- Taiwan

- /

- Semiconductors

- /

- TPEX:3265

3 Reliable Dividend Stocks Yielding Up To 9.8%

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes approaching record highs and positive sentiment bolstered by strong labor market data, investors are increasingly looking for reliable income sources amidst ongoing geopolitical uncertainties. In this environment, dividend stocks stand out as a compelling option for those seeking steady returns; these stocks not only offer regular income but also have the potential to provide stability in a fluctuating market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

China Kepei Education Group (SEHK:1890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Kepei Education Group Limited is an investment holding company that offers private vocational and profession-oriented education services in China, with a market cap of HK$2.68 billion.

Operations: China Kepei Education Group Limited generates its revenue primarily from the provision of education services, amounting to CN¥1.60 billion.

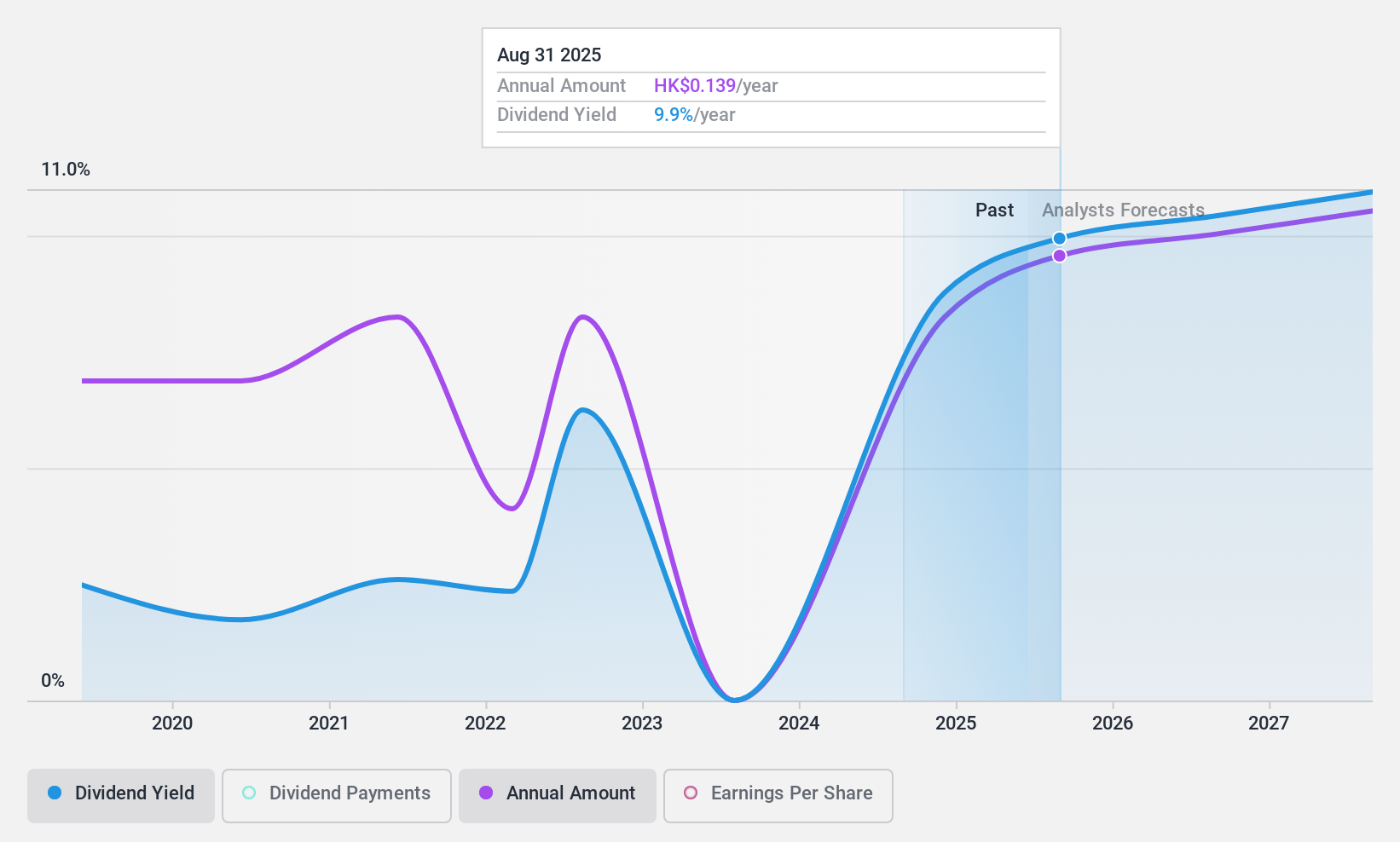

Dividend Yield: 9.9%

China Kepei Education Group offers a high dividend yield, ranking in the top 25% of Hong Kong market payers. However, its dividend history is unstable with volatility over the past five years and payments have been made for only five years. The dividends are well covered by earnings and cash flows, with payout ratios at 16.7% and 33.1%, respectively. Despite good relative value, recent removal from the S&P Global BMI Index may impact investor sentiment.

