- Taiwan

- /

- Metals and Mining

- /

- TPEX:6175

3 Global Dividend Stocks To Own With At Least 4.5% Yield

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates, tariff uncertainties, and record highs in major U.S. indices like the Nasdaq Composite, investors are increasingly seeking stability and income through dividend stocks. In such an environment, selecting stocks with robust dividend yields can provide a reliable income stream while potentially offering resilience against market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.75% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.71% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.80% | ★★★★★★ |

| NCD (TSE:4783) | 4.67% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.02% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

| Daicel (TSE:4202) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.71% | ★★★★★★ |

Click here to see the full list of 1400 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

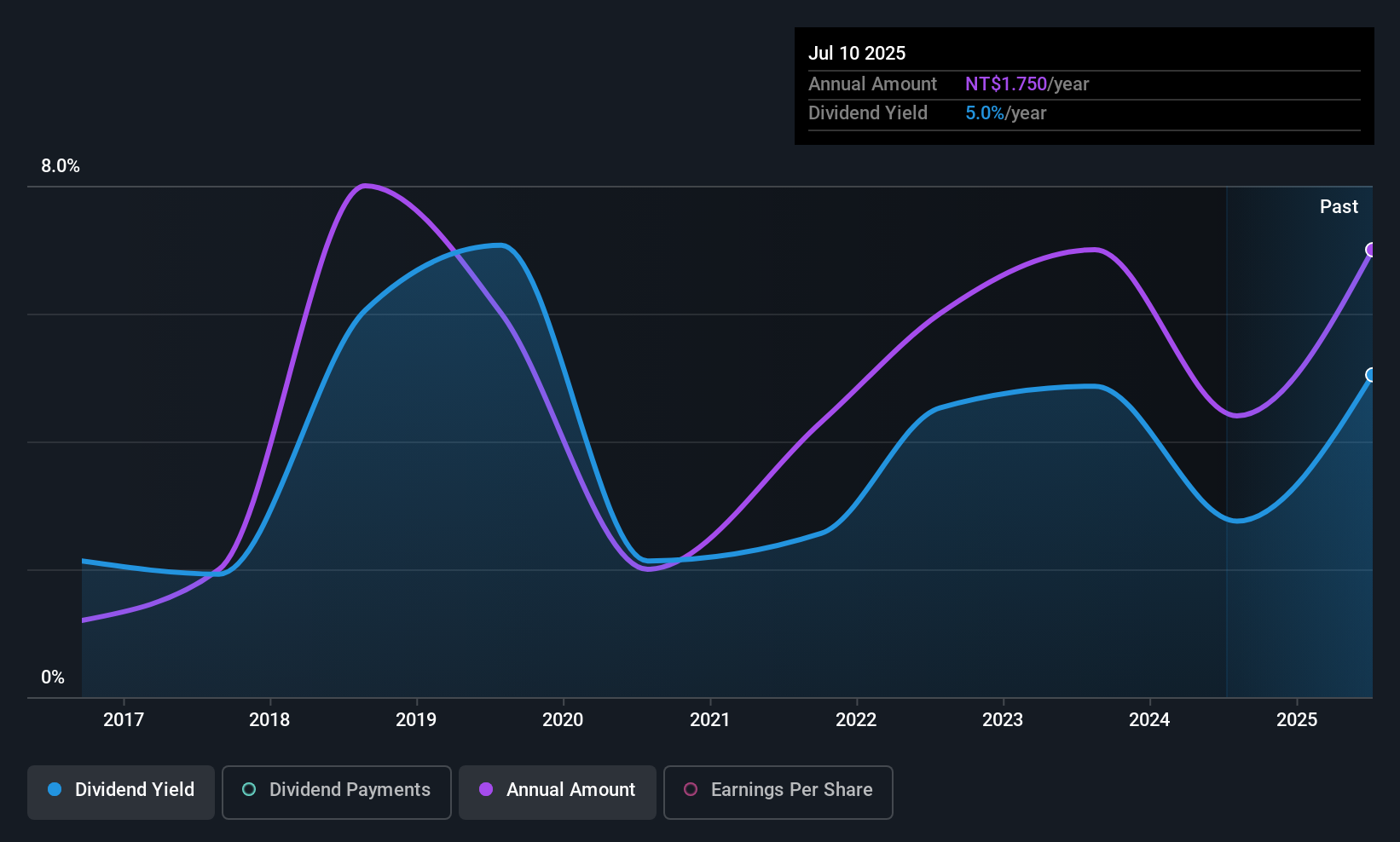

ADATA Technology (TPEX:3260)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ADATA Technology Co., Ltd. is a global manufacturer and seller of memory products, with a market capitalization of NT$30.31 billion.

Operations: ADATA Technology Co., Ltd. generates revenue primarily from its E-commerce Division, which accounts for NT$39.16 billion, and its Biotech Department, contributing NT$44.86 million.

Dividend Yield: 5%

ADATA Technology's dividend payments have been volatile over the past decade, with a payout ratio of 68.1% indicating coverage by earnings and a low cash payout ratio of 27.1% suggesting strong cash flow support. Despite trading at 47.3% below its estimated fair value, the dividend yield of 4.98% is lower than the top quartile in Taiwan's market. Recent buyback activities saw the repurchase of shares worth TWD 699.32 million, potentially impacting future dividend capacity positively by reducing outstanding shares.

- Click to explore a detailed breakdown of our findings in ADATA Technology's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of ADATA Technology shares in the market.

