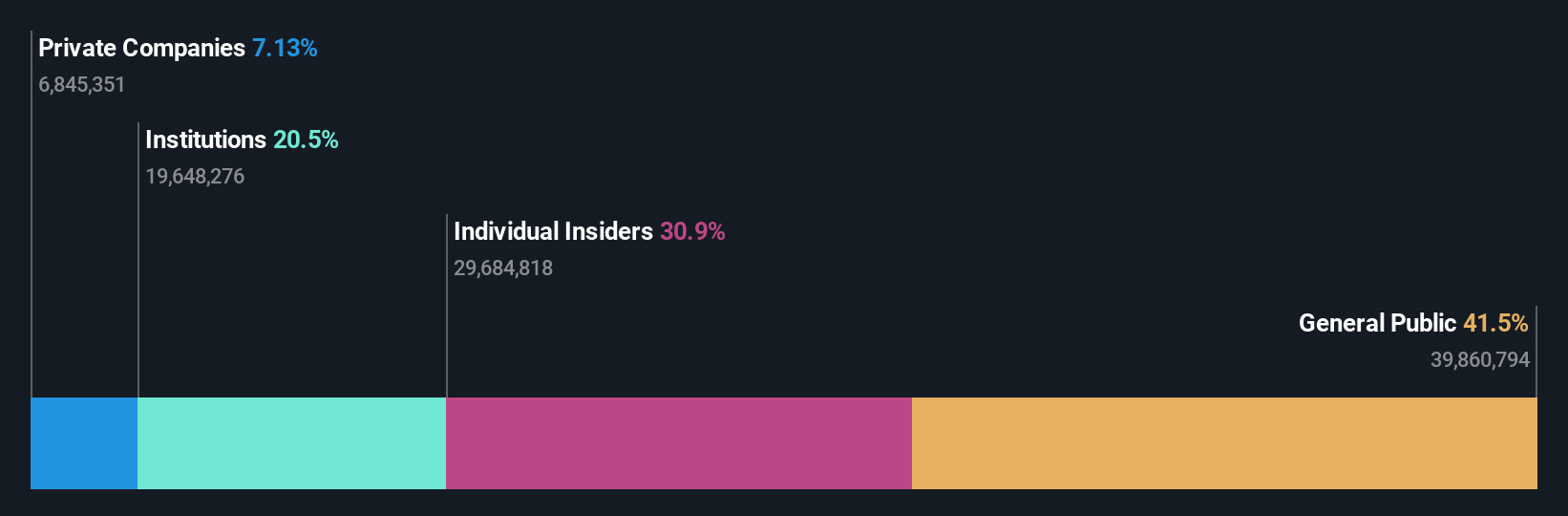

Gudeng Precision Industrial (TPEX:3680)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gudeng Precision Industrial Co., Ltd. offers technology services globally and has a market cap of NT$44.86 billion.

Operations: The company's revenue primarily comes from semiconductor manufacturing, which generated NT$5.01 billion, and semiconductor equipment manufacturing, contributing NT$1.20 billion.

Insider Ownership: 31.3%

Earnings Growth Forecast: 33% p.a.

Gudeng Precision Industrial is experiencing significant growth, with earnings projected to increase by 33.03% annually, outpacing the Taiwanese market. Recent financials show a strong performance with Q3 sales of TWD 1.89 billion and net income of TWD 415.11 million, reflecting substantial year-over-year growth. The company plans to expand through JiaChen Venture Capital Co., Ltd., backed by a board-approved capital injection of TWD 280 million, enhancing its strategic position despite past shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in Gudeng Precision Industrial's earnings growth report.

- Our valuation report here indicates Gudeng Precision Industrial may be overvalued.

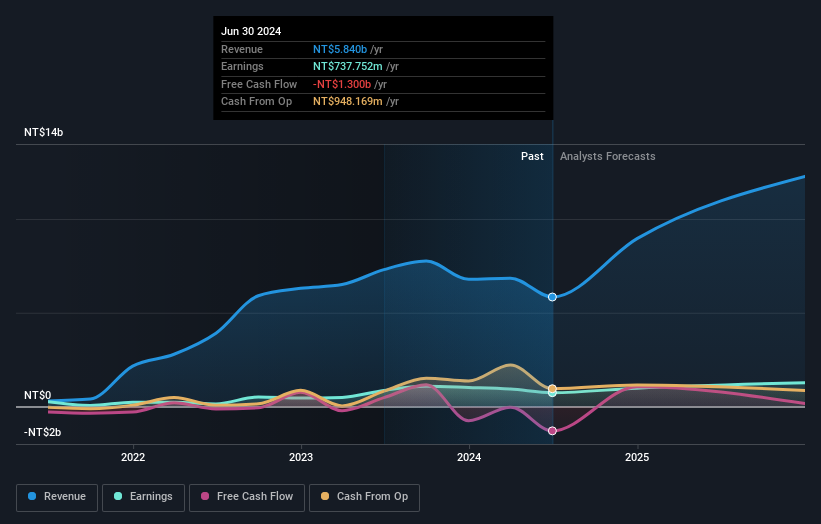

J&V Energy Technology (TWSE:6869)

Simply Wall St Growth Rating: ★★★★★☆

Overview: J&V Energy Technology Co., Ltd. operates in Taiwan, focusing on the development, investment, maintenance, and management of renewable energy plants with a market cap of NT$23.80 billion.

Operations: The company generates revenue from several segments, including Solar Engineering (NT$627.60 million), Sale of Electricity (NT$945.51 million), Energy Storage Engineering (NT$1.15 billion), and Trading of Energy Equipment (NT$178.71 million).

Insider Ownership: 19.7%

Earnings Growth Forecast: 82.4% p.a.

J&V Energy Technology is poised for substantial growth, with earnings expected to rise 82.42% annually, surpassing the Taiwanese market's average. Despite recent financial challenges—Q3 sales falling to TWD 618.5 million from TWD 2.60 billion year-over-year—the company's revenue is forecast to grow at a rapid pace of 71.5% annually. The recent acquisition by Abonmax Co., Ltd., valued at approximately TWD 170 million, and strategic buyback plans highlight ongoing corporate restructuring efforts amidst past shareholder dilution issues.

- Click here and access our complete growth analysis report to understand the dynamics of J&V Energy Technology.

- Insights from our recent valuation report point to the potential overvaluation of J&V Energy Technology shares in the market.

Taking Advantage

- Explore the 1503 names from our Fast Growing Companies With High Insider Ownership screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3680

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives