- Taiwan

- /

- Semiconductors

- /

- TPEX:3402

3 Global Dividend Stocks Yielding Up To 7.3%

Reviewed by Simply Wall St

As global markets navigate through a period of heightened volatility and uncertainty driven by escalating trade tensions, investors are increasingly seeking stability in the form of dividend stocks. In such an environment, dividend-paying stocks can offer a measure of predictability and income potential, making them an attractive option for those looking to balance risk with steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.01% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.83% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.57% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.23% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.40% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

Click here to see the full list of 1531 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

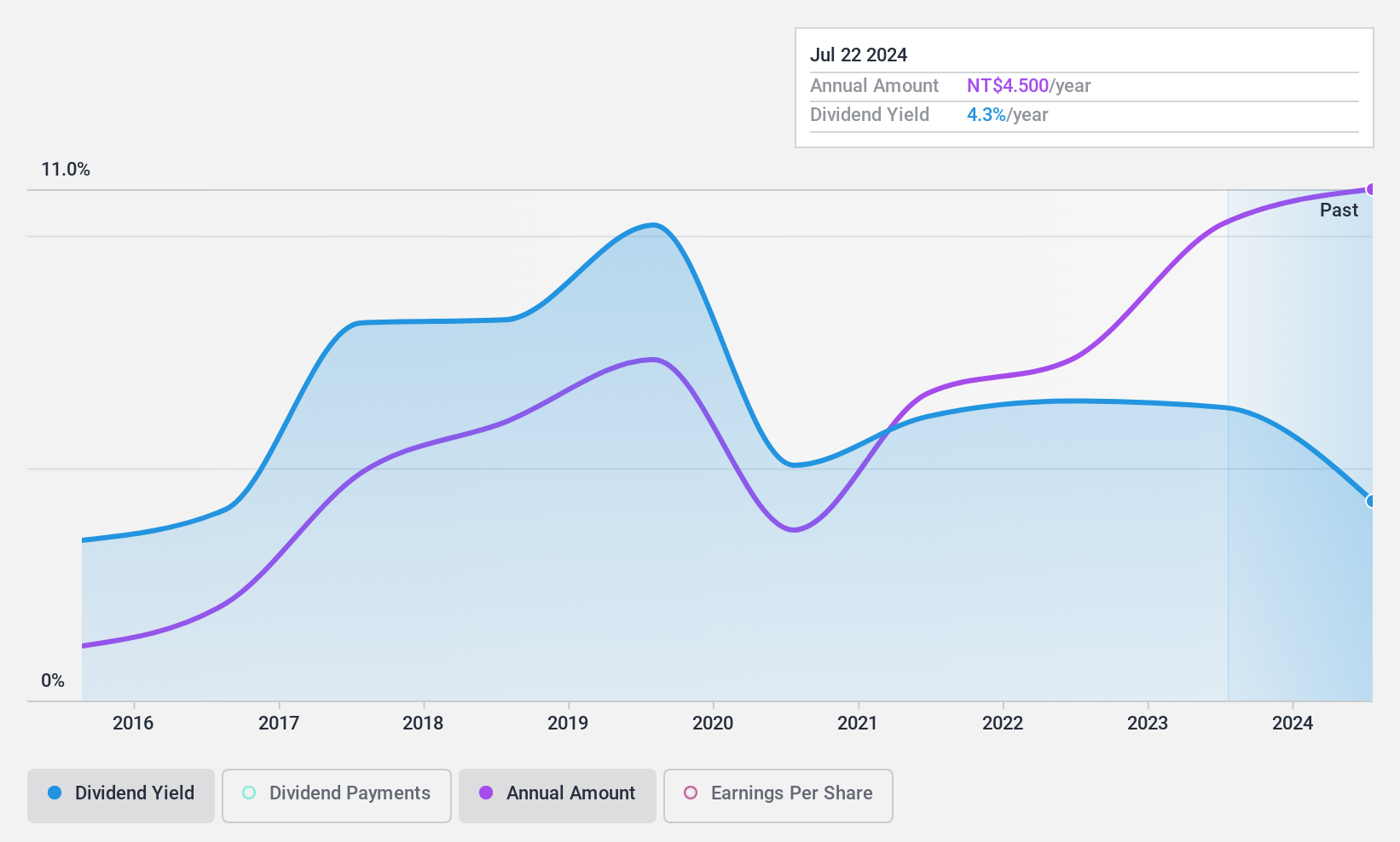

Wholetech System Hitech (TPEX:3402)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wholetech System Hitech Limited offers system integration services across Taiwan, China, and Singapore, with a market cap of NT$6.28 billion.

Operations: Wholetech System Hitech Limited generates its revenue from two main segments: Equipment, contributing NT$664.39 million, and Construction, accounting for NT$4.82 billion.

Dividend Yield: 5.8%

Wholetech System Hitech's dividend payments have grown over the past decade, yet they remain unreliable due to volatility. Despite this, dividends are well-covered by earnings with a payout ratio of 73.8% and cash flows at 20.4%. The stock trades significantly below its estimated fair value, offering potential value for investors. Recent financial results show strong growth in sales and net income, which may support future dividend stability despite past inconsistencies.

- Click here and access our complete dividend analysis report to understand the dynamics of Wholetech System Hitech.

- In light of our recent valuation report, it seems possible that Wholetech System Hitech is trading behind its estimated value.

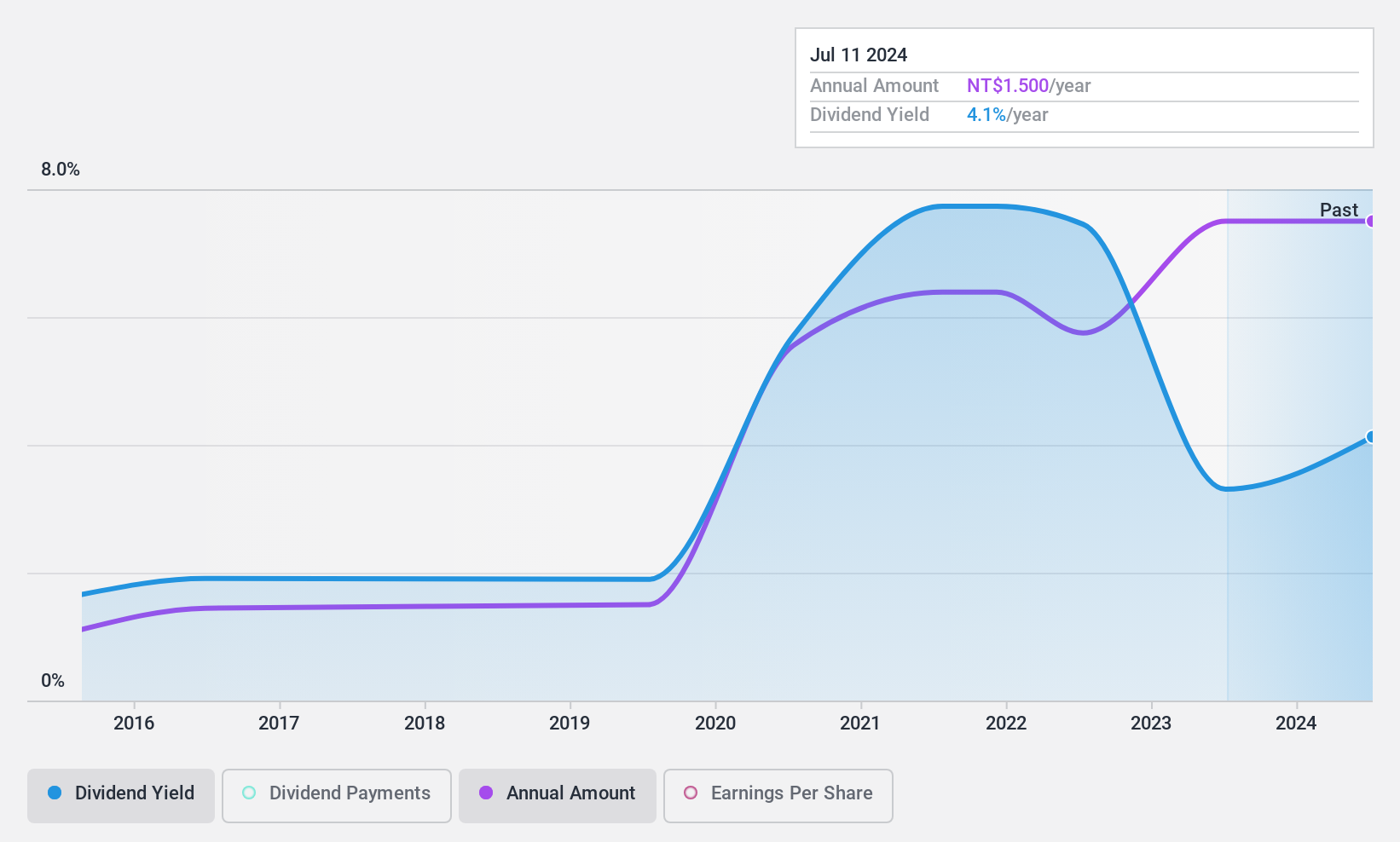

Loyalty Founder EnterpriseLtd (TPEX:5465)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loyalty Founder Enterprise Co., Ltd. manufactures, processes, and sells precision steel molds and stamping die products for computers and server chassis across Taiwan, the United States, and Mainland China, with a market cap of NT$4.62 billion.

Operations: Loyalty Founder Enterprise Ltd. generates revenue primarily from its operations in Mainland China (NT$4.11 billion), followed by Taiwan (NT$1 billion) and the United States (NT$38.60 million).

Dividend Yield: 5.8%

Loyalty Founder Enterprise's dividend payments have increased over the past decade but remain unreliable due to volatility and a high payout ratio of 98.8%, indicating they aren't well covered by earnings. However, the cash payout ratio of 63.3% suggests dividends are supported by cash flows. Recent revenue growth, with a 41% increase in March 2025 compared to March 2024, may provide some optimism for future dividend stability despite historical challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Loyalty Founder EnterpriseLtd.