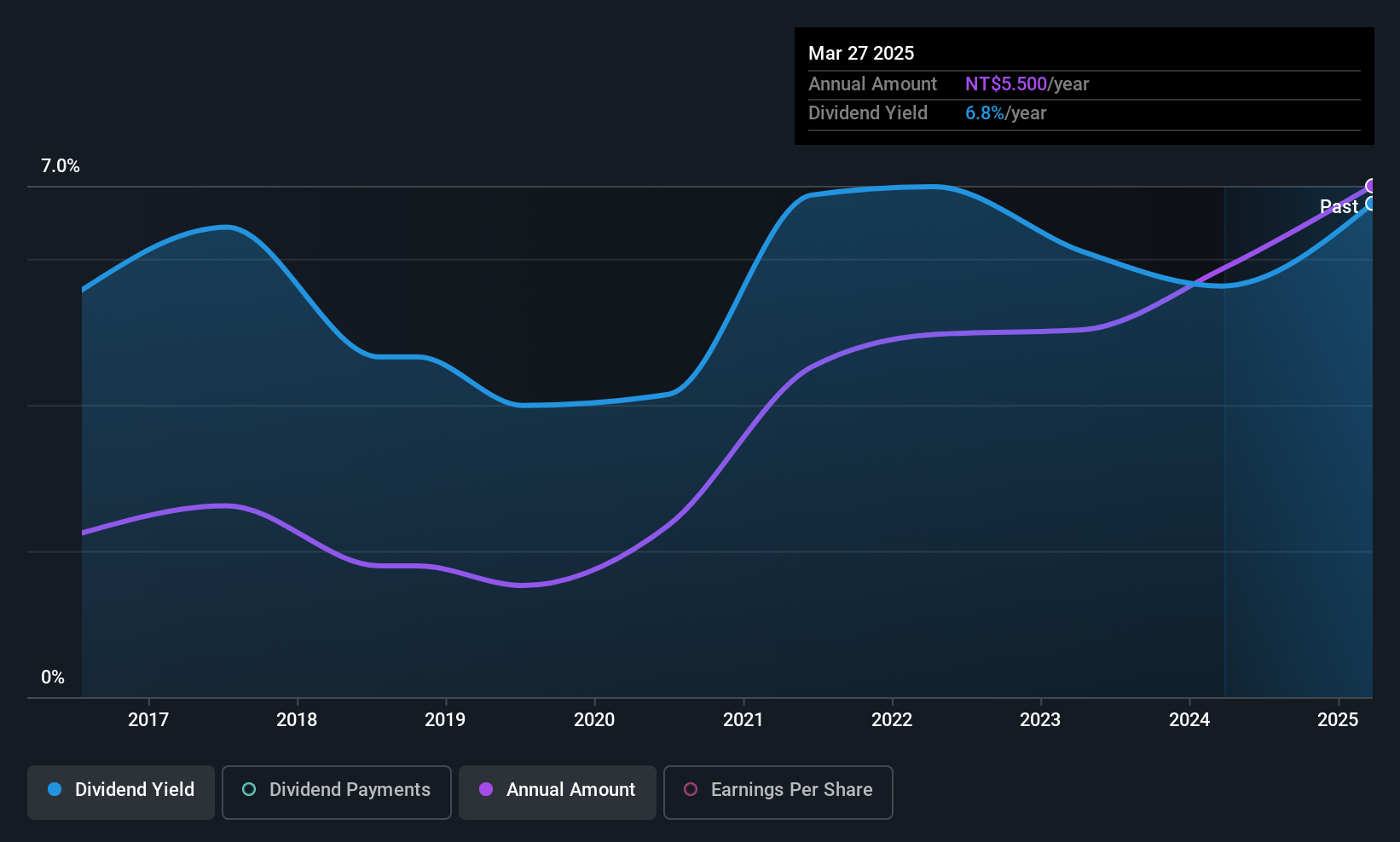

Lih Tai Construction Enterprise (TPEX:5520)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lih Tai Construction Enterprise Co., Ltd. operates in Taiwan, producing and selling ready-mixed concrete products, with a market cap of NT$5.32 billion.

Operations: Lih Tai Construction Enterprise Co., Ltd.'s revenue is primarily derived from its Ready-Mix Concrete Segment, which generated NT$3.79 billion, supplemented by NT$344.21 million from its Transportation Division.

Dividend Yield: 5.9%

Lih Tai Construction Enterprise's dividend payments, though covered by earnings (payout ratio: 58.5%) and cash flows (cash payout ratio: 56.4%), have been volatile over the past decade despite growth in payouts during this period. The dividend yield of 5.85% ranks in the top quartile of Taiwan's market, yet its unstable track record raises concerns about reliability. Recent financials show improved earnings with net income rising to TWD 144.08 million for Q1 2025 from TWD 119.02 million a year earlier, supporting its current dividend coverage.

- Delve into the full analysis dividend report here for a deeper understanding of Lih Tai Construction Enterprise.

- Our valuation report here indicates Lih Tai Construction Enterprise may be undervalued.

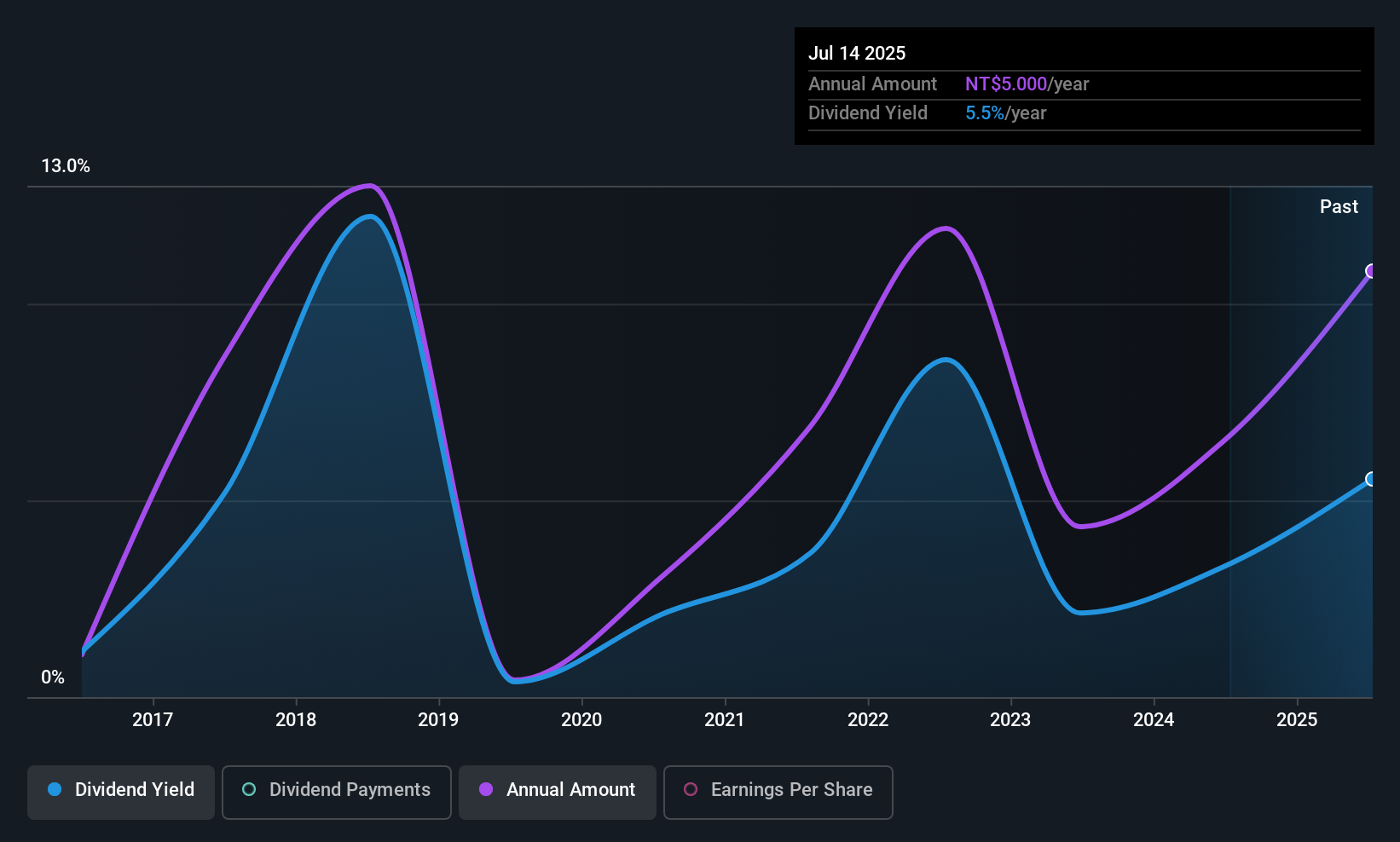

Liton Technology (TPEX:6175)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liton Technology Corp. manufactures and sells etched and formed aluminum foils across various international markets, including Mainland China, Europe, the Americas, Japan, Korea, India, Southeast Asia, Malaysia, and Indonesia with a market cap of NT$5.29 billion.

Operations: Liton Technology Corp. generates revenue primarily from Mainland China (NT$5.08 billion) and Taiwan (NT$1.16 billion).

Dividend Yield: 4.5%

Liton Technology's dividend yield of 4.54% falls below the top quartile in Taiwan, and its track record is marred by volatility over the past decade. Despite this, dividends are well-covered by both earnings (payout ratio: 54.4%) and cash flows (cash payout ratio: 50.8%). Recent financials reveal a positive trend with Q1 2025 sales increasing to TWD 1.07 billion from TWD 933.64 million year-on-year, indicating robust earnings growth that supports dividend sustainability despite historical instability.

- Get an in-depth perspective on Liton Technology's performance by reading our dividend report here.

- Our valuation report here indicates Liton Technology may be overvalued.

Taking Advantage

- Explore the 1400 names from our Top Global Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6175

Liton Technology

Engages in the manufacture and sale of etched and formed aluminum foils.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026