- Take a closer look at China Kepei Education Group's potential here in our dividend report.

- Our valuation report here indicates China Kepei Education Group may be undervalued.

Winstek Semiconductor (TPEX:3265)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Winstek Semiconductor Co., Ltd., along with its subsidiaries, is involved in the research, development, and testing of integrated circuits in Taiwan and has a market cap of NT$14.31 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment information for Winstek Semiconductor. If you have additional details on their revenue breakdown, I can help summarize that information into a concise sentence.

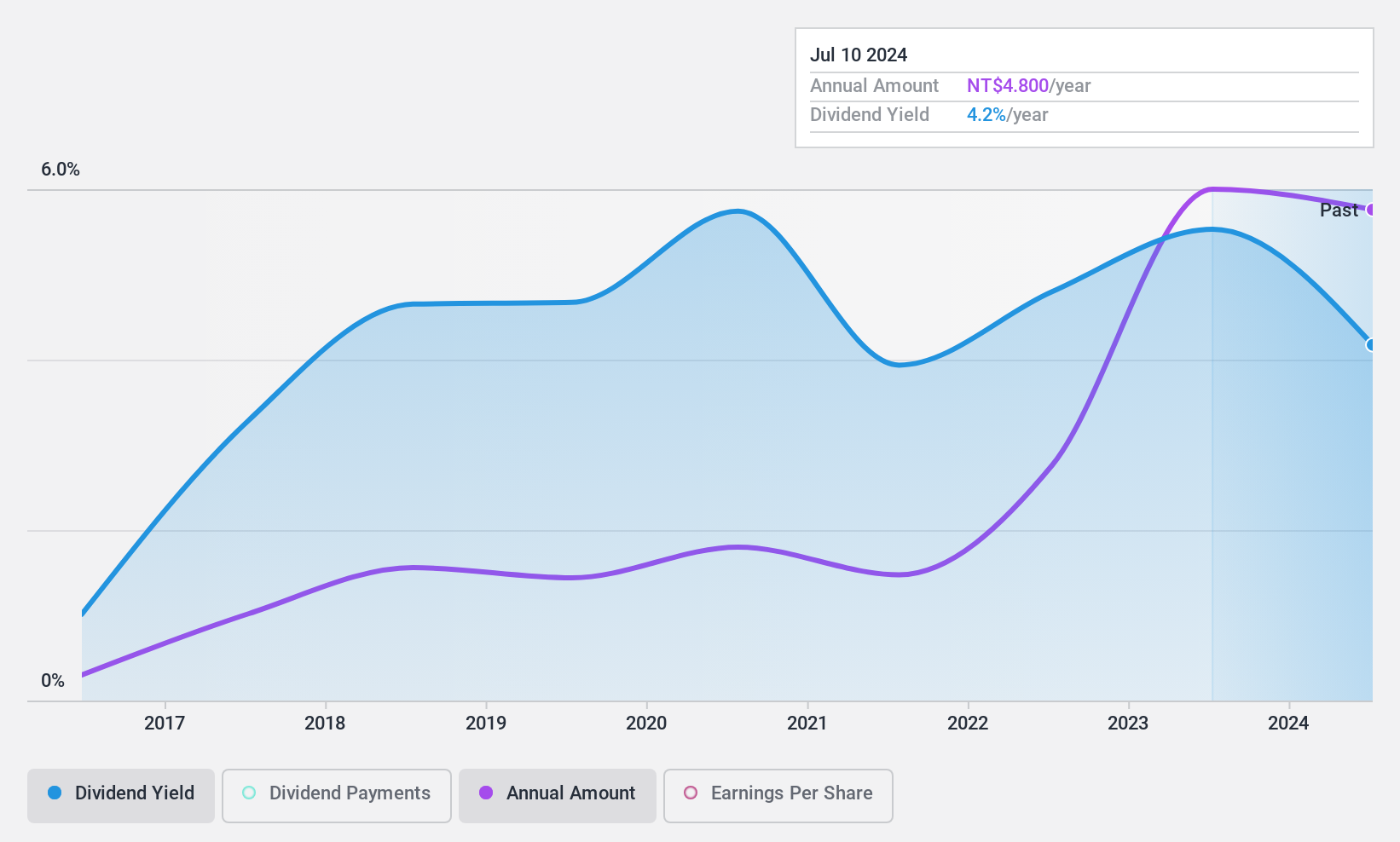

Dividend Yield: 4.5%

Winstek Semiconductor's dividend yield is among the top 25% in Taiwan, yet its dividend history has been volatile over the past decade. Despite this instability, dividends are supported by earnings and cash flows with payout ratios of 83.4% and 78%, respectively. The company's recent earnings report shows increased sales but a decline in net income for Q3 2024, which may affect future payouts. Its price-to-earnings ratio suggests good value compared to the market average.

- Dive into the specifics of Winstek Semiconductor here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Winstek Semiconductor shares in the market.

Chang Wah Electromaterials (TWSE:8070)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chang Wah Electromaterials Inc. is involved in the trading of electrical, telecommunication, and semiconductor materials and parts across Taiwan, Asia, and internationally with a market cap of NT$33.72 billion.