- The analysis detailed in our Loyalty Founder EnterpriseLtd valuation report hints at an deflated share price compared to its estimated value.

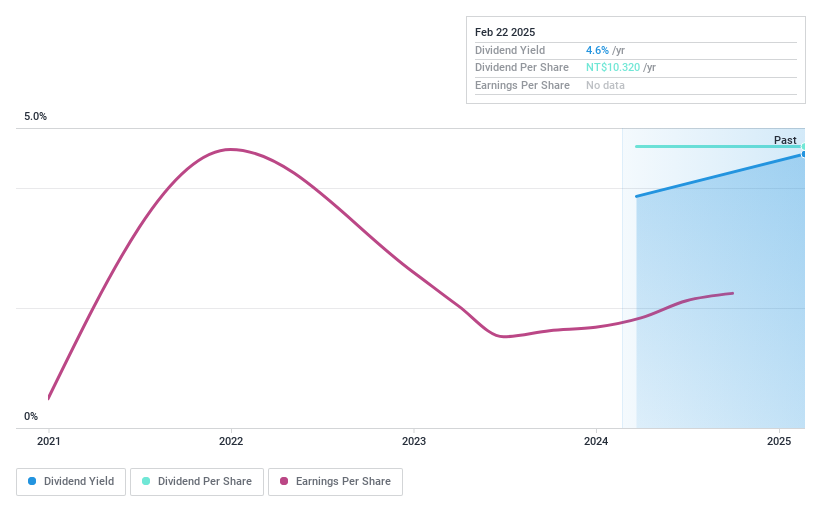

Forcelead Technology (TPEX:6996)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Forcelead Technology Corp. is an IC design company that focuses on the research, development, and sale of display driver chips and touch integrated driver chips both in Taiwan and internationally, with a market cap of NT$7.25 billion.

Operations: Forcelead Technology Corp. generates its revenue primarily from the Semiconductors segment, totaling NT$2.97 billion.

Dividend Yield: 7.3%

Forcelead Technology's dividend yield of 7.31% ranks in the top 25% of Taiwan's market, although its reliability is uncertain as dividends have only recently commenced. The payout ratio stands at 82.3%, indicating coverage by earnings, while a cash payout ratio of 89.6% confirms support from cash flows. Recent financials show robust growth with net income rising to TWD 588.56 million and an announced annual dividend increase to TWD 12.6506 per share, reflecting positive momentum in earnings performance.

- Take a closer look at Forcelead Technology's potential here in our dividend report.

- Our valuation report unveils the possibility Forcelead Technology's shares may be trading at a premium.

Seize The Opportunity

- Click this link to deep-dive into the 1531 companies within our Top Global Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wholetech System Hitech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3402

Wholetech System Hitech

Provides system integration services in Taiwan, China, Japan, and Singapore.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)