Operations: Chang Wah Electromaterials Inc.'s revenue is primarily derived from Chang Wah Technology Co., Ltd. and its subsidiary, contributing NT$11.74 billion, followed by Chang Wah Electromaterials Inc. with NT$7.12 billion.

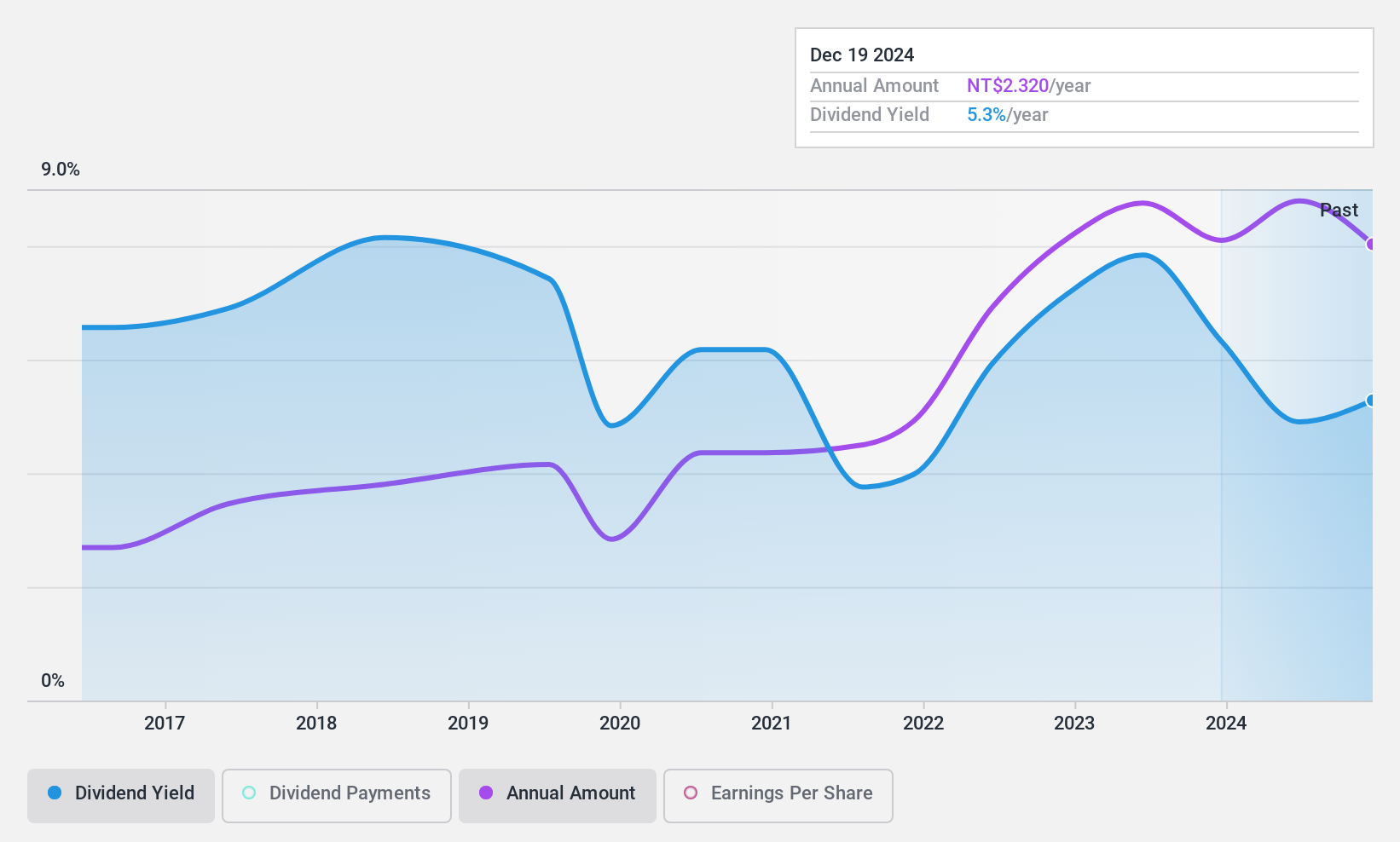

Dividend Yield: 4.5%

Chang Wah Electromaterials' dividend yield ranks in the top 25% in Taiwan, but its history of payouts has been inconsistent over the past decade. Recent earnings reports show increased sales but a decline in net income for Q3 2024, which may impact future dividends. The payout ratio of 114.7% indicates dividends are not well covered by earnings, though cash flows support them with a cash payout ratio of 79.9%.

- Unlock comprehensive insights into our analysis of Chang Wah Electromaterials stock in this dividend report.

- The valuation report we've compiled suggests that Chang Wah Electromaterials' current price could be inflated.

Next Steps

- Gain an insight into the universe of 1947 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winstek Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3265

Winstek Semiconductor

Provides integrated circuits testing services, and packing services of wafer bumping and wafer in Taiwan.

Flawless balance sheet average dividend payer.